Taking a big bite from the Apple

Tim Cook has been awarded a 40 per cent pay rise. Angela Ahrendts enjoys a $73m package. But are Cupertino’s top team really worth such stellar sums?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Executives at the world's most famous technology company gathered a bushel of ripe, and extremely sweet, Apples this year, filling up on cash and stock options.

Chief executive Tim Cook’s basic pay increased by more than 40 per cent to $2m. His total remuneration came in at $9m, more than double the 2013 figure. Other executives were similarly rewarded, Luca Maestri, Apple’s chief financial officer, for example, was handed a package worth $14m.

But many of the headlines focussed on Angela Ahrendts’ award. The former Burberry boss, who joined the Cupertino-based outfit last year in the newly created role of senior vice-president, retail and online stores, was given a package worth $73m, including $33m worth of stock – a platinum hello if you like – and a further $37m to compensate her for share awards she lost on leaving Burberry.

Apple has form here. While Cook’s reward for a highly successful year looks relatively modest, when he took on the job he was handed one of the biggest packages on record. Largely consisting of restricted stock awards he will receive over the next few years, it was valued then at $378m.

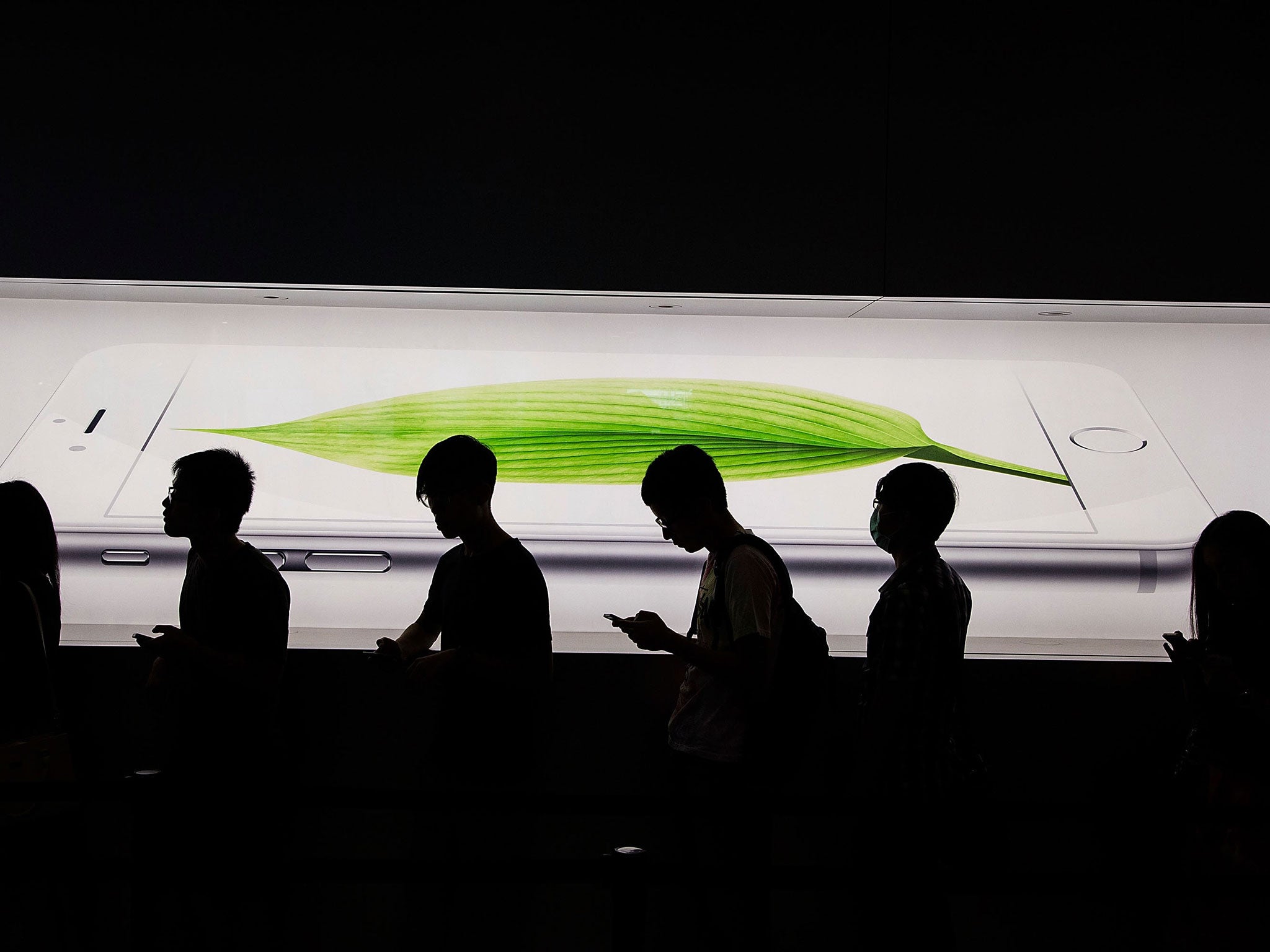

Of course, the share price has more than doubled since he took control after the death of visionary founder Steve Jobs in 2011. The hugely successful iPhone 6, fattened that price, even after receiving a torrent of criticism with sceptics taking shots at everything from the operating system to the alleged bendiness of the product. But the punters loved it, buying millions and leaving the company struggling to cope with demand in its early days.

Next up? A hotly anticipated watch which might just show if Cook has the same sort of midas touch with a new product line as Jobs did.

For now, asked if he’s worth it, Duncan Chapple, a vice-president at business consultancy Kea Company, says that he is if you are a shareholder. Chapple highlights the importance of balancing cash compensation and stock awards and says: “There’s a lot of evidence that salary and bonus schemes are wrecking companies, but that’s mainly because salaries reward the wrong sort of behaviour. Well-paid CEOs are good at raising share prices, and they are even better at improving firms’ return on assets. There’s a real, positive correlation between company performance and CEO pay.”

But critics focus on the vast sums involved. They are scathing about retention bonuses, such as those bought out by Apple for Ahrendts, saying they are little more than a racket to keep well paid executives in the manner to which they have become accustomed.

It’s hard to see anyone buying Cook out. The cost of compensating him for his Apple options might just be too much for any rival to contemplate. It is questionable, anyway, whether the 16-year veteran would be prepared to contemplate going anywhere else, having been hired by Jobs.

But what about Ahrendts? Luke Hildyard, from the High Pay Centre, explains: “So-called golden hellos show why long-term incentive plans and loyalty bonuses are completely redundant. Big companies can easily match these payments to entice an executive from a rival, meaning executive pay goes up but firms find it no easier to attract and retain their senior staff.

“We’ve seen the situation with Ahrendts played out time and time again at other companies – the departing executive receives full compensation from their new employer for any future payments they forego by leaving their previous job.

“In Switzerland they’ve had the good sense to ban the practice of golden hellos, and we should do so in the UK too.”

But what about Apple’s pay more generally. Isn’t Cook a star? A man who took over from a visionary but managed to send the share price rocketing nonetheless? Author and journalist David Bolchover dismantles the case for high pay in his book Pay Check, are high earners really worth it? Bolchover argues that talk of executive “talent” is a myth, and that pay packages such as those handed to Cook or Ahrendts are justified on the flimsiest of grounds.

Hildyard agrees: “This isn’t a case of rewarding or incentivising key staff. Does anyone really think Cook or Ahrendts would work any less hard if they were paid less? It isn’t about the innate talent of these individuals either.

“The infrastructure that made Apple the world’s biggest company is already in place – Cook and Ahrendts are bureaucrats, not entrepreneurs building a new organisation from scratch. Their success is dependent on the roads that transport their goods; the schools and universities that educate their staff; and the wider economy that puts money in the pockets of their customers. Without this, the supposed talent of the Apple executives would be of very little use.”

Apple's elite: What they earn

Tim Cook

CEO, $9.2m

Joined Apple in 1998. CEO since 2011, succeeding founder Steve Jobs. Also already owns $338m of shares.

Luca Maestri

CFO, $14m

Appointed last year. Italian born. Previously CFO for Xerox.

Peter Oppenheimer

Outgoing CFO, $4.5m

Left in September after a decade in position. Now non-executive director of Goldman Sachs.

Angela Ahrendts

Senior VP, $73m

Senior vice president, retail and online stores. Former CEO of Burberry. Remuneration figure largely represents stock.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments