Hamish McRae: George Osborne's fiscal handcuffs are political, but he does have a point

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne does politics, and you can see the political edge in the plan to curb his own borrowing powers and those of future chancellors. This does focus attention on the failure of Gordon Brown to control the underlying fiscal deficit. But the tone of the present Chancellor is remarkably similar to that of his predecessor-but-one, for Brown made fiscal probity the centre of his political platform: prudence with a purpose, the end to Tory boom and bust.

To see this initiative in solely British terms, however, is a mistake. Governments around the developed world have lost control of fiscal discipline. All, in various ways, are trying to find a way to take authority away from the politicians of the day.

In Europe there was the Maastricht limit of 3 per cent of GDP, which failed because it was ignored. Germany was an early miscreant. Now the eurozone authorities are trying to frame new controls over national budgets, as they have to if the euro is to survive, and Germany itself has a balanced-budget requirement. The US might seem to be the odd man out, for Congress rules supreme – presidents propose but Congress disposes – but you can see from the fights that go on (remember the fiscal cliff?) that most legislators accept that there has to be some better way to match spending to revenues.

Actually, the odd man out is Japan, where there is no de facto legislative curb on deficit spending, and where, thanks to the very high savings rates of the Japanese people, there are no market curbs either. I think we all know where that story will end.

Whenever there is a global failure, political institutions are created or altered to try to tackle it. This is not a smooth or easy process, more a set of trial-and-error initiatives. The great inflation of the 1970s was not solved by giving central banks control over interest rates and a requirement to keep down inflation. It was solved, painfully, by the central banks, led by the US Federal Reserve, increasing interest rates under their existing mandates. The two banks that had a degree of independence, the Fed and the Bundesbank, did best at controlling inflation and as a result other central banks, including the Bank of England, were given inflation targets and then the independence to shape policy to meet those targets.

It was a messy business, and still is. Inflation targets lulled the central banks into fuelling an asset price boom, by encouraging the commercial banks to spray loans around. Now QE has led to another asset price boom, and we are just becoming aware of the dangers of that, social as well as economic. But at least the world has not gone back to the runaway inflation of the 1970s, and emergency policies did enable output to recover after the banking crash. Progress has been made.

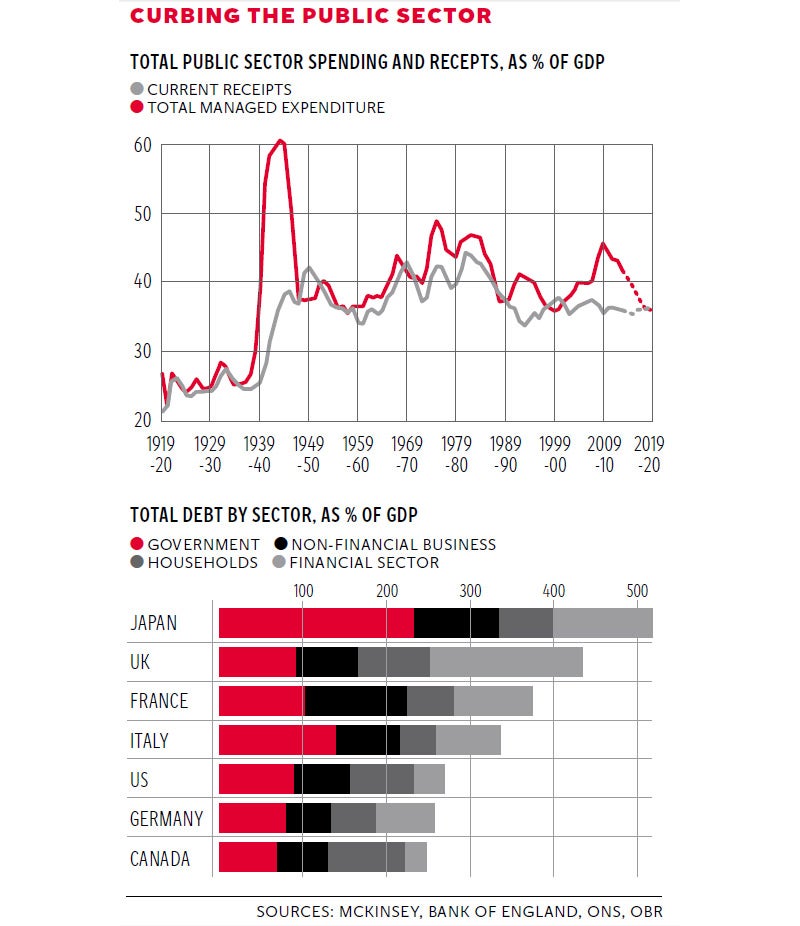

Now see fiscal policy through the lens of this experience. We have had a fiscal catastrophe analogous to the monetary catastrophe of the 1970s. You can catch some flavour of the scale of that, as far as Britain is concerned, by the top graph. That comes from the Office for Budget Responsibility and shows nearly 100 years of tax and spending as a percentage of GDP. The thing I had not quite appreciated is that during the Second World War public spending rose to only 60 per cent of GDP. Of course that is very high, but I am surprised it was not even higher. The other striking thing is how revenues have been stuck at a little above 35 per cent of GDP for the past 30 years. Unless you believe that the British willingness to pay tax is going to change radically, that is the money any government has to spend. It is on a fixed income relative to GDP.

So the question then is how best to ensure that our governments acknowledge this. Constitutional arrangements have to fit reality. Elected governments are elected governments but ideas about the proper scope for politics change over time. It would be ridiculous now to propose that the Chancellor should set interest rates, yet that was the norm until 1997. The OBR has become an effective voice, so we do have independent scrutiny of fiscal policy. It is still early days, for it is only five years old, but I suspect that most people perceive that it has performed better than expected. If it is helpful to try, in addition, to legislate for a specific fiscal objective, then let’s see if that works better than expected too.

We should not, however, expect this to be the last word. The developed world is over-burdened with debt, and public debt is only part of that. As you can see from the bottom graph, which comes from the McKinsey study of global debt earlier this year, UK public debt is pretty much in line with that of the other G7 countries, bar the outlier, Japan. But our overall debt is high, boosted by personal and financial borrowing. You can see a case for constitutional control over borrowing too, rather as we used to have strict limits on the amount people could take out on a mortgage or buy goods on hire purchase.

The central issue here is intergenerational equity. To what extent is it fair for one generation to engineer things so that its standard of living is higher than it otherwise would be, by putting the burden on to future generations? Failure to control deficits puts the burden on to the next generation and while paying for wars is one thing, feather-bedding the living standards of the early-retired is another. While populations were rising this issue was concealed, because the next and larger generation could pay the pensions (and the public deficits) of the previous one and still enjoy higher living standards.

The UK is still in a relatively comfortable demographic position, although the country will become more crowded. Most of the rest of Europe is not. But Europe has the straitjacket of the single currency, at least for the time being, and we don’t – which helps explain the thinking behind the Chancellor’s plan.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments