Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The number of new mortgage approvals fell in July, suggesting a post-Brexit vote knock to the housing market.

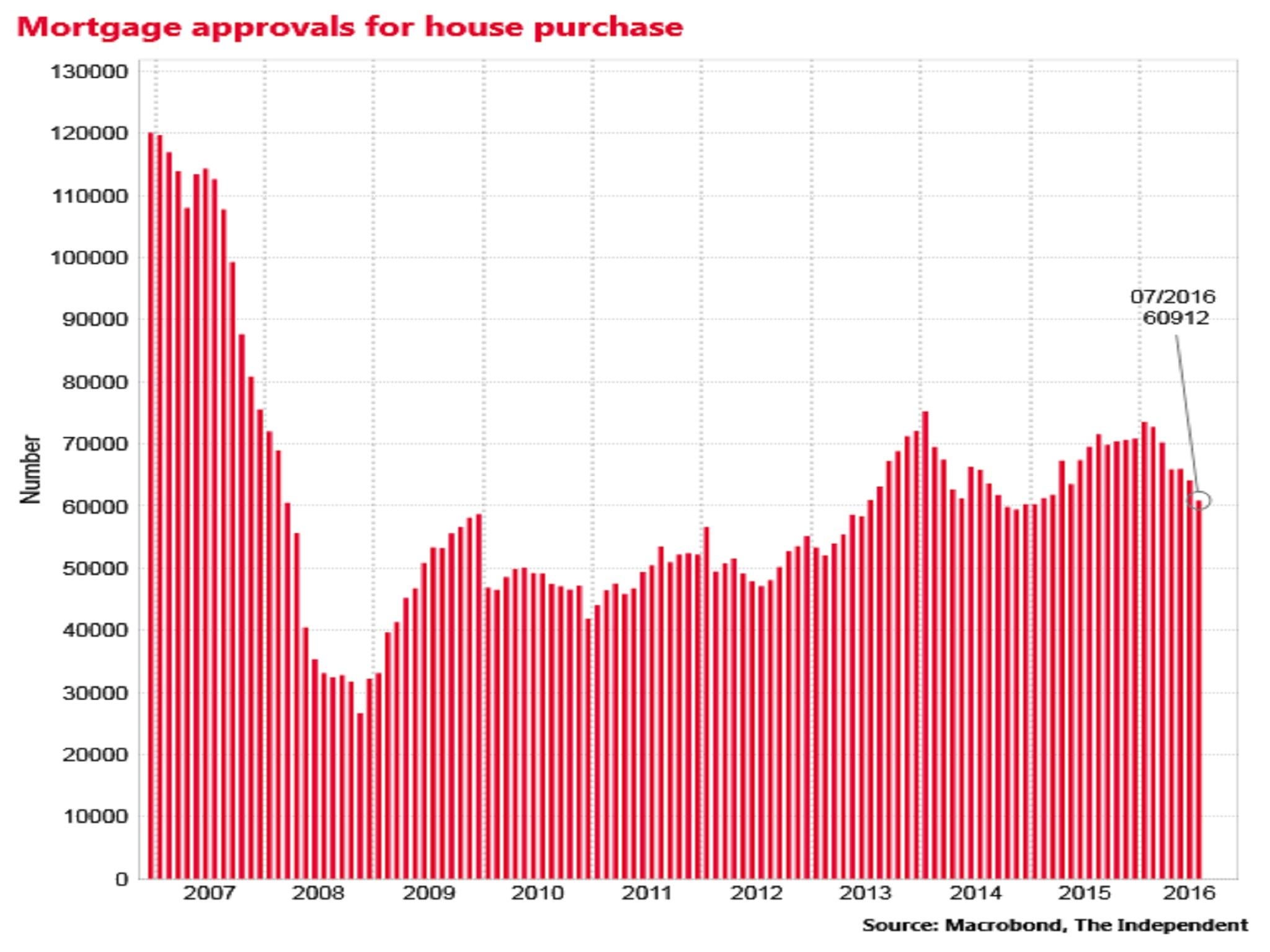

New figures from the Bank of England this morning show that there were 60,912 approvals for house purchase in July, down sharply from the 64,152 in June.

The figures were also lower than the 61,900 City of London economists had expected.

Approvals have been on a declining trend since the beginning of the year, but the July approvals figure was the lowest since January 2015 and was down 12.4 per cent on the same month a year earlier.

Lowest since January 2015

Before the financial crisis of 2007-09 banks were approving more than 100,000 new house purchase mortgages a month.

Analysts said the deepening slowdown could presage declines in house prices.

“July’s marked slowdown in mortgage approvals fuels our belief that house prices could ease back by around three per cent over the latter months of 2016 and there could well be a further 5 per cent drop in 2017” said Howard Archer of IHS Global Insight.

The latest survey from the Royal Institution of Chartered Surveyors earlier this month suggested UK house price growth was the lowest in three years in July

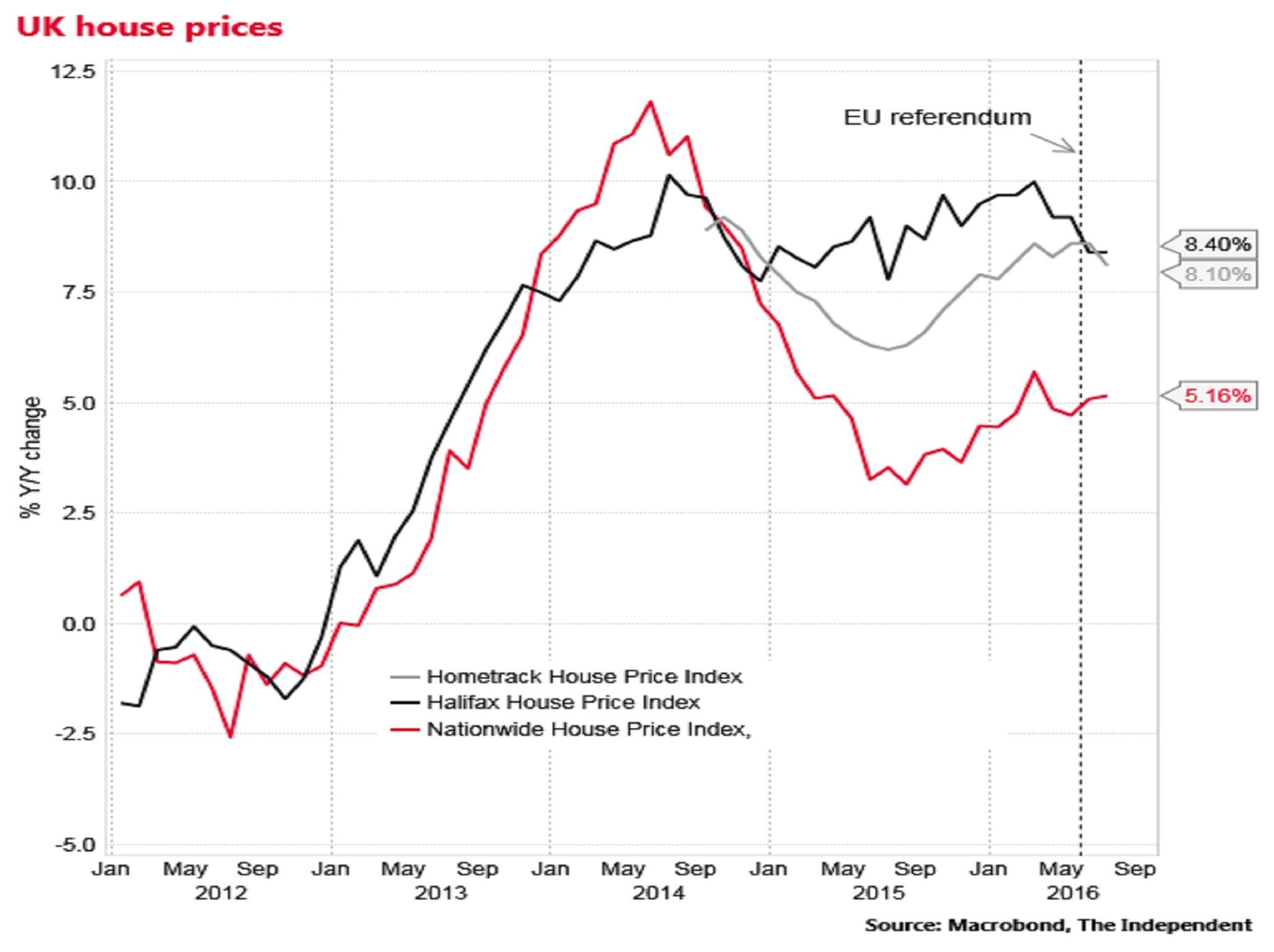

But the other major house price indexes since the 23 June vote have shown a mixed picture.

The annual rate of growth of Hometrack’s index fell from 8.6 per cent to 8.1 per cent in July.

But Halifax’s remained steady at 8.4 per cent, while Nationwide’s strengthened slightly to 5.2 per cent.

Going down?

An analysis by the Treasury before the referendum suggested house prices could fall by between 10 per cent and 18 per cent in the event of a Brexit vote by 2018.

But given this forecast was relative to a counterfactual of continued strong growth in house prices this was consistent with a flatlining of average prices in nominal terms.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments