David Blanchflower: The Coalition's economic legacy is plain - it has left us worse off

We can assess the overall success of the Coalition by examining the state of the economy the Coalition is about to hand over

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Now is precisely the right time to ask a variant of the question famously posed by presidential hopeful Ronald Reagan back in 1979: “Are you better off today than you were when the Coalition was formed?”

The definitive answer to that question is “no”. Since May 2010 weekly wages, as measured by the national statistic, average weekly earnings (AWE), have risen 8.0 per cent. Over the same time period, inflation, as measured by the CPI, has increased 11.4 per cent. So real earnings – the difference between wage growth and price raises – have fallen by 3.4 per cent. Workers can buy less today with their pay packets than they could at the beginning of the recession. The Coalition treatment has been bad for you; there has never been a comparable drop in real wages in any previous parliament. Plus there was a rise in VAT and a cut to all those benefits and services. It’s as simple as that. The Coalition has been an unmitigated disaster for ordinary folk.

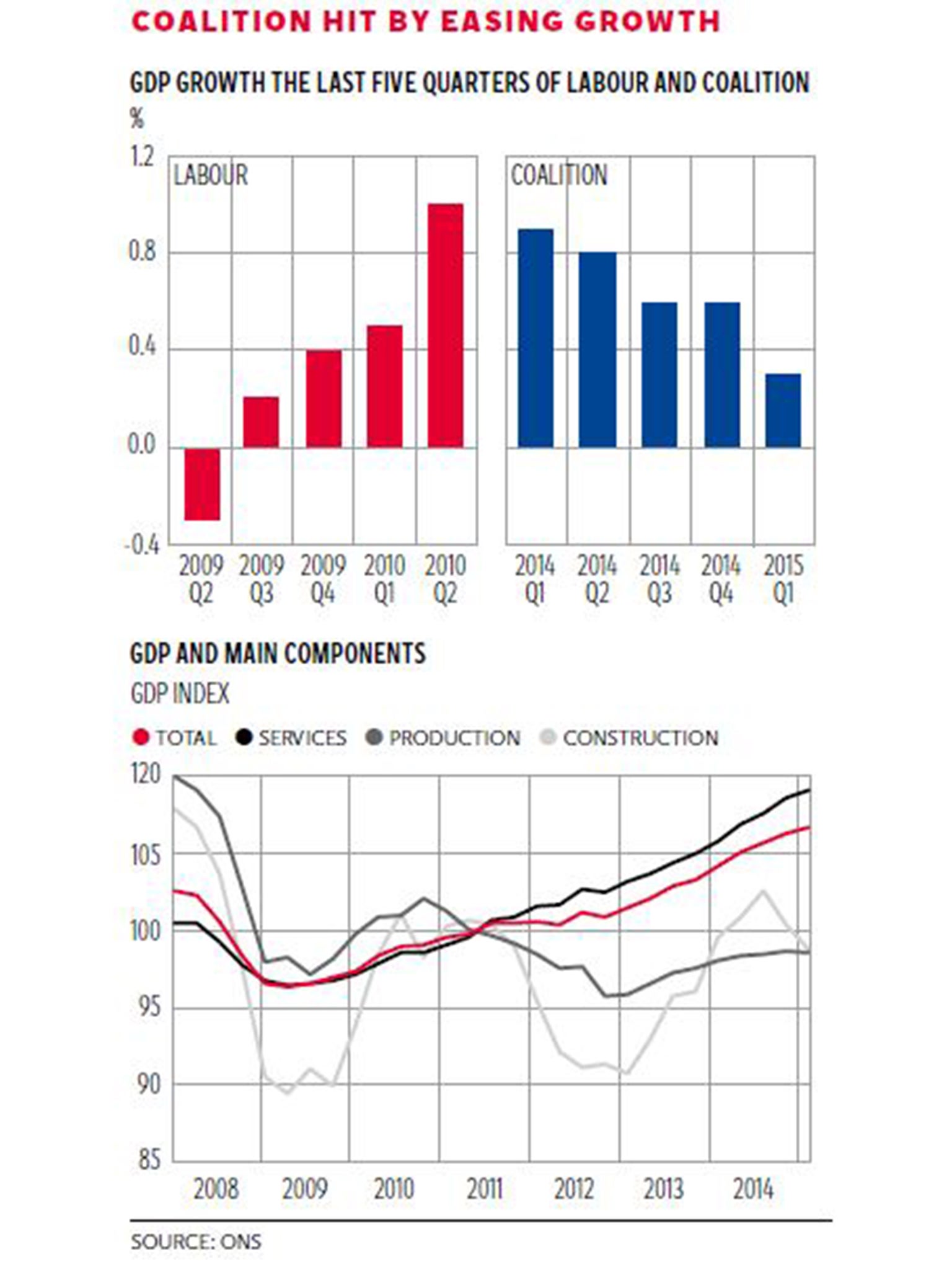

We can assess the overall success of the Coalition by examining the state of the economy the Coalition is about to hand over compared with the state of the economy they were gifted. The simplest is to examine what happened to growth over the last five quarters for which we have data in 2014 and 2015, and then to compare it with the last five quarters under Labour in 2009 and 2010. Recall that Osborne, Cameron and Clegg argued at the time that the UK was bankrupt and like Greece, which was of course totally untrue.

The chart shows that GDP growth under Labour from 2009 Q2 to 2010 Q2 grew steadily from minus 0.3 per cent at the outset to 1 per cent in the quarter when they left office. Ever onward, ever upward. Now we move to the right of the chart to see the Coalition story: from a high of 0.9 per cent in 2014 Q1, GDP growth slowed steadily until the disastrous 0.3 per cent for Q1 2015 published by the Office for National Statistics (ONS) last week. The Coalition never achieved a quarterly growth rate as high as the 1 per cent they were handed by Alistair Darling in 2010. Plus the AAA credit rating they were handed remains long gone.

Employment of those aged 16 and over in January 2008 at the onset of recession is up by 4.6 per cent in the most recent data. Employment is indeed at record levels, but so is the 16-plus population, which is up 5.4 per cent. So the 16-plus employment rate has fallen from 60.4 per cent to 59.9 per cent. As a proportion of the adult population, a smaller proportion are employed than before the recession. Since May 2010, the number of jobs is up by 1.4 million, of which 300,000 is due to UK born and 1.1 million from the non-UK born. Just over half of this increase is due to growth in the number of workers from the 10 Eastern European Accession countries.

Plus the Coalition will hand over an economy almost certainly headed immediately into deflation from its present 0 per cent. How I know that is a simple matter of adding up the 12 monthly increases that make up the annual inflation rate. If April’s monthly number is less than 0.4 per cent, as seems likely, then – bingo – the UK is in deflation. The new chancellor gets handed deflation on a plate within a few days of taking office.

The second chart, also published by the ONS this week, shows how output in the three main sectors of the economy has developed since the onset of recession in 2008. Of note is the fact that this quarter construction output fell by 1.6 per cent, production by 0.1 per cent, and agriculture by 0.2 per cent. Overall, since 2008 Q1 GDP is up by 3.7 per cent, but output per head remains 1.2 per cent below starting levels. The rise in real GDP is primarily driven by a rise in services output: construction and production still remain below starting levels. There has been no march of the makers.

There was also further evidence of slowing in manufacturing from the latest Purchasing Manager’s Index (PMI) from Markit, which reported its weakest growth for seven months in April, and the second-weakest in two years, falling from 54.0 in March to 51.9. The survey signalled the largest downturn in export orders since the start of 2013, and the fifth decline in the past seven months, highlighting how the appreciation of sterling – notably against the euro – is hitting competitiveness abroad.

Markit’s chief economist, Chris Williamson, noted: “Not only did the PMI survey signal a disappointing start to the second quarter, linked to falling exports and business investment, but job creation also waned and output prices fell at the fastest rate since 2009, highlighting weak demand.” According to new figures from the industry analyst Glenigan, UK construction activity hit a two-year low as UK activity suffered its sharpest fall since Q1. Not good.

Eight distinguished professors of economics and I in a letter to the Financial Times* argued that “it is imperative that the mistakes of the past five years are not repeated, and that the new government elected on May 7th pursues a balanced expansion, eschews further major cuts in public expenditure or large tax increases, and focuses on desperately needed investment in capacity, research and skills to address the productivity crisis that is the other main economic outcome of the past five years”. It’s time for a change of tack.

* Christopher Allsopp (Oxford & ex-MPC); Mark Blyth (Brown); David Cobham (Heriot Watt); Lord Eatwell (Cambridge); Marcus Miller (Warwick); John Van Reenen (LSE); David Vines (Oxford); and Simon Wren-Lewis (Oxford).

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments