Brexit: Dow closes more than 600 points following EU referendum result

The reaction came after British voters decided to leave the EU

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

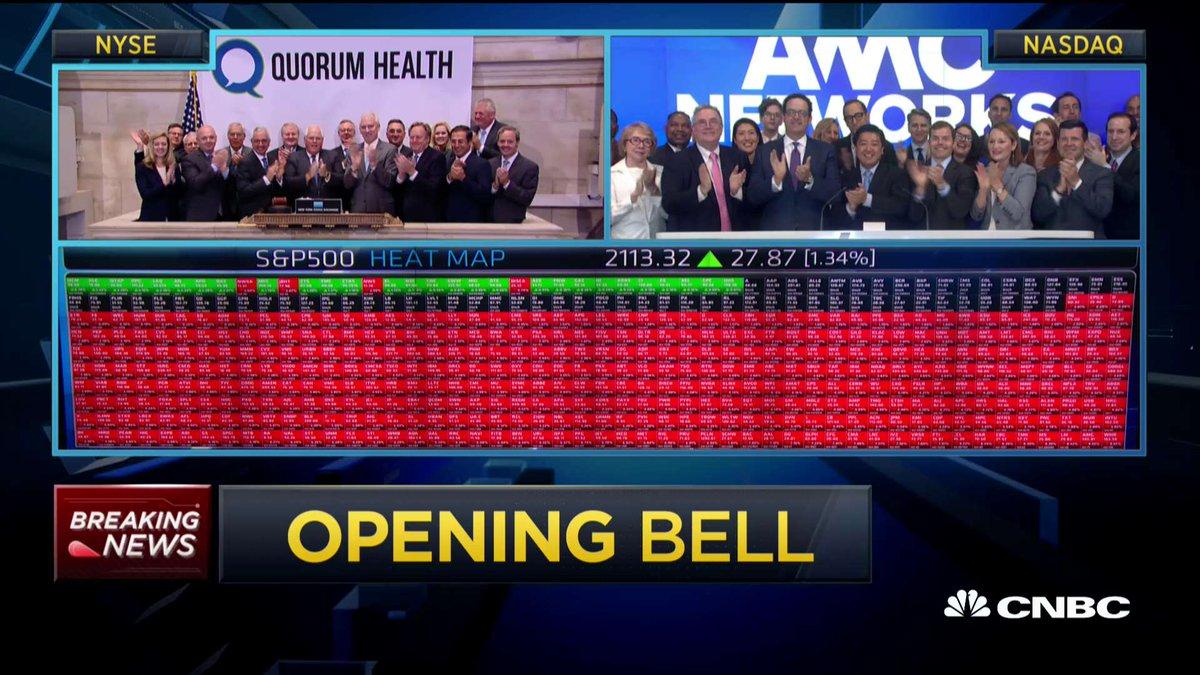

Your support makes all the difference.The American markets - and those around the word - reacted sharply to Britain’s decision to leave the EU with the Dow plunging more than 530 points in the first few minutes of trading. It closed, at 4pm, 611 points down.

“This is going to go on for several weeks,” Mohamed E-Erian, a senior adviser to Allianaz told CNN. “You are going to have major economic uncertainty.”

Reports said that investors were flocking to gold and Government Bonds, in a a sign of concern about the likely impact of the decision, both for the UK and the global economy.

US stocks took far smaller losses than markets in Europe and Asia, but were still sharply lower, the Associated Press said.

The Dow Jones industrial average was down 503 points, or 2.8 percent, to 17,508 at midday on Friday. The S&P 500 was on pace for its biggest loss since last August, down 62 points, or 2.9 percent, to 2,051. The Nasdaq composite dropped 172 points, or 3.5 per cent, to 4,737.

The vote brought a massive dose of uncertainty to financial markets, something investors loathe. Traders responded by dumping riskier assets that appeared to have the most to lose from disruptions in financial flows and trade: banks, technology companies and makers of basic materials.

“This vote is a step away from free trade,” said Bob Doll, chief equity strategist Nuveen Asset Management. “When you add to it the specter of the last couple of years of terrorism it causes the average individual ... to be more nationalistic, more populist, more protectionist.”

Bond prices surged and yields fell, the AP said. The yield on the 10-year US Treasury note dropped to 1.56 per cent from 1.75 per cent on Thursday, a large move.

Banks took the largest losses by far. Citigroup plummeted $3.56, or 8 per cent, to $40.90 and Bank of America fell 96 cents, or 6.8 per cent, to $13.08.

Technology stocks also took hefty losses. Microsoft fell $1.94, or 3.7 per cent, to $49.97 and IBM gave up $7.29, or 4.7 per cent, to $148.06.

Banks have the most to lose in Britain’s departure from the EU as they do a lot of cross-border business in Europe based from their offices in London.

They also become less profitable when bond yields fall, since that lowers interest rates on many kinds of loans such as mortgages.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments