Hamish McRae: Manhattan re-examines its values after shattering blow to its wealth

Economic Life in New York

Your support helps us to tell the story

As your White House correspondent, I ask the tough questions and seek the answers that matter.

Your support enables me to be in the room, pressing for transparency and accountability. Without your contributions, we wouldn't have the resources to challenge those in power.

Your donation makes it possible for us to keep doing this important work, keeping you informed every step of the way to the November election

Andrew Feinberg

White House Correspondent

The supertanker has started to swing round. The US economy has not yet begun to move forward and there are several mighty forces checking any return to growth. But there are signs that the relentless downward grind of economic activity is over. Things are not getting better, or at least not to any significant extent. But they are not getting worse.

New York, of course, is not America. Wall Street most certainly isn't. Ahead of yesterday's dire US jobs figures, at least, shares have just recorded their best quarter for more than a decade, though the previous quarter had been so utterly dreadful that most of what they were doing was recouping that lost ground. The Standard & Poor's 500 index was up 17 per cent on the three months. But there are other signs, both in the statistics and the streets, that the economy is starting to stir again.

The stats say that household spending, which accounts for 70 per cent of the economy, has stopped falling. It may be down a little in the second quarter, but not by much, and consumer confidence has been rising for the past couple of months. Car sales were up, consumer durable sales were up and sales of services, the largest element of people's budgets, were stable.

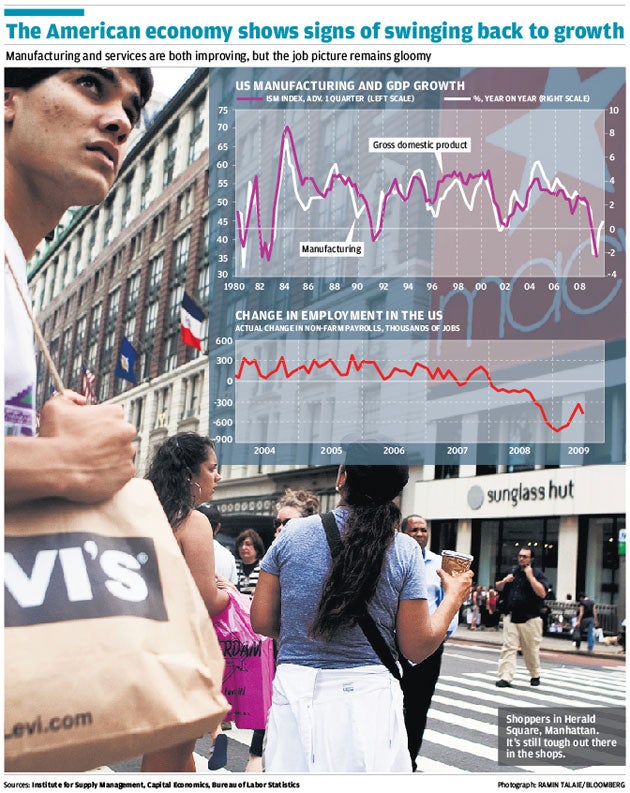

The figures also say that manufacturing may be turning up at last. For the past six months the ISM manufacturing index (derived from asking manufacturers whether they expect output to expand or contract) has been creeping up. But until now the balance between companies expecting expansion and those expecting contraction has been consistent with a falling economy. On Wednesday it finally nudged up to a point where it might signal some growth, as the first chart (from Capital Economics) suggests. The point here is that though there are more companies that expect a contraction than an expansion, ie the index is still below 50, in past cycles this has signalled a turn is on the way. This says nothing about the strength of the recovery, and there are many reasons for expecting that to be unusually weak. But it is consistent with the economy starting to grow in the third quarter of this year, that is from now on. If that turns out to be right, the recession will have lasted about 18 months, about the normal duration for post-war recessions but shorter than that of the early 1980s.

As for the streets, well, New York always gives the appearance of being busy: the bars seem full enough and there are still queues for taxis. The obvious signs of distress include some stores boarded up, even in the smart mid-town Manhattan, and discounts on hotel rooms. But the street economy certainly feels no worse than it did after the dot.com bust, and utterly different from the New York of the early 1980s, when the city looked battered and poor. Tomorrow will be a test because it is a public holiday, as Independence Day falls on a Saturday. Traditionally Americans celebrate the gaining of freedom from their colonial oppressor by shopping. We will see whether they celebrate and reinforce an economic turning point too.

This leads to a couple of reflections about American consumerism, the force that drove the whole world economy in the past few years, accounting each year for half or more of the increase in global aggregate demand.

The first thought is that people can live quite well, assuming they can pay their daily bills, without having to spend money on big-ticket items. They have already accumulated the basics. The car can be replaced a year later; you don't have to have new furniture and new carpets; you don't have to move home. The mass of goods that people have acquired is so huge that for people who still have some income, the goods they already have insulates their standard of living.

It is the reverse of the absurd consumerism of recent years, with people buying things they didn't need and still feeling dissatisfied. People are buying less but in some ways living just as well, maybe better. I am not trying to minimise the distress many people are experiencing. Far from it. It is just that in the middle of Manhattan that distress is not apparent, and the reason that it is not apparent is that this sharp downturn was preceded by an even sharper boom.

That leads to another point that has been made about consumers. It is that as and when incomes and employment start to rise again people may well behave differently from the way they responded during previous expansions. For the moment employment sadly is still shrinking, as the figures out yesterday (and shown in the other graph) bear testimony. I am afraid that employment fell by 467,000 in June, up from a loss of 322,000 in May. Unemployment is now 9.5 per cent of the workforce.

It is true that employment is a lagging indicator and you would expect it to keep falling for some months after the turn in the economy, but those numbers are deeply discouraging. So it is unsurprising that people have been trying hard to rebuild their savings and pay off debt: you would expect this at a time of uncertainty. But as and when the job market does improve there may well be a legacy of caution. It is conjecture, of course, but it would make sense if, after this experience, people will continue to try to borrow less and save more.

What will, I suggest, happen is that American consumers will become a bit more like those in the rest of the world. In macroeconomic terms, to consume 70 per cent of GDP is way out of line with the rest of us. Thus in the UK consumption is about 66 per cent of GDP, and that is probably unsustainably high. (Mind you, consumption can also be too low: in China it is about 40 per cent, and they are trying to get it higher.) You could say that America as a country and Americans as individuals have both been living beyond their means.

The change need not be that huge. The US will remain a consumer society. It is just that it will be a bit more like the consumer society of, say, the late 1990s rather than of the mid-2000s.

That leads to a final point. Chatting to friends here in New York I find they are using this downturn to reflect on values. It has been a shattering experience for a city where wealth is the principal social arbiter to have seen so much of that wealth destroyed. People typically are one-third poorer than they were a year ago. The more they had, the more they have lost – and that goes for the people who did not leave their funds with Mr Madoff. Everyone seems to know families that have been wiped out by his practices.

Other Americans would not feel particularly sorry for New Yorkers, partly because it is as bad or worse on Main Street, where car dealers and real estate agents have been devastated, and partly because New Yorkers have not always engendered warm and comfy feelings among their fellow citizens.

The city is resilient, and it will bounce back; it may already be doing so. But it will bounce back with perhaps a little more humility, a little more caution, a little more thoughtfulness about what really matters in the world.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments