What price the new democracy? Goldman Sachs conquers Europe

While ordinary people fret about austerity and jobs, the eurozone's corridors of power have been undergoing a remarkable transformation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By replacing the scandal-surfing Silvio Berlusconi, Italy has dislodged the undislodgeable. By imposing rule by unelected technocrats, it has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic.

This is the most remarkable thing of all: a giant leap forward for, or perhaps even the successful culmination of, the Goldman Sachs Project.

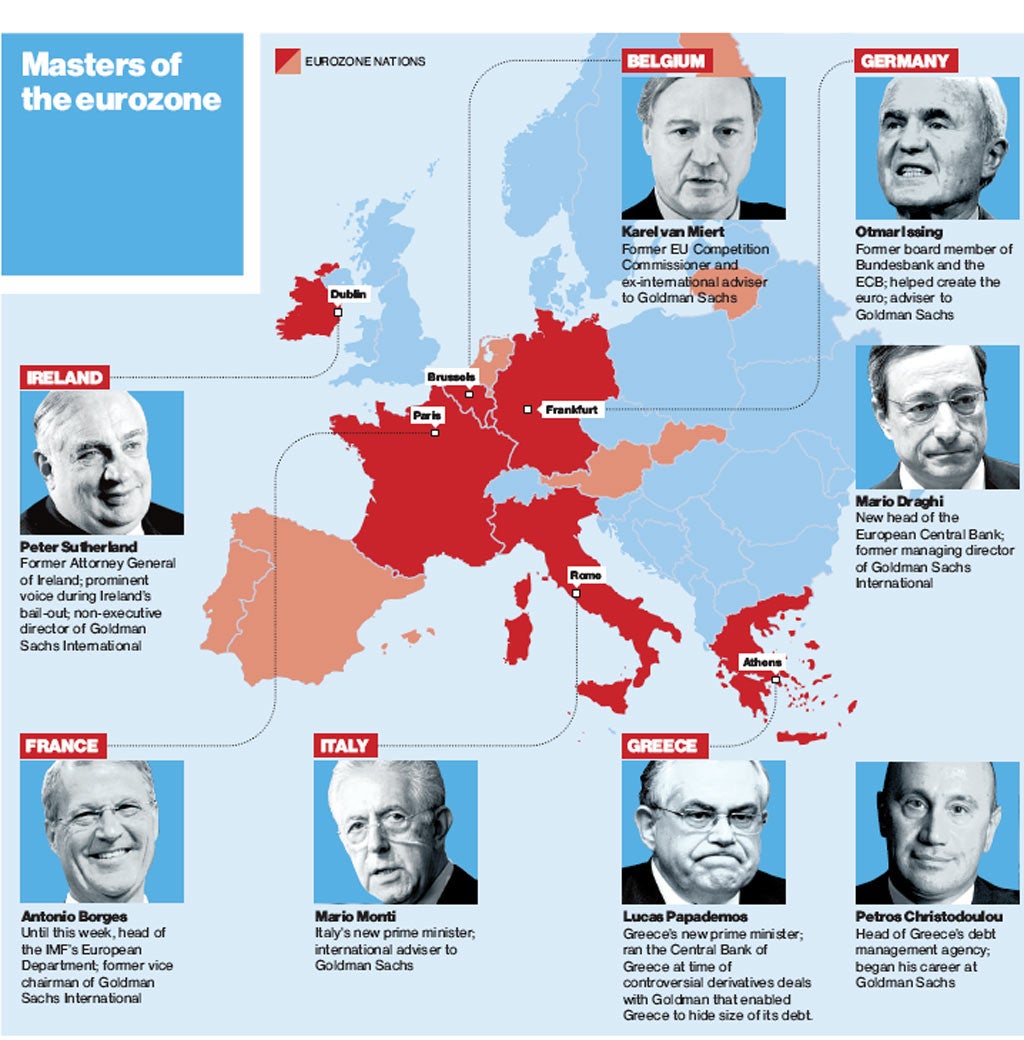

It is not just Mr Monti. The European Central Bank, another crucial player in the sovereign debt drama, is under ex-Goldman management, and the investment bank's alumni hold sway in the corridors of power in almost every European nation, as they have done in the US throughout the financial crisis. Until Wednesday, the International Monetary Fund's European division was also run by a Goldman man, Antonio Borges, who just resigned for personal reasons.

Even before the upheaval in Italy, there was no sign of Goldman Sachs living down its nickname as "the Vampire Squid", and now that its tentacles reach to the top of the eurozone, sceptical voices are raising questions over its influence. The political decisions taken in the coming weeks will determine if the eurozone can and will pay its debts – and Goldman's interests are intricately tied up with the answer to that question.

Simon Johnson, the former International Monetary Fund economist, in his book 13 Bankers, argued that Goldman Sachs and the other large banks had become so close to government in the run-up to the financial crisis that the US was effectively an oligarchy. At least European politicians aren't "bought and paid for" by corporations, as in the US, he says. "Instead what you have in Europe is a shared world-view among the policy elite and the bankers, a shared set of goals and mutual reinforcement of illusions."

This is The Goldman Sachs Project. Put simply, it is to hug governments close. Every business wants to advance its interests with the regulators that can stymie them and the politicians who can give them a tax break, but this is no mere lobbying effort. Goldman is there to provide advice for governments and to provide financing, to send its people into public service and to dangle lucrative jobs in front of people coming out of government. The Project is to create such a deep exchange of people and ideas and money that it is impossible to tell the difference between the public interest and the Goldman Sachs interest.

Mr Monti is one of Italy's most eminent economists, and he spent most of his career in academia and thinktankery, but it was when Mr Berlusconi appointed him to the European Commission in 1995 that Goldman Sachs started to get interested in him. First as commissioner for the internal market, and then especially as commissioner for competition, he has made decisions that could make or break the takeover and merger deals that Goldman's bankers were working on or providing the funding for. Mr Monti also later chaired the Italian Treasury's committee on the banking and financial system, which set the country's financial policies.

With these connections, it was natural for Goldman to invite him to join its board of international advisers. The bank's two dozen-strong international advisers act as informal lobbyists for its interests with the politicians that regulate its work. Other advisers include Otmar Issing who, as a board member of the German Bundesbank and then the European Central Bank, was one of the architects of the euro.

Perhaps the most prominent ex-politician inside the bank is Peter Sutherland, Attorney General of Ireland in the 1980s and another former EU Competition Commissioner. He is now non-executive chairman of Goldman's UK-based broker-dealer arm, Goldman Sachs International, and until its collapse and nationalisation he was also a non-executive director of Royal Bank of Scotland. He has been a prominent voice within Ireland on its bailout by the EU, arguing that the terms of emergency loans should be eased, so as not to exacerbate the country's financial woes. The EU agreed to cut Ireland's interest rate this summer.

Picking up well-connected policymakers on their way out of government is only one half of the Project, sending Goldman alumni into government is the other half. Like Mr Monti, Mario Draghi, who took over as President of the ECB on 1 November, has been in and out of government and in and out of Goldman. He was a member of the World Bank and managing director of the Italian Treasury before spending three years as managing director of Goldman Sachs International between 2002 and 2005 – only to return to government as president of the Italian central bank.

Mr Draghi has been dogged by controversy over the accounting tricks conducted by Italy and other nations on the eurozone periphery as they tried to squeeze into the single currency a decade ago. By using complex derivatives, Italy and Greece were able to slim down the apparent size of their government debt, which euro rules mandated shouldn't be above 60 per cent of the size of the economy. And the brains behind several of those derivatives were the men and women of Goldman Sachs.

The bank's traders created a number of financial deals that allowed Greece to raise money to cut its budget deficit immediately, in return for repayments over time. In one deal, Goldman channelled $1bn of funding to the Greek government in 2002 in a transaction called a cross-currency swap. On the other side of the deal, working in the National Bank of Greece, was Petros Christodoulou, who had begun his career at Goldman, and who has been promoted now to head the office managing government Greek debt. Lucas Papademos, now installed as Prime Minister in Greece's unity government, was a technocrat running the Central Bank of Greece at the time.

Goldman says that the debt reduction achieved by the swaps was negligible in relation to euro rules, but it expressed some regrets over the deals. Gerald Corrigan, a Goldman partner who came to the bank after running the New York branch of the US Federal Reserve, told a UK parliamentary hearing last year: "It is clear with hindsight that the standards of transparency could have been and probably should have been higher."

When the issue was raised at confirmation hearings in the European Parliament for his job at the ECB, Mr Draghi says he wasn't involved in the swaps deals either at the Treasury or at Goldman.

It has proved impossible to hold the line on Greece, which under the latest EU proposals is effectively going to default on its debt by asking creditors to take a "voluntary" haircut of 50 per cent on its bonds, but the current consensus in the eurozone is that the creditors of bigger nations like Italy and Spain must be paid in full. These creditors, of course, are the continent's big banks, and it is their health that is the primary concern of policymakers. The combination of austerity measures imposed by the new technocratic governments in Athens and Rome and the leaders of other eurozone countries, such as Ireland, and rescue funds from the IMF and the largely German-backed European Financial Stability Facility, can all be traced to this consensus.

"My former colleagues at the IMF are running around trying to justify bailouts of €1.5trn-€4trn, but what does that mean?" says Simon Johnson. "It means bailing out the creditors 100 per cent. It is another bank bailout, like in 2008: The mechanism is different, in that this is happening at the sovereign level not the bank level, but the rationale is the same."

So certain is the financial elite that the banks will be bailed out, that some are placing bet-the-company wagers on just such an outcome. Jon Corzine, a former chief executive of Goldman Sachs, returned to Wall Street last year after almost a decade in politics and took control of a historic firm called MF Global. He placed a $6bn bet with the firm's money that Italian government bonds will not default.

When the bet was revealed last month, clients and trading partners decided it was too risky to do business with MF Global and the firm collapsed within days. It was one of the ten biggest bankruptcies in US history.

The grave danger is that, if Italy stops paying its debts, creditor banks could be made insolvent. Goldman Sachs, which has written over $2trn of insurance, including an undisclosed amount on eurozone countries' debt, would not escape unharmed, especially if some of the $2trn of insurance it has purchased on that insurance turns out to be with a bank that has gone under. No bank – and especially not the Vampire Squid – can easily untangle its tentacles from the tentacles of its peers. This is the rationale for the bailouts and the austerity, the reason we are getting more Goldman, not less. The alternative is a second financial crisis, a second economic collapse.

Shared illusions, perhaps? Who would dare test it?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments