Labour is being far too reticent: it didn’t cause the global financial crisis and Coalition austerity policies have stalled the recovery

‘The cut of public investment by 40% was the opposite of sensible macroeconomics’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.My old Bank of England colleague Tony Yates – soon to be Professor of Economics at the University of Birmingham – has an interesting post about electoral politics on his blog, longandvariable. He notes that the Coalition claims credit for the extraordinary job-creation – which he argues almost certainly had nothing whatsoever to do with government policy. The most pertinent thing to say, he notes about the surprisingly high employment, is that it “would have been even higher were it not for the Coalition having over-egged austerity”.

Tony notes that key elements of the debate about the best fiscal policy in future are not being recognised. First, it was Labour that took the plunge in making the Bank of England independent, the Tories being “too wedded to the idea that monetary policy setting should be available for manipulating the business cycle”. Second, the financial crisis cannot be laid at Labour’s door. It was a global crisis, caused by almost total negligence and misapprehension of the risks accumulating in a fast-innovating financial system. He argues that this aspect of our history “would have played out identically had the Tories instead been in office. The Tories favoured light-touch regulation too”. Third, there was not, as is commonly thought, gross mismanagement of public finances. With the benefit of hindsight, we can see that pre-crisis tax revenues from the financial sector, and the trajectory of productivity driving taxes from income, were not sustainable. But those key aspects of the fiscal challenges we now face could not have been so easily foreseen.

The Coalition makes capital out of the creation of the new regulatory architecture as the solution to the financial crisis, which is in turn pinned on Labour having created the former Financial Services Authority out of the Bank of England. Tony argues that the shuffling of regulators’ chairs did not cause the crisis, and reshuffling them will not prevent another one. That seems right.

The letter in another newspaper from 103 Tory supporting business folk, saying the Tories were wonderful and that Labour was anti-business, received a lot of attention in the media. A survey of the UK’s top macroeconomists, who probably know more about economics than the letter writers, received less attention, but was more noteworthy as it said the economic policies of the Coalition had been a disaster.

The Centre for Macroeconomics asked 33 of them if austerity had had a positive effect on economic activity. Two thirds disagreed or strongly disagreed. Eleven strongly disagreed and nobody strongly agreed. Five distinguished professors who strongly disagreed were very confident in their answers.

Simon Wren-Lewis of Oxford University asked: “This is a joke, right?” He continued: “The only interesting question is how much GDP has been lost as a result of austerity. Based on [Office for Budget Responsibility] numbers, you can derive a ‘lowest estimate’ cumulative GDP loss of 5 per cent of GDP (that is about £1,500 for each adult and child). A best guess could be nearer 10 per cent of GDP, although a lot depends on how monetary policy would have reacted.”

John Van Reenen at LSE argued: “Fiscal consolidation was introduced too early into the UK, especially in the 2010-11 and 2011-12 period. The cut of public investment by 40 per cent over this time period was the opposite of sensible macroeconomics. The OBR estimates that UK GDP was reduced by 2 per cent due to this austerity. This was bad enough, but is likely to be an underestimate of the economic damage”.

Andrew Mountford at Royal Holloway concluded: “The Coalition’s austerity policies have had a significantly negative effect on the UK economy.” Richard Portes from the LBS said “the recovery aborted” when austerity began, then resumed when austerity measures were “semi-covertly” relaxed.

Ray Barrell at Brunel University argued: “Austerity policies have reduced GDP below where it would have otherwise have been over the last five years.” Economists 5, Cameron’s business backers 0.

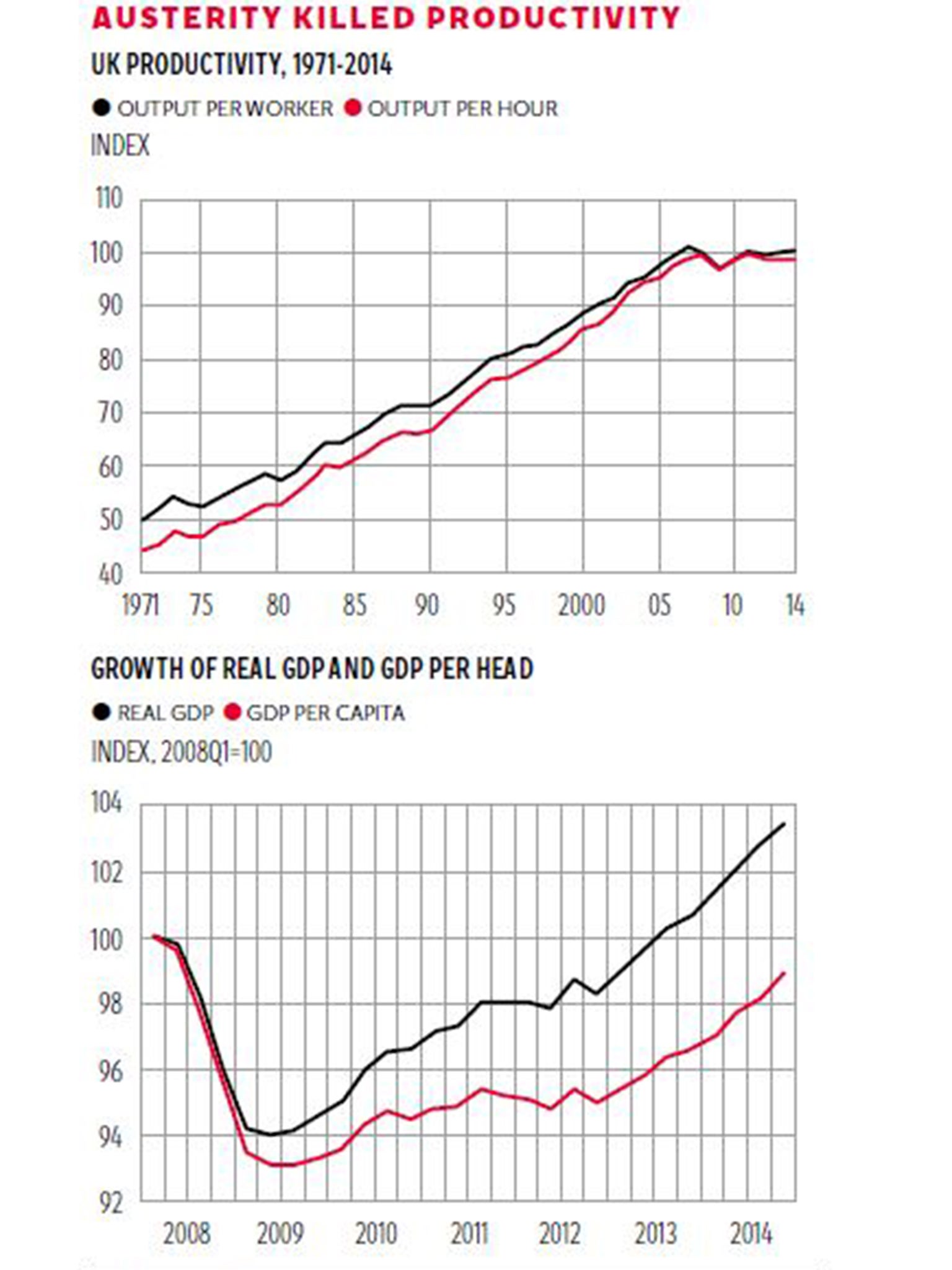

There was also data out last week that backed up the views of the five professors. The first chart plots UK productivity, measured as output per worker and output per hour. Productivity fell in the Great Recession, picked up under Labour in 2010 and has stalled under the Coalition. UK labour productivity, as measured by output per hour, fell by 0.2 per cent in the fourth quarter of 2014 compared with the previous quarter. In 2014 as a whole, labour productivity was little changed from 2013, and slightly lower than in 2007. The OBR forecast depends on productivity picking up like gangbusters right now. If it doesn’t, growth will be a lot lower than predicted and the Chancellor’s plan for the deficit will be trashed.

The second chart illustrates well the points made by the professors. Despite the fact that GDP is now around 3.4 per cent above its starting level, this is still the slowest recovery in more than 100 years. Of note is the flatlining in 2011 and 2012; growth came only when austerity was “covertly removed”, as Professor Portes noted. But the reality is that most of the growth came because there were more people, and especially more migrants. These are the people whose entry the Coalition wants to restrict. But the most telling statistic is the growth in GDP per head, which is still 1.1 per cent below its starting level. This sustains Labour’s claims of a crisis in living standards; the majority of people aren’t feeling recovery.

Amazingly, the PM is trying to take credit for the worst recovery in 300 years and the collapse of output his policies caused. The evidence is clear that output is lower than it would have been without the Coalition’s utterly misconceived austerity policy. Substance over spin, please.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments