The Big Question: Could the government bailout of the banks bankrupt the country?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Why are we asking this now?

It's the £1 trillion question. As the creeping nationalisation of the UK's banks and credit system gathers pace, more and more of our commercial banks' liabilities will technically find their way onto the national "balance sheet". Of course the British taxpayer will receive some assets as well, the great majority of them perfectly sound. But it is the scale and the "worst-case scenario" nature of the debts that has terrified observers.

How much are we talking about?

Well over £1 trn, which is £1,000 billion or a million million pounds. That's about one year's national income. It could be more, depending on how much more serious the banking crisis becomes and how many banks get taken over by the state.

Could we end up like Iceland?

It is possible, because, like Iceland our banks are in a good deal of trouble, because our banks alsorepresent such a large proportion of our GDP, and because our banks too have such large foreign currency liabilities. If we nationalise our banks' bad debts, then all that really happens is that their difficulties are transferred to the sovereign state of the United Kingdom, and the risks and scepticism displayed by the financial markets towards those banks gets moved over to the British state. The stigma, in other words, does not magically disappear simply because Parliament decides that we should all share the burden. The problem comes if the burden is not sustainable, or is perceived not to be.

What happens if investors lose faith in the UK?

They will sell sterling assets and push the pound to depths previously unexplored. Sterling's depreciation would become a rout. The trigger would be a downgrade of the UK's government debt by one of the major ratings agencies. They have recently taken a dim view of Greece, Portugal, Spain and Ireland; why not the UK? The idea that the UK Treasury may default on its debts would gain credibility and the premium for holding UK government stocks would rise to unaffordable levels. So interest rates would go higher – as they may also have to if inflation eventually results from "quantitative easing", or printing money. That would finally wreck the economy.

Aren't we gettinga little panicky?

At the moment, such risks seem remote. Apart from those already state-owned, the banks are not bust. The market for UK government securities is still healthy, if only because investors are so scared of other assets, such as bank shares. Deflation rather than inflation is the immediate danger. And the UK Treasury has never overtly defaulted on its debt, although, it has to be admitted, it has always covertly done so by inflating it away – something the markets are well aware of.

What are the figures?

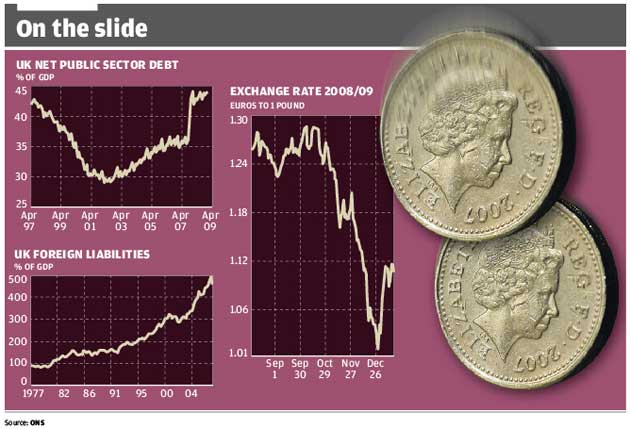

The debts of the big failed Icelandic banks amounted to about 600 per cent of her GDP: the liabilities of our (not yet failed) banks run to about 400 to 450 per cent of our GDP.

Taking those sorts of level of liabilities onto the national books is a problem if the banks are fundamentally unsound, or their assets – loans and mortgages to households and companies here and abroad, plus some "toxic" debts – become so.

Technically, the size of the banks' liabilities look large enough to sink the UK economy, as they did in Iceland. In other words, the nation will reach a point where it cannot afford to service its debts. However, the majority of the banks' assets are sound – straightforward lending to business and on domestic housing. So the UK taxpayer will acquire something for the money it is spending. If it holds these assets to maturity it may even make a profit.

But can a sovereign state go bust like an individual can?

Technically no, but, as the world has seen time and again, nations are perfectly capable of defaulting on their debts. Usually the answer is to borrow yet more from the International Monetary Fund, but that usually comes with some harsh conditions and a significant loss of sovereignty. It is possible that even the IMF might not be able to prop up the UK completely, because the IMF is only as strong as its strongest member – the US, which has plenty of its own difficulties.

But hasn't the UK gota relatively small national debt?

Yes and no. Yes, because the first half, roughly, of the Labour Government was an outstandingly prudent one, and has left us with a good deal of "headroom". Sticking to the Tories' spending plans at a time of mostly strong economic growth and buoyant tax revenues pushed debt down to levels not seen in decades. As Chancellor, Gordon Brown was so keen on fiscal rectitude that he even used a £22.5bn windfall from the sale of 3G telecom licences in 2000 to pay off part of the national debt. Even now public-sector net debt – the current description of what we used to call the national debt – is low by international standards. At less than 40 per cent now, and a peak of 57 per cent in 2013-14, it compares favourably with, for example, the US at around 68 per cent of GDP, Japan's national debt at 194 per cent, and Italy at more than 100 per cent.

What's the problem then?

The deterioration in the economy could leave the figures looking much larger because of the shortfall in tax revenues from shrinking economic activity. But it is the sheer size of the UK banking sector that could leave those numbers looking unsustainable and take public sector net debt to 200 or 300 per cent of GDP, or more. This would be bigger even than Zimbabwe or Iceland.

What's the most likely outcome?

The banks won't go completely bust, their debts won't all go bad and they will be only partially nationalised. Thus, only a proportion of the UK banks' liabilities will probably end up being paid for by the taxpayer, on a sustainable but rather onerous basis, and one that will mean higher taxes and lower growth than otherwise for perhaps decades. We might be looking at £200bn of "toxic" assets.

Any more bad news?

There is also the small matter of the UK public sector's "hidden" liabilities, such as the future liabilities of public pensions and of the large number of Private Finance Initiative projects – both of which will bump up debt in future. Up-to-date figures on these areas are not available.

What about national debt during the Second World War?

The UK's national debt peaked at around 262 per cent of GDP in 1946, and stayed high for decades after. Mortgaging the nation up to the hilt was how we paid for two World Wars, freedom and the welfare state, but it caused successive governments from the 1950s to the 1970s lots of trouble in trying to run the economy, as periodic sterling crises choked off growth and investment. With a level of national debt once again at those sorts of levels, we could easily see a new era of sluggish UK growth and relative decline. The arguments for the pound to join the euro would gather force.

So are we facing bankruptcy?

Yes...

* Our national liabilities are growing at an alarming and unsustainable rate

* The banks' problems are becoming more severe by the day, and nationalisation is inevitable

* The United Kingdom has to face up to a harsh truth: nobody owes us a living

No...

* Even if we nationalised all the banks they still have plenty of solid assets

* We can always borrow from the International Monetary Fund, as well as other sources

* If the worst comes to the worst we can always join the euro, which would reduce the danger facing us

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments