Hamish McRae: The cost of the US government's borrowing could be the recovery

Economic Life

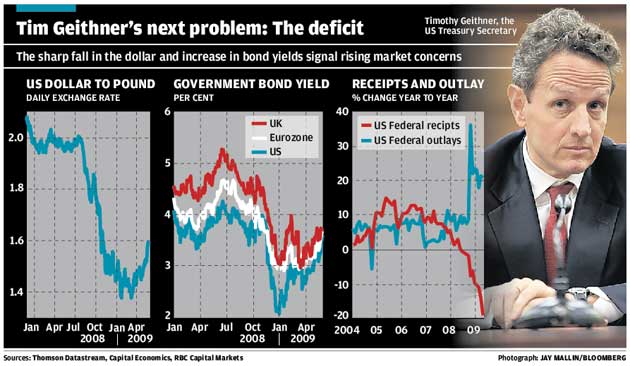

Maybe it isn't such a great idea for the US government to be borrowing so much money. We see the shift in perception of US financial probity in the dollar/sterling exchange rate but there is something more troubling going on: longer-term US interest rates are on the rise.

Let's step back a moment. Three months ago, financial markets were in a blue funk; share prices were collapsing worldwide. Any currency deemed to be at all risky, such as sterling, was plunging. Everyone sought a safe haven for their savings and the general perception was that the safest haven of all was US government debt.

That has all changed. Share prices have made a solid recovery from their early March lows though, to put that in perspective, they have merely regained the ground lost in the previous three months and they still look twitchy now. Sterling has recovered strongly, despite the possibility of the government losing its prized AAA status. And, to take a more arcane indicator of market confidence, the spread between interbank rates on the money markets and official interest rates has narrowed significantly. Things are not yet back to normal, for the weaker banks are still struggling to persuade the stronger ones to lend them money, but the collective heart attack suffered by the money markets a few months ago is past and the markets are in recovery mode.

Now, many market commentators write of this as a return of risk appetite: investors are prepared to accept the risks involved in, for example, holding banking shares and don't demand the ultra-safety on US Treasury securities. I think that is wrong, or at least only partly true in the sense that some assets, bank shares being a good example, had become so cheap that the risk was more than compensated for by the potential returns.

Another, more helpful way of looking at what is happening is to see it as a change in perception of where risk lies. Of course, there is risk in equities – how could there not be with the prospect of the once-mighty General Motors filing for bankruptcy? But there is also risk in bonds, including dollar bonds issued by AAA governments. So, as you can see in the graphs, the dollar/sterling rate has come sharply back, reflecting a change in the relative perception of risk between the two countries. More significant still has been the rise in the interest rate on 10-year bonds issued by the US, the UK and eurozone governments. As you can see, the interest rate on 10-year US bonds spun down from about 4 per cent in the middle of last year, to close to 2 per cent at the turn of the year. Now it is heading back to 4 per cent again. Those are astounding swings. If you have bought at the right moment last summer, and then sold at the right moment, you could just about have doubled your money. December buyers would now be facing a large loss.

Now look ahead. What will happen over the next decade, particularly in the US? Tax revenues have collapsed, while spending has soared, as the third graph shows. The US federal government is raising only about 55 cents in taxation for every dollar it spends. The rest has to be borrowed, either from foreign countries such as China and Japan, or by artificially creating the stuff by borrowing from the US Federal Reserve system. In the latter case the debt is being "monetised", the practice that normally happens only in wartime or in Latin America and which threatens massive inflation (the US mechanism for monetising debt is slightly different from our own "quantitative easing", but the effect is pretty much the same).

This cannot go on, as President Barack Obama acknowledges. "We are," as he puts it, "out of money." So what will happen?

It is very hard to know because there are no obvious precedents. Will there be a long period of cold turkey, as debts are gradually paid off, albeit at the cost of sub-par growth in living standards for perhaps a decade, or will governments try to inflate away the debt, as occurred after the Second World War? I have been looking at some work by Chris Watling of Longview Economics, who has looked at what happened in a variety of situation, including the Latin American extreme inflations and the rather less extreme inflation that cut US indebtedness after the Civil War. His conclusion is that the outcome will probably be somewhere between paying off the debt in real terms, with all the pain that this will bring, and inflating it away. If so, you have then to ask about the risks of holding government debt that yields only a nominal 4 per cent. At least equities give some protection against inflation as well as a similar running yield from dividends.

There is a further issue. If governments borrow so much and long-term rates rise as a consequence, they will crowd out other borrowers and push up the cost of finance for everyone else. So people wanting mortgages, or companies seeking to replace scare bank loans with bond issues will have to pay more for their money. The result will be that far from boosting the economy, high levels of government borrowing might start to hinder the recovery. The economy gets a Keynesian boost from the extra spending but that is offset by a monetary squeeze from higher long-term interest rates.

I don't think we face this sort of dilemma yet, either here or in the US, or indeed on the Continent. The point worth making, though, is that central banks control only short-term rates; they influence longer-term ones but that influence is conditioned by other factors, including trust in governments not to inflate away the real value of their debts. At the margin, the recent rise in long-term rates will put a curb on recovery and, if it continues, this could become serious.

What has to happen is very clear. Governments, all governments including our own, have to set out a convincing plan both for unwinding the monetisation of debt that has taken place and for correcting the fiscal imbalances that have been made much worse by the downturn. It cannot be right to spend nearly double your income, can it? Yet that is what the US federal government is doing.

Confidence is a funny thing. Look at the way it suddenly evaporated during the sub-prime collapse. In the space of a few weeks loans that were deemed impeccable suddenly were dud. I don't think we are facing that sort of catastrophic breakdown now and the US has just had its AAA rating confirmed. But the global perception of the US government's ability to service its debts has dropped a couple of notches and may well drop further in the months ahead.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments