Three Bank of England policymakers in shock vote for interest rate rise

Michael Saunders and Ian McCafferty joined Kristin Forbes in voting to increase the cost of borrowing

Three members of the Bank of England’s Monetary Policy Committee (MPC), out of the eight voting, wanted to raise interest rates this month.

Michael Saunders and Ian McCafferty joined Kristin Forbes in voting to increase the cost of borrowing on Thursday.

All three are external MPC members, rather than permanent employees of the central bank.

City analysts had expected only Ms Forbes, who leaves the MPC on 30 June, to vote for an increase.

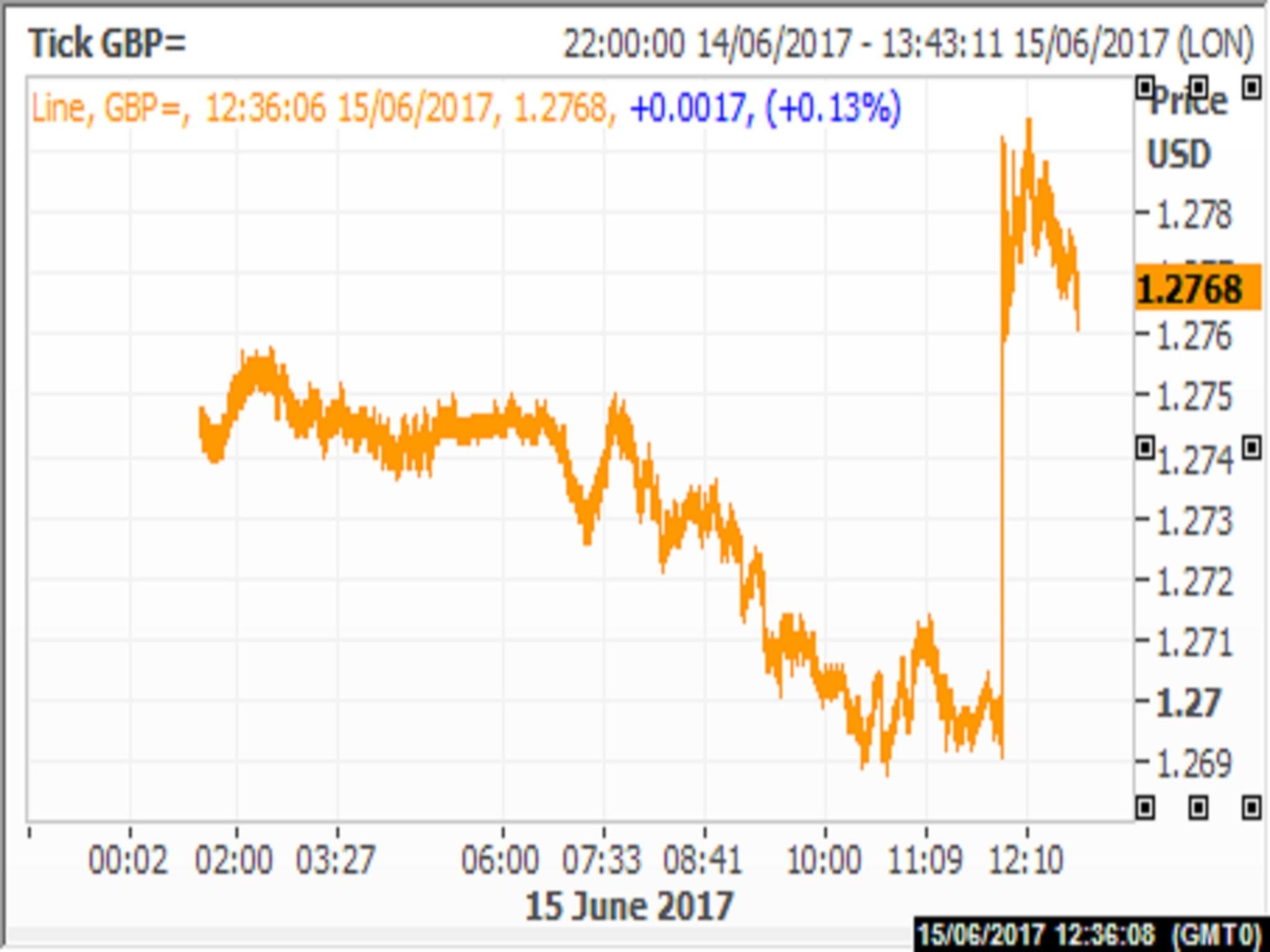

The surprise news sent sterling up sharply to $1.2768, up 0.13 per cent on the day, as traders responded.

Pound up

The pound ended the day at $1.2759, around 0.5 per cent higher.

But the FTSE 100 shed 0.74 per cent and the FTSE 250 of more domestically-oriented companies had its worst day since the period after last June's Brexit vote, shedding 2.11 per cent.

The 5-3 split of the MPC in favour of leaving rates at 0.25 per cent means that it was, effectively, the closest the Bank has come to raising rates since 2007.

The last time three MPC members voted for a rate rise was in 2011, when the committee had its usual nine members. The last time when a single switched vote could have swung the outcome was June 2007.

The deputy governor and MPC member Charlotte Hogg resigned from the Bank earlier this year and has not yet been replaced, meaning there are only eight members currently.

“It is clear that there is a split between the internal Bank of England MPC members and the external appointments,” said James Knightley, economist at ING.

“Given the BoE ‘looked through’ inflation at 5 per cent plus rates in 2008 and 2011, we think the committee as a whole will look through this spike too. The economic and political uncertainty, we believe, is too great to get a consensus behind higher rates and with Kristin Forbes leaving the Bank this month, the hurdle to getting that consensus will soon be harder to achieve.”

Inflation in May hit 2.9 per cent according to the Office for National Statistics, already higher than than the 2017 peak projected by the Bank of England’s Inflation Report in May.

In its meeting minutes, the MPC reported that the Bank now expects inflation to exceed 3 per cent in the autumn and that the post-election decline in the pound could also push prices higher than previously expected.

The Bank’s official target is 2 per cent, and the Bank’s Governor, Mark Carney, is required to write an open letter to the Chancellor when the rate deviates more than 1 percentage point from that.

The MPC’s meeting minutes suggest that it regards the continued robust labour market as a sign that rates may need to rise sooner than expected.

“The continued growth of employment could suggest that spare capacity is being eroded, lessening the trade-off that the MPC is required to balance and, all else equal, reducing the MPC’s tolerance of above-target inflation,” it said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments