Until Europe writes down Greece's debt, the drama will continue to run

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.So the tale of Greece lurches on, with some sort of denouement expected in the next couple of weeks. It is not possible to call that outcome.

Our experience of countries that get themselves into this sort of mess suggests that the situation is binary. Either the government caves in to its creditors. Or it defaults on its debts. That is what usually happens.

The example closest to home of the former is the UK in 1976, when after a month of dithering, the Labour government caved in to the International Monetary Fund, reversed its policies and got a bailout. The most recent example of the latter is Argentina, which defaulted last August for the second time in 13 years.

The trouble with the Greek situation is that it has in the past both caved in, and de facto defaulted, and it has done it twice. This will be the third rescue, if it goes through.

Were Greece an independent country it would all have been easy. There is a template. Countries often default. There have been 11 major sovereign defaults since 2000, and more than 100 since 1800. Argentina has done so eight times, Ecuador and Venezuela 10 times. While most have been in Latin America, since 1800 Austria has defaulted seven times, Spain six, and Germany and Portugal four each. Greece has defaulted seven times, if you count as a single default the two recent rescues when it defaulted on its privately held debt but not its publicly held debt.

What has changed now is that Greece is not financially independent. If you don’t control your own currency you become a sort of super-municipality. You can default on your debts, as Detroit has done, but then you will not be able to borrow any more money. So your ability to continue functioning depends on your ability to raise enough tax to pay wages and pensions, and buy the goods and services that any government needs. You are not paying any interest. You are not repaying any debts as they fall due. But as long as enough tax comes in to cover your day-to-day spending, you are still in business.

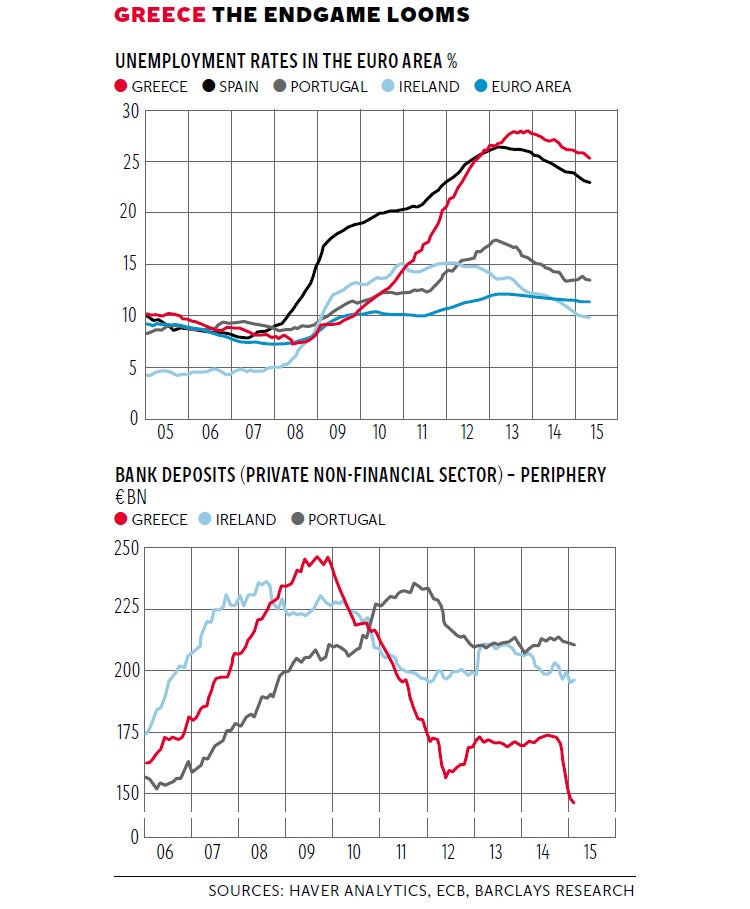

Until a few weeks ago that looked like being an option for Greece. It could default but carry on as a member of the eurozone, rather in the way that Detroit can continue using the dollar. The economy was growing, albeit slowly. Unemployment, while still dreadful, seemed to have plateaued and was starting to fall, as you can see in the top graph. The country was running a small primary surplus, in the sense that tax receipts were greater than spending if you don’t allow for interest payments. I suspect that was the reason behind the swagger of its finance minister.

Since then three things have happened, all of them negative. One is that growth has gone and the country is back in recession. Another is that the primary surplus has disappeared, for reasons that are not totally clear but which are probably associated with the economic paralysis that many, maybe most, Greeks feel. And the third is that people have been taking their money out of their bank accounts, in some cases literally stuffing it under the mattress. You can see this sudden decline in bank balances in the bottom graph.

This closes options. The banks may be unable to pay out deposits when they fall due, for they are already relying on their credit lines at the European Central Bank and may not be able to offer collateral if their holdings of Greek government debt become worthless. So there may be capital controls – indeed that seems extremely likely, though this in effect turns the euro into a two-tier currency, with “good” euros that can cross borders and “bad” ones in Greek banks that cannot do so. That has happened on a small scale with Cyprus, so there is a precedent. On Monday the credit-rating agency Moody’s warned that there was a high probability that capital controls would be brought in.

There is, however, no precedent for a eurozone country not being able to pay its employees. That has happened in US cities, a harsh reminder that the federal government does not stand behind cities, or indeed states. But it has not happened in Europe, yet. The Greek government has been slow at paying its bills, for example for imported medicines, and it has cut its pension payments. But it has always been able to meet payroll. A number of Greek politicians have asserted that they would prioritise payroll over debt service, and that is understandable. But it may not be a question of that: Greece may be unable to meet payroll, even if it pays no interest on its debt – let alone makes any repayments.

So what will happen? My hunch is that there will be some sort of fudge, or at least this is the most likely outcome. There will be a deal that enables the government to continue functioning in response for concessions that it can argue are just about within its red lines. Greece will keep the euro for the time being, and there will be no further formal default. There may have to be a referendum to get popular approval for what will be an unpopular agreement.

This deal will last a few months, maybe into next year. The economy will recover a little but not enough to convince the electorate that a corner has been turned. It will be a poor summer season for German tourists, the largest national group of visitors. Tourism is 17 per cent of GDP, so this is serious.

Then, at some stage in the future, there will be further political revolt, and Greece and its European debtors will have to accept that there has to be a formal write-down of Greek debt, something that is legally not possible at the moment. So the denouement in the next couple of weeks will not be the end of the drama after all.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments