Hamish McRae: Such depths of pessimism should make equity investors optimistic

Economic Life

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.This column should start with a public health warning. It is that what follows may prove completely wrong. I say that because I want to make the case for buying equities at this stage of the cycle, arguing that they are cheap on just about any valuation but that on a five-year view shares offer a much better chance of producing good returns than the alternatives of fixed-interest securities, property or gold.

The health warning has to be there because quite a lot of us have felt this for some months and we have been wrong. Anyone who followed the "better to be too early than too late" advice will have lost money, and there is no secure evidence that even the most recent dip in share prices was indeed the bottom of this cycle. The economic news is still deteriorating, and will continue to do so for some months yet. As a result everything feels very gloomy. But historically markets turn between three and six months ahead of the economy, so it is reasonable to expect some sort of turning point this year, even if the recovery is delayed well into 2010.

You can take further comfort from the fact that several experienced fund managers are now turning bullish. Anthony Bolton, who achieved legendary status at Fidelity, is one. Warren Buffett is another. Larry Kantor at Barclays Capital just this week joined the crew. And those most nimble of the investment banking fraternity, Goldman Sachs, have just produced a paper that suggests that real returns for UK shares over the next five years will average 20-25 per cent a year. A year? Yup, a year.

More of that in a moment. First, let's acknowledge that the past decade has been one of those periods where shareholders have on average lost money. That is not just because the main indices have gone nowhere. Even with reinvested dividends they have lost money. This has led to suggestions that the cult of the equity is over, that what we are seeing is a new era that will be outside all our experience.

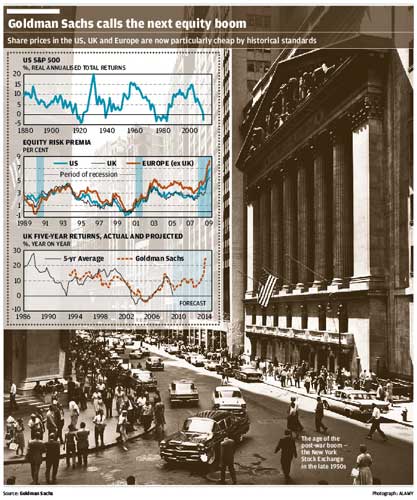

Well, that is not quite true. It is unusual for shares to go backwards for more than a decade, but not unprecedented. The first graph shows the total return (ie, including dividends and adjusted for inflation) for the Standard & Poor's index looking backwards over the previous 10 years. As you can see, there have been only four periods in the past 130 years when this has happened.

On the other hand, on a very long view, shares do outperform both bonds and cash. The annualised total return has, over the past 125 years, averaged 7 per cent for the US market and has been 6 per cent for the world. Why should the return be higher than for bonds? Because investment in shares carries a risk, so the higher return is called the equity risk premium.

There is however a paradox here. When shares go up that increases the historic risk premium. If you look backwards you have received a very high return for the risk you have taken. If on the other hand you look forwards to the prospective risk premium, it goes down. You cannot expect such high returns, over and above those that you would get from bonds, in the future.

Now look at the next graph. The prospective equity return premium back at the end of 2000 was negative for the US, Europe and the UK. But now, according to these calculations by Goldman, the risk premia are unusually high – in fact, remarkably so. Investors want much higher prospective excess returns to hold shares rather than bonds. That is the flip side of the present "flight to quality".

So what returns can investors reasonably expect from shares over the next few years? What is the best guide to the return investors will require? Here the Goldman maths wizards have tested several variables and have found that the best single indicator is the output gap – the extent to which an economy is running below capacity. That would figure because if an economy (and hence its companies) are running below capacity, there is a big latent opportunity to increase profits as demand returns. Markets will anticipate that.

Goldman has created its own valuation model for shares, which calculates whether they are expensive or cheap. If you put that with the prospective real returns that investors demand for holding shares, you can read off the annual returns you would expect equity markets to deliver. The results for the UK markets are shown in the final graph. The black line shows the return for the previous five years. The red line shows the Goldman model's predictions, run back to show how they compared with what actually happened and then projected forward to 2014. Shares, and particularly UK shares, should produce very good returns over the next five years.

I know this all sounds a bit "black-boxy" and anyone would have a right to distrust any mathematical models given the damage that all those maths PhDs have done to global finance over the past few years, but in this case there is common-sense support for this approach. When investors are risk-averse (as they are now) and when there is lots of spare capacity in the economy (as there is now) both the investment climate and the corporate outlook are likely to improve. So returns will be high. When, by contrast, investors want to take risks and when companies are running flat out, things are likely to get worse. So returns will reflect that. You don't need to buy the maths to accept the principle.

At a time like this, where there is such huge uncertainty, I find it more comforting to look at data rather than listen to opinions. That is why it seems to me to be helpful when looking at the economy to try to compare this cycle with previous ones rather than listen to views about when the bottom might be. But there is a final puzzle as far as share prices are concerned. If it is possible to predict future equity returns with the sort of confidence that Goldman Sachs is doing, why does the market not take this into account? How can markets be so inefficient?

The Goldman paper suggests two reasons. One is that many investors cannot take advantage of such predictability. Markets can become detached from fundamentals for several years and that is longer than fund managers are allowed to hold underperforming positions.

The other is memories are short. For the past 10 years, equities have performed badly. Analysts tend to extrapolate recent experience. If shares rise, they expect them to rise further, and vice versa. Intellectually they know this is unlikely, but that does not change their opinion. Look back 10 years. In 1999 investors were hugely optimistic about equities, so much so that they drove the FTSE 100 index to a peak it has subsequently failed to reach. Now they are correspondingly pessimistic. An obvious moral there?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments