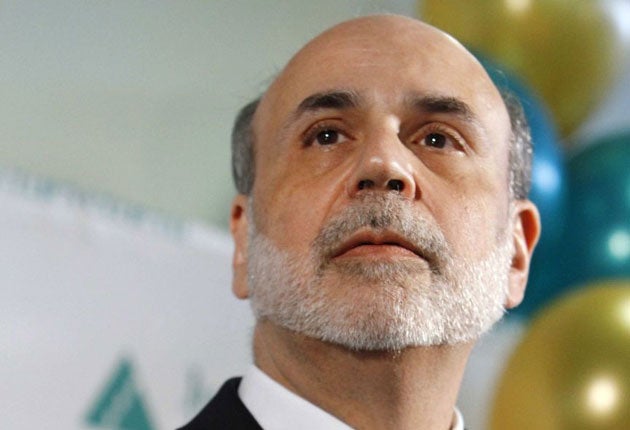

Ben Bernanke could have gone back to college instead of a hedge fund's embrace

Outlook

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.So Ben Bernanke, like Alan Greenspan before him, swans off from the US Federal Reserve to earn millions of dollars working for a hedge fund.

Not just any hedge fund either. Citadel is said to be the most highly leveraged major fund in the world, and is one of the biggest “flash boy” players in high-frequency trading, currently causing so much controversy on Wall Street.

Mr Bernanke sees no conflict in his new position. In fact, he says, he took a job at a hedge fund precisely to avoid accusations of such clashes. You see, he explains, unlike banks, hedge funds are not regulated by the Fed – so there’s no problem.

True, hedge funds are not directly regulated by the Fed. But they are 100 per cent affected by its monetary policies.

Having said that, it’s absurd to suggest Mr Bernanke will be getting leaks of interest rate decisions from his successor, Janet Yellen. And it’s also highly unlikely that his old regulator pals in Washington will give him any untoward insight into future clampdowns on flash trading.

But Mr Bernanke’s move does show the more subtle side of the Washington-Wall Street nexus.

He may think Citadel has hired him for his investment insights, but more important will be his usefulness in its marketing machine – persuading your and my pension managers to invest our cash in its funds.

Investors want to back hedge funds with the best connections, and who could be better connected than Mr Bernanke? Like Tony Blair at JP Morgan, his time in public office makes him a celebrity whose aura will be ruthlessly exploited by his new employers to get investors into its funds.

Back in his days running the Fed, in 2008 he was asked by a Congress suspicious of Wall Street why it should back the bank bailout, Mr Bernanke responded: “I’m a college professor ... I never worked on Wall Street. I don’t have those interests or those connections. My interest is solely for the strength and recovery of the US economy.”

The humble speech worked, and we should all be grateful it did. But what a shame he couldn’t be satisfied with resuming life as a simple academic.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments