Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Chancellor wants to turn out the lights. George Osborne declared today that the latest report on living standards from the Institute for Fiscal Studies had “put to bed” some myths. But I’m afraid the report – or rather the way it was widely reported – actually roused a few myths from their slumber and gave them an invigorating mug of strong coffee.

First, consider the idea that living standards are now “back to around pre-recession level”. This was the headline of the press release from the think-tank, and many media outlets adopted this as their own top line. What lesson would most people, glancing at the news headlines, take from this?

That living standards are finally back to where they were before the economy derailed and that the damage wrought by the Great Recession has finally been repaired. That’s certainly the way the Chancellor sought to spin the report, describing the IFS findings as a “major milestone” in the UK’s recovery.

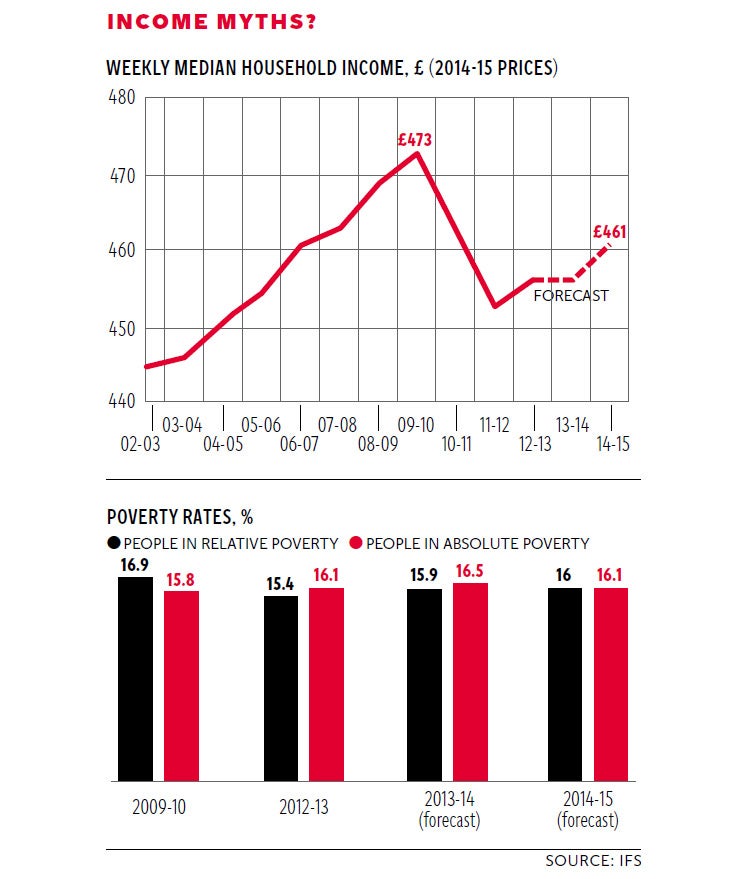

Yet the detail of the IFS report tells a very different story. The think-tank’s modelling clearly shows that weekly incomes in 2014-15 (£461) are still 2 per cent below the peak they reached in 2009-10 (£473), as the first chart shows. So the damage to living standards is not, in fact, repaired.

If the IFS’s projections are accurate, the average British family is worse off today than it was five years ago. That’s not a very comfortable record for Coalition ministers to defend in this May’s general election. It’s true that incomes are now roughly equal to where they were in 2007-08. But given that incomes carried on rising strongly for two more years after this, it’s not obvious why this comparison is relevant. Do mountain climbers get 100 metres from the summit and start celebrating? Of course not – it’s the peaks that matter. Or to be more precise, it is how quickly one gets to the peaks. The IFS is very clear in its report that whatever the exact level of living standards at the moment, they have been growing extraordinarily slowly in recent years.

That raises the question of why they have been so slow. The IFS, quite reasonably, points out that it’s misleading to attribute every trend in incomes before the 2010 election to the previous Labour government and everything after to the Coalition. Labour was also planning a fiscal consolidation after 2010, which would have inevitably eroded incomes. Productivity growth has been abysmal, for reasons that we don’t really understand.

Still, it is hardly unreasonable to argue that policy choices made by the Coalition after 2010 – particularly the Chancellor’s front-loaded fiscal consolidation – depressed the level of real economic output relative to where it would have been if a more gradual deficit reduction path had been followed. And, further, that this weakness in GDP fed through to lower living standards for a great many households. Even the OECD, in its recent report on the UK, quietly recognised that fiscal policy had been a serious drag on growth in 2010-11 and 2011-12 and that the diminishing impact of that early austerity is helping to support growth now.

Another myth that the Chancellor claimed the IFS report had put to bed was that his austerity had hit the poor more than the rich. But today’s IFS report did not produce an impact assessment specifically analysing the period 2010 to 2015 – instead looking at the whole period since 2007-08. And some research from the London School of Economics's Centre for Analysis of Social Exclusion, which has a narrower focus, suggests the bottom half of earners have done worse than those in the top half over the period in this Parliament.

The final myth identified by the Chancellor was that income inequality has worsened over this Parliament. It is true that inequality gauges, such as the 90/10 ratio (which measures the distance between the top tenth of earners and the bottom tenth), projected out to 2015 by the IFS, suggests a fall in inequality. Yet, as the IFS itself stresses, its inequality analysis excludes the top 1 per cent of earners. It is within this group that the vast increases in income have been taking place over the past 30 years – and some evidence suggests that it is still taking place. Data from the Manifest shareholders’ organisation, for instance, suggests that the average total remuneration realised by FTSE 100 bosses rose by 10 per cent between 2010 and 2014, from £4.27m to £4.72m. Average wages over that time rose by just 5 per cent. This highlights the weakness of official income inequality data. The pay of the very highest earners is most unlikely to appear in the income surveys used by researchers such as the IFS and the Office for National Statistics.

Their research is much more suited to capturing inequality trends at the bottom end of the income distribution. And the IFS’s projections suggest that absolute poverty has actually been rising slightly, up from 15.8 per cent in 2009-10 to 16.1 per cent in 2014-15. Interestingly, relative poverty has gone in the other direction, creeping down from 16.9 per cent in 2009-10 to 16 per cent in 2014-15 (as the second chart shows). Why the divergence? The answer lies in the aforementioned slump in average incomes. The incomes of poor families have been falling in recent years, but not as fast as those in the middle of the distribution, spelling a decline in relative poverty but an uptick in absolute poverty.

The Chancellor’s most coherent defence of his record on living standards in the forthcoming election campaign will be that external shocks from oil prices and the disaster in the eurozone took a severe toll on UK families. He can also claim – although this is much less credible – that without his front-loaded austerity policies there would have been a collapse in investor confidence in Britain and the situation for families would have been even worse. But seeking to imply that families are now better off than they were in 2010 is surely the least credible position.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments