David Blanchflower: Wages slide shows Bank must act strongly and quickly

The MPC should be easing policy right away given that the risks to inflation are so markedly on the downside

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.At first glance there was some good economic news last week. But the good was tempered with much weakness. First, CPI inflation came in at 2.8 per cent, which was better than most economists expected. Rapid falls in oil prices, which are down $30 a barrel since April, suggests that the CPI may well be below the 2 per cent target by the end of the year. Second, May's official measure of retail sales increased by 1 per cent, although this largely reflected the fading of the temporary factors that depressed spending by 2.8 per cent in April and so should not be interpreted as an indicator that consumers are suddenly planning on a burst of new spending.

Nearly 1 per cent of the 1.4 per cent monthly rise in overall sales volumes in May was due to a return in fuel and clothing sales to more normal levels. March's fuel panic caused by Francis Maude meant that consumers bought much less petrol in April, while the bad weather in the month temporarily reduced clothing sales. Third, the ONS jobs report also contained some better news. Private sector employment rose by 205,000 between January and March 2012. Unemployment was down 10,000 and employment was up 50,000 on the month. Total hours were also up.

But that news was countered by some not-so-good news. The number of long-term unemployed was up by 30,000. The number of part-time workers wanting full-time jobs was up 25,000. The number of vacancies remained unchanged. There was a jump of 59,000 in the number of people who were out of the labour force (OLF) and couldn't find a job. The claimant count for May was up 8,000 compared with April. This is a more timely measure than the ILO count, which does not augur well for the future path of unemployment.

Over the last year the number of employees has fallen by 136,000 while the number of self-employed has risen by 186,000. The number of full-time employees has fallen by 122,000. Of particular concern is the fact that we have little idea what these new self-employed workers are actually doing; it is most unlikely that many of these are budding entrepreneurs. The concern is that they are doing low-paying jobs with relatively few hours; it is most unlikely then that many of these are "good jobs". We know that the earnings distributions for the self-employed and employees are very different from each other.* Median incomes are lower for the self-employed than they are for employees, but the self-employed distribution, of course, has a longer right-hand tail. There is also little evidence to show that a higher self-employment rate – the proportion of total employment that is self-employed – which is up from 13.6 per cent to 14.2 per cent on the year – has any correlation at all with macroeconomic performance.**

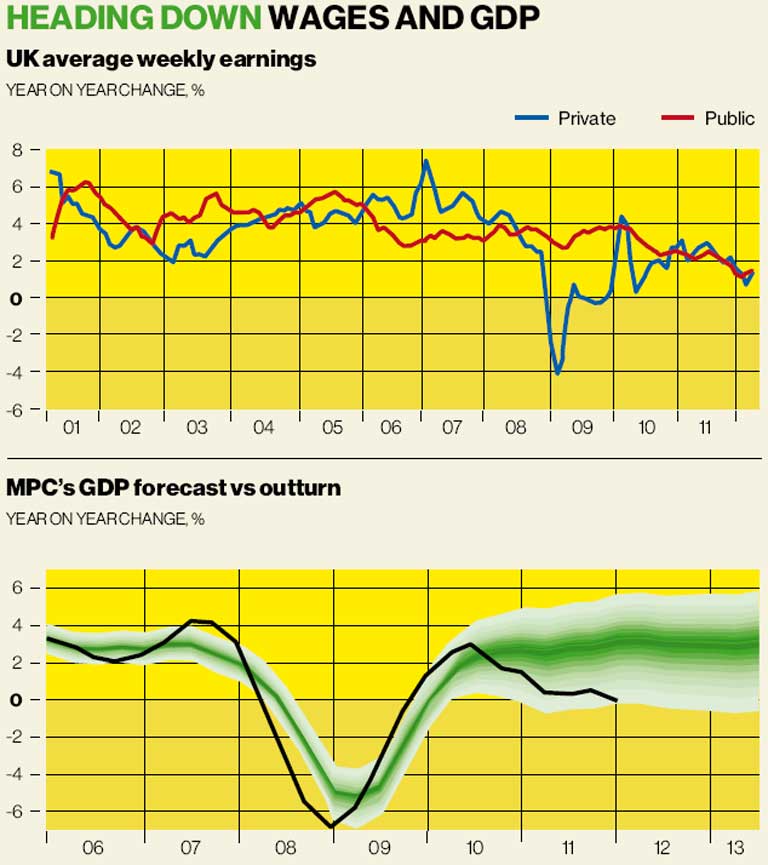

The most important piece of evidence in my view in the ONS jobs release was the evidence on wages presented in the chart. As we can see nominal earnings growth has been falling over the last nine months or so as the economy headed back into double-dip recession. Private-sector earnings growth picked up through 2011, reaching a high point of 2.9 per cent in August 2011, but has fallen steadily since then. Earnings growth averaged over the last three months, February-April, was only 1.1 per cent in the private sector and 1.3 per cent in the public. In combination with an inflation rate of 2.8 per cent real earnings continue to fall. This does not suggest to me that there is any risk at all of domestically generated inflation, which means that the MPC should be easing policy right away given that the risks to inflation are now so markedly to the downside.

We found out last week from the newly published minutes of the June meeting that four of the nine members of the MPC, including the Governor, Sir Mervyn King, plus Adam Posen, Paul Fisher and David Miles, all voted for more quantitative easing. King, Miles and Posen voted for an additional £50bn while Fisher voted for £25bn. This is the third time that the Governor has voted in the minority; it is not obviously a good thing as it suggests a lack of influence and leadership, especially when King was unable to carry three of his own internal appointees with him – Charlie Bean, Spencer Dale and Paul Tucker.

Bean is well known to be a terminal ditherer and is the most likely to change his vote at the next meeting. Independence is all very well as long as people make the right decisions; knuckles need to be rapped when they don't. Interestingly in a Reuters interview one of the five dissenters, the external member Ben Broadbent, argued that the case had strengthened for the Bank of England to pump yet more money into Britain's struggling economy as the outlook had weakened over the past few weeks and the eurozone crisis is likely to hurt the country for some time, although it remains unclear why this is news as that has been apparent for months.

In addition the external member Martin Weale, who also voted against more monetary stimulus in June, made a speech entitled "Navigating Rough Waters", where he noted that the "immediate prospects for the economy have worsened". And he concluded that now "there is appreciably more room for further monetary stimulus".

Weale also took a heavy swipe at the recession deniers who have argued that despite no basis in evidence, for sure, the GDP data will be revised up. Weale concluded that, "I am confident that the GDP figures will be revised again but would not like to say whether this will be up or down". I agree.

Weale also produced a chart, reproduced above, showing the MPC's terrible forecasting performance on GDP growth from two years ago; the data have continued to disappoint to the downside. The data shows the MPC's forecast with the actual data as the black line; note that the gap between forecast and outcome is growing. But still the MPC continues to believe, wrongly, all will be OK on the night.

Momentum does seem to have moved in the direction of more QE. More is better than less. Sooner is better than later.

*David G Blanchflower and Chris Shadforth, "Entrepreneurship in the UK", Foundations and Trends in Entrepreneurship, Vol 3, No 4 (2007), pp 257-364

** David G Blanchflower, "Self-Employment: More May Not Be Better", Swedish Economic Policy Review, vol 11(2), Fall (2004), pp 15-74

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments