Hamish McRae: Should Italy push for more fiscal prudence in this age of austerity?

Your support helps us to tell the story

As your White House correspondent, I ask the tough questions and seek the answers that matter.

Your support enables me to be in the room, pressing for transparency and accountability. Without your contributions, we wouldn't have the resources to challenge those in power.

Your donation makes it possible for us to keep doing this important work, keeping you informed every step of the way to the November election

Andrew Feinberg

White House Correspondent

It is a funny time in Italy. On paper the country's economy has now shrunk for seven consecutive quarters, making it the longest recession since the Second World War, and leaving it some 8 per cent below the peak reached in 2007.

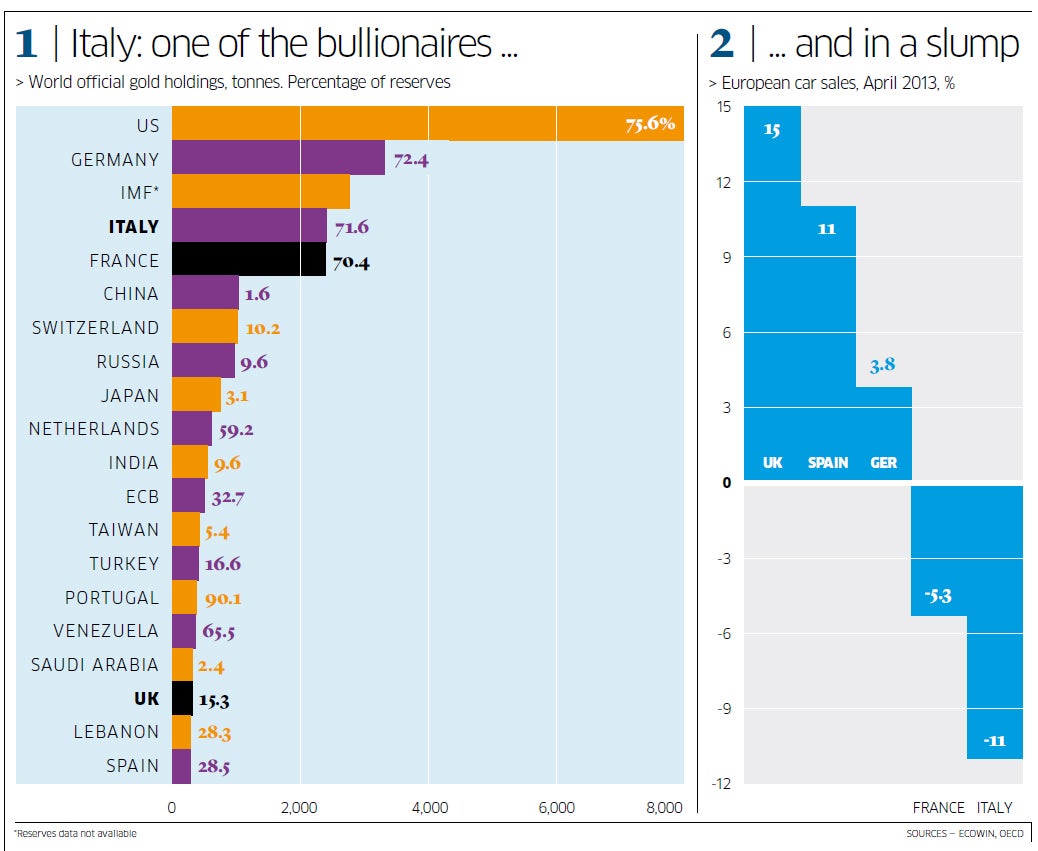

The recession will, I am afraid, go on for a lot longer. Istat, the Italian national statistics agency, forecasts the economy to fall by 1.4 per cent this year, following a decline of 2.4 per cent last year. The two main consumer associations think things are even worse: they expect a fall of 2 per cent. It is easy to see why. Sales of the largest single consumer item, motor cars, were down 11 per cent in April on the previous year, making it the worst of the five main European markets (see right-hand graph).

You can go on trotting out the list of negatives. National debt will rise to a record of more than 131 per cent of GDP by the end of this year, according to the OECD, and will be more than 134 per cent by the end of next. The government still maintains that the budget deficit will come out below 3 per cent this year, but the OECD thinks it will be 3.3 per cent this year and 3.8 per cent next.

But, as always in Italy, there is another side to the story. It is not just that Rome feels comfortable and reasonably prosperous – capital cities always seem to resist recession better than the hinterland – or that the tourist season is getting under way. The positive side of the story includes the fact that the country is close to running a current account surplus and that it is able to borrow at what, six months ago, would have seemed astonishingly low rates. The yield on 10-year Italian debt is now down to 3.9 per cent, which compares with nearly 7 per cent last summer. This is in line with a decline in borrowing costs for nearly all European nations, particularly those that were hit by the crisis in confidence last year. There were some successful auctions of bonds by Italy and Spain on Friday, which suggest that yields for "fringe Europe" may have further to fall.

Being able to fund itself cheaply is vital for Italy, given the size of its outstanding debt, the third largest in the world after the US and Japan, and the relative shortness of that debt's maturity. Maybe investors are comforted by the fact that though it has huge debts it also has a huge stock of gold, the third largest of any country in the world. I know the size of a country's gold reserves should not be taken as a proxy for the quality of their economic strength, but I found the statistics published by the World Gold Council on Friday (and shown in the main graph) fascinating.

Should a country hold three-quarters of its reserves in gold, as do the US, Germany, Italy and France, or should it try to earn as big a return on them by investing in other assets? Over the past 20 years it would have been right to stay in gold. Maybe for the next 20 years other assets will outperform gold. At any rate Italy, for all its problems, scores high on this element of monetary prudence.

That leads to an even bigger question: how far should one push fiscal prudence in this age of austerity? It is a practical question facing much of Europe right now. Italy's new coalition prime minister, Enrico Letta, has promised to come up with a pump-priming plan this summer. His particular target is to do something about youth unemployment, now at around 40 per cent in Italy.

"Europe must respond to youth unemployment, which has reached absolutely unsustainable levels," he said. "We ask that the next European Council summit in June concentrates on an extraordinary plan for youth unemployment that launches concrete measures immediately."

Fine words, but you see the point: he can only move if the powers that be in Europe move with him. It is hard to judge quite how this will play out. There will inevitably be some pan-European plan to cut youth unemployment and there may be some easing of the profile of deficit reduction. Fringe Europe, which in this case includes France, will be given more time to get deficits below the 3 per cent Maastricht ceiling, still notionally the target. But past experience has taught us that in the absence of general economic growth, specific initiatives such as one targeting youth employment have only limited impact. And yes, let's assume that Europe does ease up a bit on austerity, for that is what will surely happen, but will that really bring more growth?

That is a question you are very aware of in Italy. The economy is back to where it was 20 years ago and thousands of ambitious young people are leaving for jobs in Germany, the UK, US and beyond. But the place is lovely. It frequently tops the league tables for quality of life, is creator of the famous "slow food" movement, and more parochially is the place where a lot of Britons want to spend their summer holidays. It is easy for an outsider to see a list of reforms that could take place that would encourage growth, but getting the balance right between fast growth and slow food is a tricky one, and I am not sure the rest of the EU can or should have much to do with it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments