David Blanchflower: Economic sentiment has turned – bad news for George Osborne

It now seems that business and consumer confidence started to collapse around the spring of 2014

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Chancellor George Osborne has frequently claimed that the International Monetary Fund supports his reckless austerity. Indeed on 6 June 2011, commenting on the IMF’s review of the UK economy, he said: “I welcome the IMF’s continued strong support for our overall macroeconomic policy mix, including our deficit reduction strategy”. This week the IMF’s internal watchdog, their Independent Evaluation Office, concluded that that support was a mistake, arguing that the IMF’s support for fiscal consolidation in 2010 and 2011, including in the UK, “proved to be premature as the recovery turned out to be modest in most advanced economies and shortlived in many European countries.”

They said that “waiting longer to shift to fiscal consolidation might also have allowed for less aggressive monetary expansion, with less negative side-effects”.

Their critique is devastating to Osborne: “The policy mix of fiscal consolidation coupled with monetary expansion that the IMF advocated for advanced economies since 2010 appears to be at odds with longstanding assessments of the relative effectiveness of these policies in the conditions prevailing after a financial crisis characterised by private debt overhang. In particular, efforts by the private sector to deleverage rendered credit demand less sensitive to expansionary monetary policy, irrespective of its ability to maintain low interest rates or raise asset prices. Meanwhile, a large body of analysis, including from the IMF itself, indicated that fiscal multipliers would be elevated following the crisis, pointing to the enhanced power relative to the pre-crisis environment of expansionary fiscal policy to stimulate demand.” Yup.

Many of us tried to explain that to George before he embarked on his reckless austerity path that produced the third worst recovery in 650 years, behind only the Black Death and the South Sea Bubble. The economy was growing at escape velocity when he inherited it in May 2010 but then the economy flatlined for three whole years until picking up in 2013. GDP per head remains well below its peak level at the start of 2008. Most of the growth we have seen has come from a rise in the 16+ population, which is up 2.5 million (5 per cent) since January 2008 and 1.5 million since May 2010 (3 per cent), mostly through immigration.

The number of workers born outside the UK is up by nearly 900,000 since May 2010, of which 380,000 are from the A10 Accession countries of Europe. Migrants from the A8 countries (excluding Malta and Cyprus) have employment rates of 81.5 per cent. For workers from the EU as a whole it is 79.3 per cent, compared with 73.2 per cent for those born in the UK.

In response to Ukip’s rise in the polls the Tories have been sharpening their attacks on migrants, suggesting that they will attempt to restrict free movement of people to the UK from the European Union. This was quite rightly immediately booted into touch by Chancellor Angela Merkel as inconsistent with membership of the EU.

Difficulties for the Tories over immigration were compounded further last week by the widely reported publication of a paper by Christian Dustmann and Tomasso Frattini. The authors investigated the fiscal impact of immigration on the UK economy, and found major economic benefits. They found that immigrants from the European Economic Area (EEA) have made a positive fiscal contribution, even during periods when the UK was running budget deficits, while non-EEA immigrants, not dissimilar to natives, have made a negative contribution. For immigrants that arrived since 2000, contributions have been positive throughout, and particularly so for immigrants from EEA countries. Notable is the finding of a strong positive contribution made by immigrants from countries that joined the EU in 2004. Dustmann and Frattini concluded that the recent wave of immigrants, those who have arrived in the UK since 2000, “have contributed far more in taxes than they have received in benefits”.

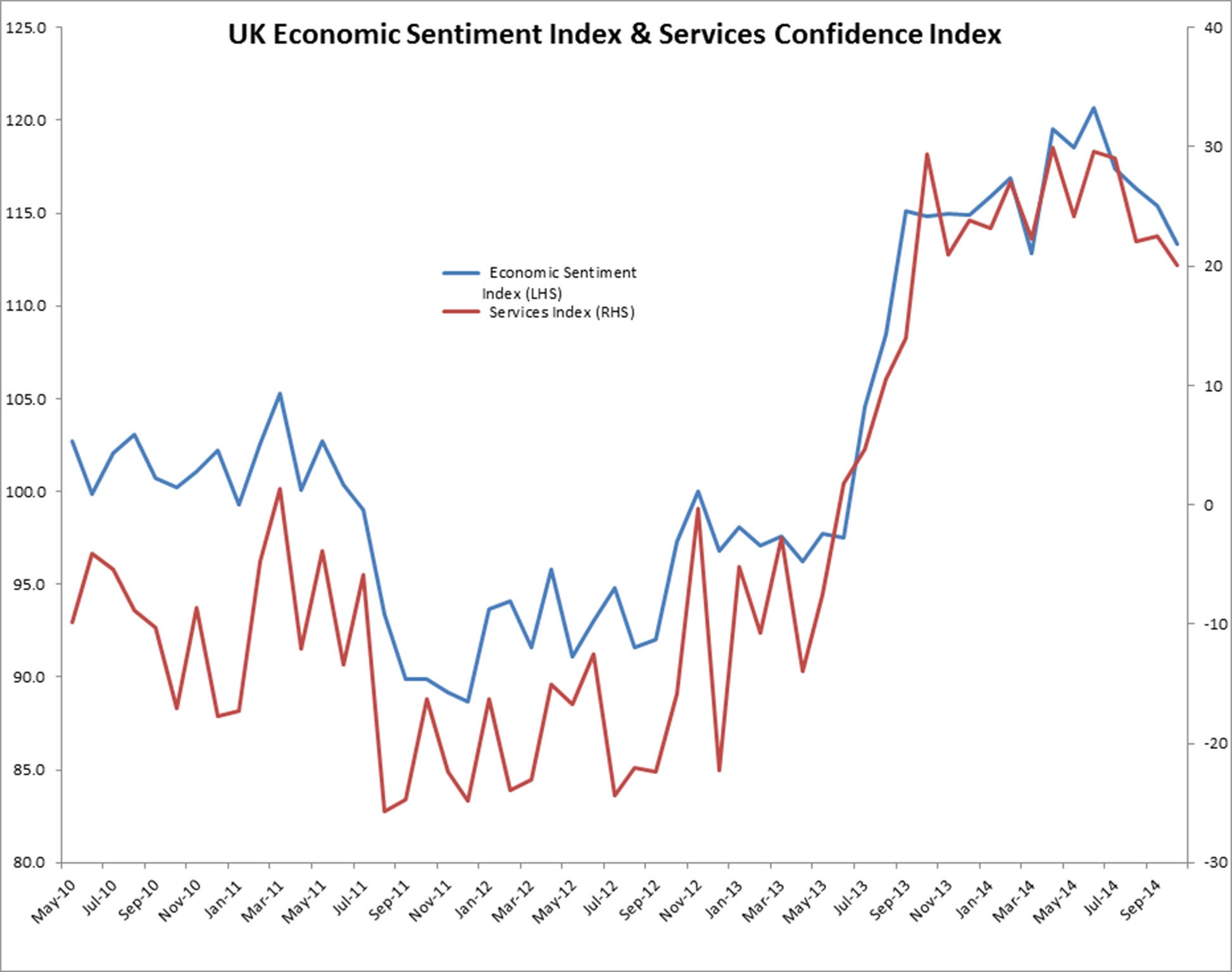

Last week also saw further bad news for Mr Osborne on animal spirits in the UK, only seven months before the election. It now seems business and consumer confidence started to collapse around the spring of 2014 both in the UK and in the eurozone. The first chart shows the recent falls in the services and the composite of construction, manufacturing and service Purchasing Managers Indexes (PMI) for the UK. The services PMI in October fell to a 17-month low of 56.2 in September. There was also a slowdown in the rate of new business growth to a five-month low.

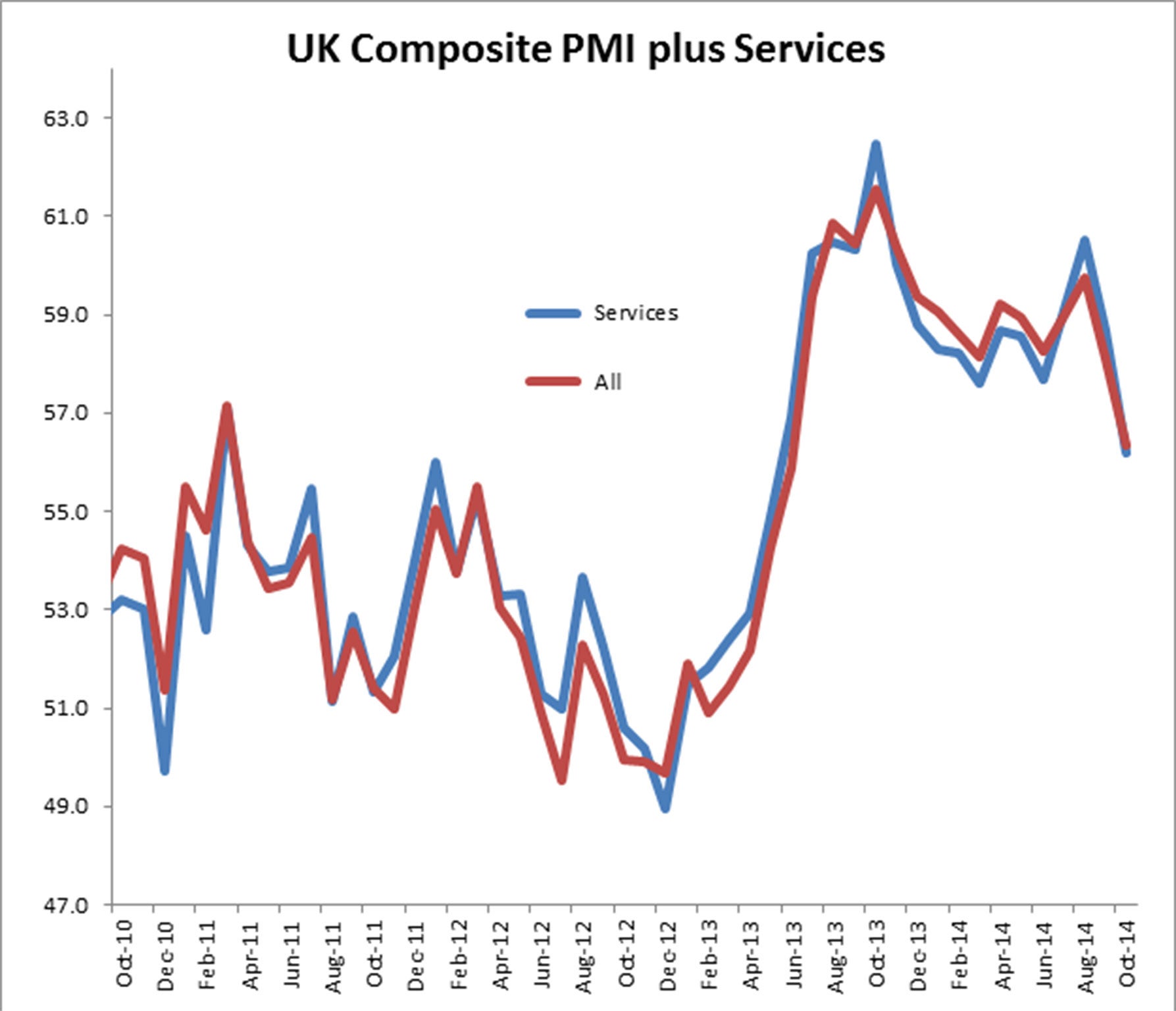

The second chart shows the fall in the UK Economic Sentiment Index (ESI), which the EU Commission conducts monthly. The ESI is a combination of four business confidence indices (retail, industry, construction and services) along with a consumer confidence index. I also include the service sector business confidence index. Both of these started falling in June. The ESI is also constructed in every EU country and it started falling in the spring in both the EU as a whole and the eurozone. The YouGov/CEBR Consumer Confidence Index for the UK also started falling in April. It dropped by 4.6 points in October. This is the largest month-on-month fall since July 2010 and it now stands at its lowest level since December 2013.

The weakness in the eurozone appears to be spreading rapidly to the UK. Confidence appears headed down, down, down.

Disinflation – slowing rates of price increases – also appears to be spreading and may soon become outright deflation, where prices start to fall. Oil prices, commodity prices including food prices all continue to fall. The British Retail Consortium reported that food inflation fell in October to 0.1 per cent after three consecutive months at 0.3 per cent — the lowest recorded rate since the series began in December 2006. Fresh food had its lowest deflation rate since the series began in December 2006, falling to 0.4 per cent from September’s flat rate.

The Consumer Price Index is likely to soon fall below 1 per cent, requiring the first letter from the Bank of England’s Monetary Policy Committee explaining why inflation is so far below target. Rate rise anyone?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments