Why the economic forecasts for Britain are so apocalyptic – and how much Brexit is to blame

Has the UK’s economic outlook really suddenly become very much worse – or has this reckoning been coming for some time? And is there any way out of this mess?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The economic headlines of the past 48 hours have been thoroughly miserable, if not apocalyptic.

“Treasury forecaster delivers worst economic growth forecasts in its history”.

“UK facing longest fall in living standards for over 60 years”.

“Britain’s debt will not fall to 2008 levels until 2060s”.

So what’s going on?

Has the UK’s economic outlook really suddenly become very much worse – or has this reckoning been coming for some time?

To what extent is Brexit to blame?

And is there any way out of this mess?

Below we explain what’s going on with the British economy behind the headlines.

The key is something called productivity….

The fundamental reason for those awful economic projections in the Budget is a severe downgrade in the Office for Budget Responsibility’s view of the UK’s potential productivity growth over the next five years.

Productivity is the amount of output the UK workforce as a whole can produce per hour of work. It’s essentially a measure of the efficiency with which the British people are working.

Productivity may sound like an abstract “economicky” concept, but it is fundamentally important for a host of more tangible economic data that households really do care about such as wages, interest rates and public spending.

From the Second World War until the global financial crisis in 2008 the UK’s productivity reliably grew by around 2-2.5 per cent a year on average. There were recessions and crises over that time, but the overall economy always sooner or later got back to trend productivity growth, which means that wage and GDP growth etc, always eventually bounced back too.

But then the financial crisis hit and productivity has pretty much flatlined ever since. The Resolution Foundation has calculated that the past decade has actually been the worst for the UK’s productivity growth since 1812.

…and the Office for Budget Responsibility has become less optimistic about it…

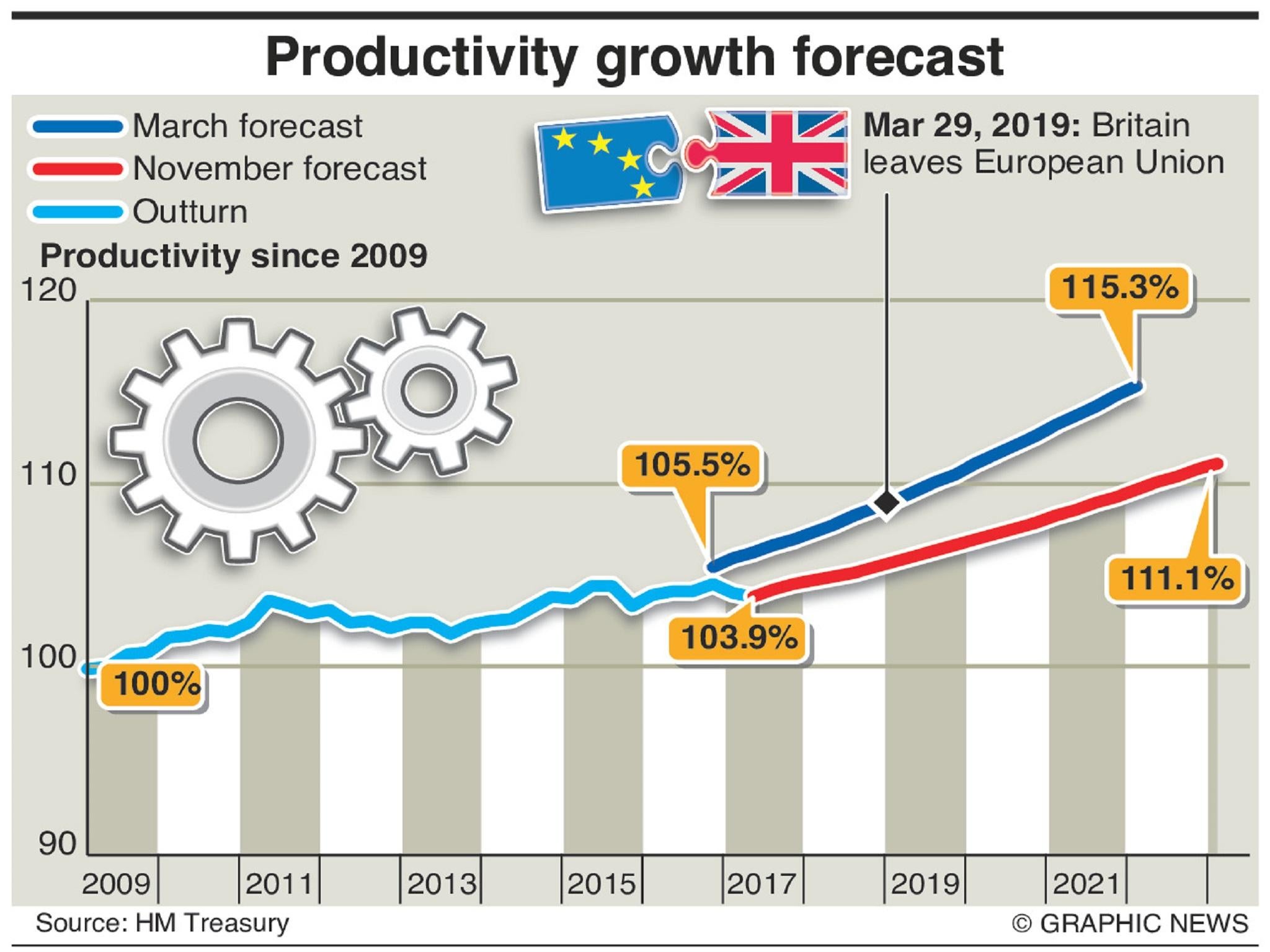

The independent OBR has been the Treasury’s official forecaster since 2010. And a key feature of all its forecasts since 2010 has been its assumption that the 2 per cent plus post-war trend rate of productivity growth would always return by the end of its five-year forecast period.

But having seen all its previous forecasts prove woefully over-optimistic, it chose this week to break the habit. It now thinks UK productivity will only be growing an annual rate of just 1.3 per cent in 2022.

…so growth, wages and incomes are all expected to suffer…

Because the productivity outlook forms the basic building block of all GDP forecasts, the productivity downgrade is the reason why the OBR turned in the most miserable set of GDP growth forecasts for the UK since it was established seven years ago on Wednesday, with output growth never rising above 2 per cent over its five-year outlook.

Productivity is also the key determinant of wage growth. Many economists (although not all) take the view that if wages grow considerably faster than productivity the result is a surge of damaging inflation, which means that in inflation-adjusted terms, wages don’t actually grow at all.

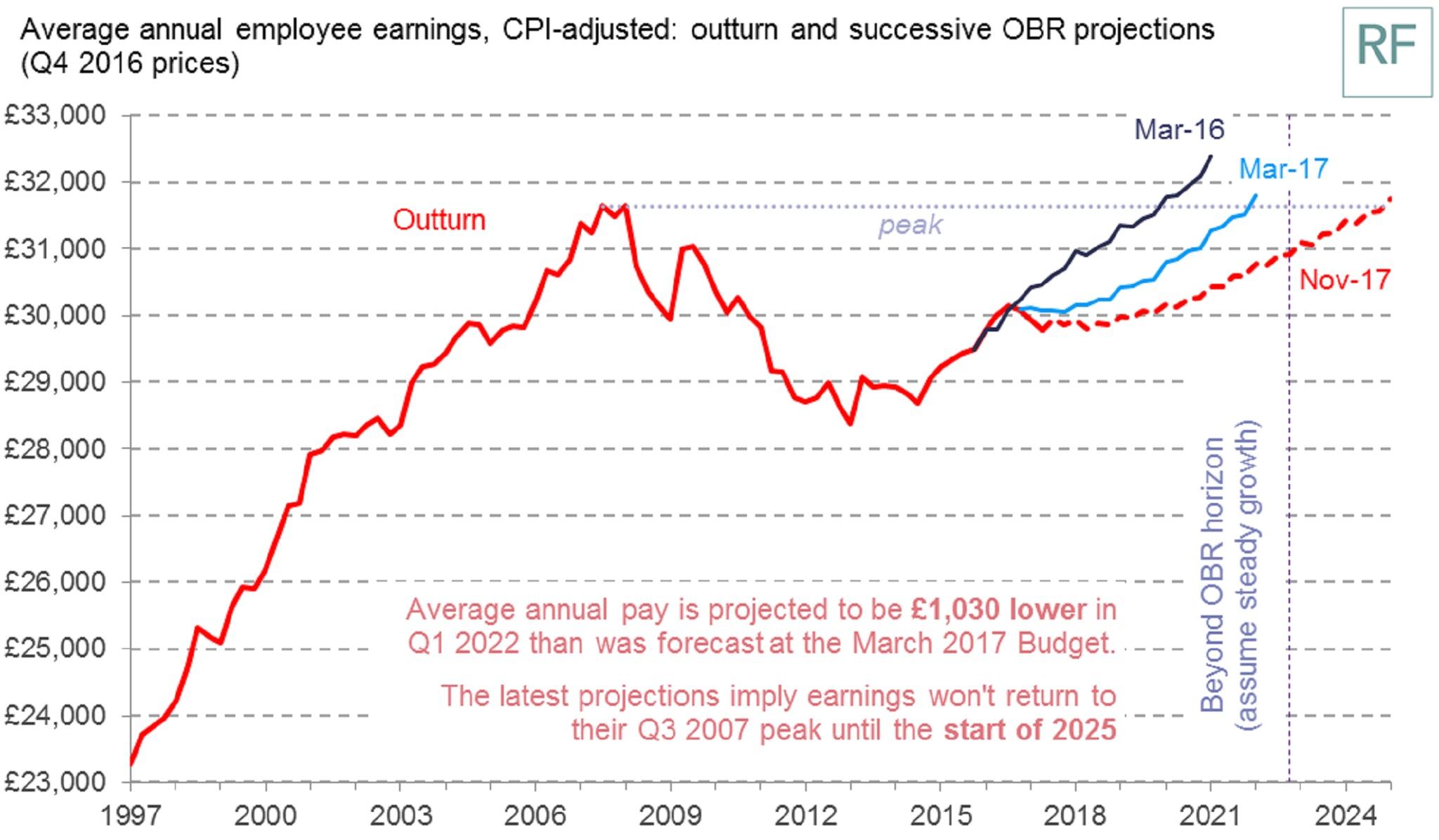

Average real wages in the UK are still around 6 per cent below where they were in 2008, with the blame being put on the fact that productivity has not grown over that time.

And because the OBR has severely downgraded its view of productivity growth over the next five years, that means it has also downgraded its forecast for UK wage growth.

Put the latest weak wage growth forecast from the OBR over the next five years together with the realised weak wage growth over the past decade and you have the shocking calculation from the Resolution Foundation: that wages are not projected to recover back to their 2008 level until 2025 – essentially 17 lost years for workers.

…and public services and welfare spending too…

The size of the economy has a profound influence on how much money the Government receives in taxes to spend on things like schools, hospitals, the police, the military and also cash transfers such as tax credits and other benefits etc.

Weak productivity growth leads to weak GDP growth which means pressure on public spending.

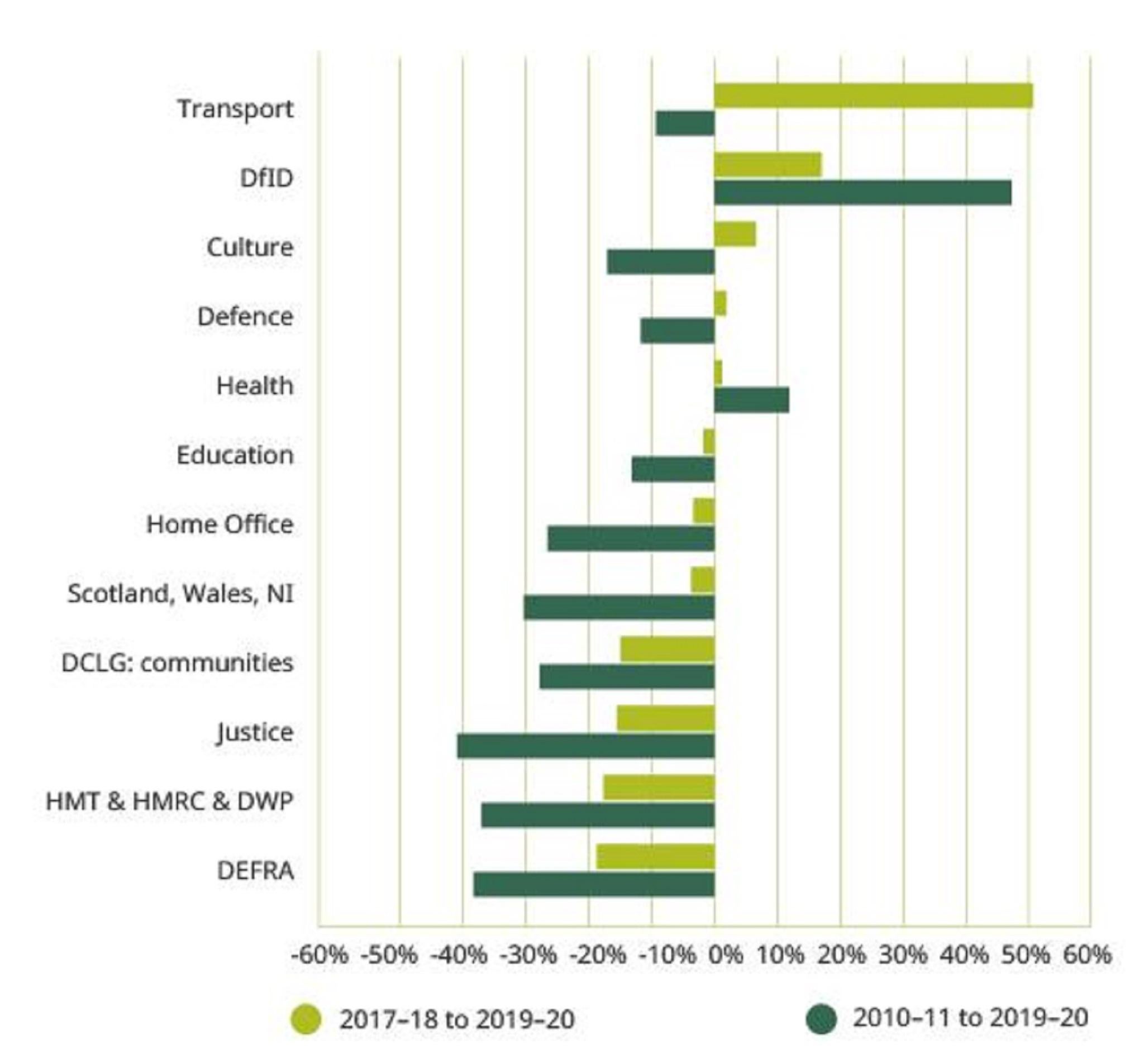

After the deficit shot up to 10 per cent of GDP in the 2008-09 recession the previous Chancellor, George Osborne, imposed severe austerity policies to curb state borrowing. He originally expected the job of reining in the Government’s deficit to be done by 2015.

But the economy has massively underperformed expectations, which means the deficit did not fall as planned and ministers have responded by prolonging the squeeze on public spending and benefits.

The budgets of some Whitehall departments are due to be cut by almost 50 per cent on 2010 levels by the end of the decade.

And though NHS spending has been growing in real terms since 2010, this has not been enough to met the demand generated by an increasingly elderly population, resulting in stretched waiting times for operations and over-crowded accident and emergency wards.

…Economists are baffled about productivity’s weakness…

Since productivity growth is the key piece in the economic jigsaw, economists have been keen to work out why it is so abnormally weak. If they can diagnose the illness they might be able to recommend a policy cure that will rectify it.

But, alas, in seven years of investigations they are still searching for a coherent and broadly accepted explanation for the productivity disaster.

Some explanations are UK-specific such as historic under-investment in workers’ skills here, an excessively flexible British labour market, an unusually sclerotic domestic banking sector, or even damagingly loose monetary policy from the Bank of England that has kept low-productivity “zombie” firms alive. Some blame the ready availability of low-skilled migrant labour from the EU.

And it is true that something is particularly awry here in Britain, where the level of productivity has long been worse than peer economies such as France, Germany and the US.

Yet productivity growth has also been weak by historic standards across the developed world since the global financial crisis and official forecasters have been reducing their projections for many countries, not just the UK.

One view advanced by the US economist Robert Gordon is that the advanced world in recent years has essentially come to the end of a long era of technologically-driven productivity growth that began in the industrial revolution and that the lower rates we are experiencing today are the new normal. Others, however, regard that as hyperbolically pessimistic and cite exciting recent advances in biotechnology, robotics, quantum computing and materials science, among other areas, as fundamental reasons to be optimistic about the future of global productivity growth.

…but economists generally agree that Brexit will make productivity worse…

One thing economists do generally agree on is that leaving the European Union and putting new trade barriers between Britain and our largest and closest trading partners is extremely unlikely to boost UK productivity growth – and is far more likely to retard it.

The OBR’s latest productivity downgrades are not, in fact, due to its view of the impact of Brexit but rather a capitulation to the view that it has been unduly optimistic about a natural bounce-back previously.

The productivity issue should be separated out from the short-term negative impact of the Brexit vote. The slump in sterling since the vote in June 2016 has pushed up domestic UK inflation, which has eaten into household incomes and curbed spending.

UK businesses are also investing less due to uncertainty over the outcome of government negotiations with Europe over future trade arrangements after March 2019. Both these factors have hit domestic demand and slowed the economy down this year, just as Europe and the wider global economy seem to be perking up.

A disastrous no-deal Brexit could well plunge Britain back into recession. But this should really all be thought of as distinct from the longer-running and underlying problem of UK productivity stagnation.

…and, actually, they do think there are things that can be done to improve UK productivity

Aside from not leaving the European Union’s single market and customs union, most economists believe that the best way of encouraging productivity growth, at least in the long-term, in the UK is more investment.

A big part of this is state investment in transport infrastructure, which helps make private-sector firms more productive. Another important form of state investment is in education and skills to make individuals more productive. There is also investment by firms into research and development in new technologies, which well-designed government tax and subsidy policies can encourage.

Corporate governance reforms might also help here, by removing the incentives on chief executives and boards to underinvest from their profits.

A specific area that economists, such as Andy Haldane of the Bank of England, are increasingly looking at is improving management systems at the UK’s less productive firms (of which there are many) in the hope of bringing them up to the levels of their higher-performing peers.

Another group of economists, including Simon Wren-Lewis of Oxford University, argue that the Government has actually been holding back domestic productivity-growth since 2010 through excessive fiscal austerity – and that budget cuts have thus been a false economy and a major policy mistake.

Their prescription is for the Government to stop obsessing about bringing down deficits and focus instead on keeping overall spending demand in the economy sufficiently high.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments