David Blanchflower: Our fragile economy still has further to fall

It seems unlikely any announcement will have any effect on the economy much before 2015

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In an interview in the Financial Times last week CBI boss John Cridland criticised the Government for failing to boost the economy. Essential upgrades to roads and funding for renewable energy he argued were being held up for no good reason. He went on to say that members of the Government appeared to be "dazzled in the headlights", which resulted in a lack of progress on its growth plan which George Osborne announced seven months ago.

Rachel Reeves MP, Labour's Shadow Chief Secretary to the Treasury, responding to Cridland's comments, said: "With Britain now one of just two G20 countries in a double-dip recession, the CBI is right to criticise the failure of the Government's growth policies. The Government's plan has completely failed. That's why we need a change of course and a real plan for jobs and growth. And it's why we need a full-time Chancellor 100 per cent focused on getting our economy moving again. Without urgent action now, Britain will pay a very heavy long-term price." Sounds right.

The lack of urgency from the Coalition in response to the lack of growth is astonishing given that it takes a really long time for big infrastructure projects to have any effect on the economy and on people's pockets and even longer still to actually show up in the official data. It seems most unlikely that any announcement will have any effect on the economy much before the next election in 2015.

The chances of there being any feel good factor from the economy appears by the next election is disappearing into the ether. Monetary policy can only do so much and the fiscal drag from the spending cuts to come is going to be marked. The downside risks from the euro area continue to increase, China, India and Brazil are slowing and UK banks are still not lending, especially to SMEs.

This is all a very long way from where things were supposed to be. There was supposed to have been a huge expansion in the private sector despite the contraction in the public sector. The evidence was always supportive of the view that in a recession the public sector crowded in the private, rather than the reverse.

In the Budget of June 2010, Mr Osborne, pictured, was able to claim that his newly formed Office for Budget Responsibility had taken a look at his plans and, never fear, all was going to be well on the growth front.

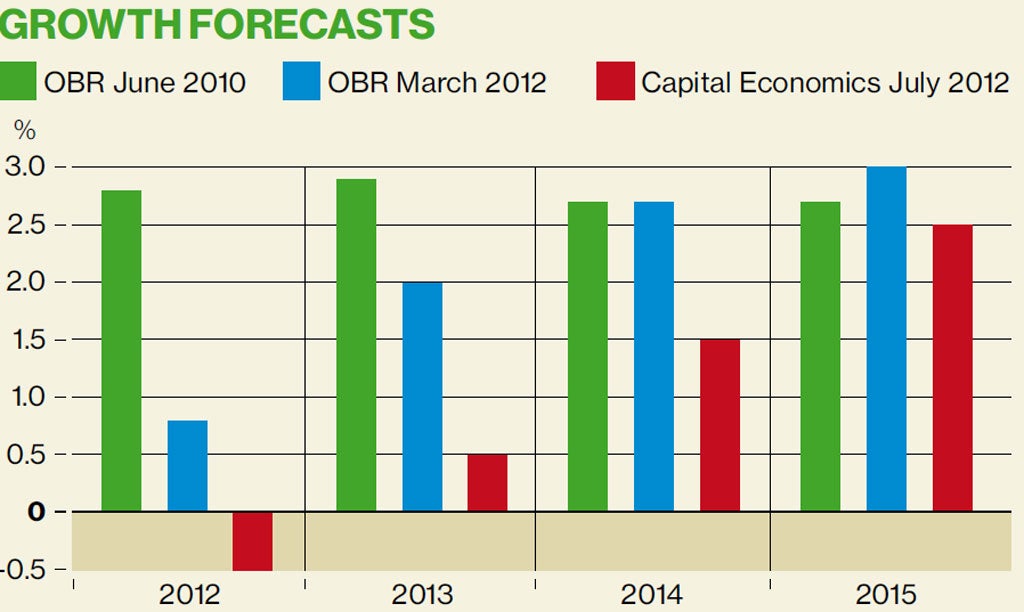

As is clear from the chart above, their forecast then was for growth in 2012 of 2.8 per cent with broadly similar numbers in each of the following three years. By March 2012 the OBR had changed their tune considerably for 2012 with a forecast of 0.8 per cent and down a little in 2013 to 2 per cent from 2.8 per cent with 2014 unchanged about with increased growth in 2015 of 3 per cent. This now looks most unlikely.

The much respected forecasting team at Capital Economics, headed by my old friend Roger Bootle, has a much more bearish, and much more believable recent forecast, presented in the final row of the chart. They are predicting a contraction of 0.5 per cent for 2012 and a 0.5 per cent expansion in 2013, meaning pretty much no growth at all for two years.

Even if their predicted growth of 1.5 per cent in 2014 and 2.5 per cent in 2015 were to be achieved output would still be less than it was at the start of the recession.

Capital Economics (CE) argue that it is hard to see much improvement in the trade data over the next few quarters. Plus the fact that GDP was boosted by government spending in the two most recent quarters is also a concern as "it is hard to see how government spending can continue to support growth to such an extent".

CE are expecting only a modest recovery in investment of only 2.5 per cent this year followed by growth of 3.5 per cent and 5 per cent in 2013 and 2014 respectively.

They also remain cautious about the outlook for consumption. Recent employment growth, they argue has depended largely on a rise in part-time jobs. But the number of people working part-time out of necessity, not choice, CE notes, is soaring which clearly does not bode well for consumer confidence.

Consequently households look likely to continue to boost their savings and so CE expect spending to fall by 0.5 per cent this year and to rise by just 0.5 per cent in 2013.

Of particular concern for the Government is what is going to happen to house prices; rising values make people feel good and they spend more, which presumably means they are more likely to vote for the incumbent government.

I have long held the view that house price to earnings ratios need to come back to more sensible levels. According to the Halifax house price index they are now 4.36, down from a high of 5.81 in July 2007. When compared to the long run average from 1983-2002, before the latest surge in prices, of 3.63 it looks like prices still have at least 20 per cent to fall, unless there is a burst of wage inflation, which seems unlikely.

House prices, according to the Halifax, have already dropped 19 per cent from their 2007 peak. The concern is that the price fall could be even greater given that corrections in the past have initially involved overshooting on the downside, so the drop could be as much as a further 40 per cent.

CE is forecasting a 5 per cent decline in house prices in both 2012 and 2013 and a 3 per cent drop in 2014. But they argue "the risks of a sharper adjustment cannot be ignored", which seems on the money.

Clearly house prices are very interest rate sensitive and any increase in rates would be disastrous for home owners on variable rate mortgages, who have already seen some increase in their borrowing costs.

The Bank of England's outgoing Governor Mervyn King said last week that Britain's economy "shows few signs of recovery".

The scary thing for the rest of us is that none of our economic policy makers seem to have the faintest clue what to do about it. As for me, I'm just off to get married!

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments