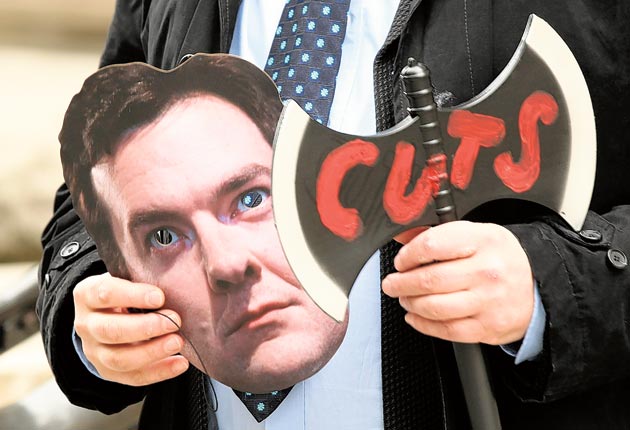

Slugging it out over spending cuts

Business leaders back George Osborne, but the debate about cuts is finely balanced. Sean O'Grady reports

In the blue corner: No, the cuts go too far and too fast

According to the Chancellor, the list of his opponents is short and unimpressive: "On the other side is Ed Miliband and the trade union leaders who put him where he is. The national interest or the vested interests."

Not quite. The Chancellor neglects a clutch of the world's leading economists, including a couple of Nobel prize-winners. David Blanchflower, a former member of the Bank of England's Monetary Policy Committee, and the sole MPC member to appreciate the full horror of the approaching recession in 2008, is the latest to speak out. "A good way to think of what has happened is that we are struggling to recover from the effects of an economic war that has hit us hard," he said. "Faced with this economic war, this misguided coalition government has ... shown appalling cowardice; rather than fight, Osborne is about to run up the white flag of defeat. His response is the equivalent of surrendering immediately because of the potential impact of the war on the deficit. It's as ridiculous as that."

Mr Blanchflower is in distinguished company. Joe Stiglitz, formerly the chief economist at the World Bank, a White House adviser, Nobel prize-winner in economics and now a professor at Columbia University, has described the cuts as "risky – really scary". Paul Krugman, a Nobel laureate in 2008, echoes his fears about global synchronised austerity. It is a classic example of a Keynesian paradox; that what may be good for any one nation – fixing its public finances – is foolish for the world.

Mr Krugman also challenges the notion that the UK was in any case going the way of Greece. Asking "Why, then, are Very Serious People demanding immediate fiscal austerity?" he answers: "The answer is, to reassure the markets – because the markets supposedly won't believe in the willingness of governments to engage in long-run fiscal reform unless they inflict pointless pain right now. And the basis for this belief that this is what markets demand is ... well, actually there's no sign that markets are demanding any such thing. There's Greece – but the Greek situation is very different from that of the US or the UK. And at the moment everyone except the overvalued euro-periphery nations is able to borrow at very low interest rates. So wise policy, as defined by the G20 and like-minded others, consists of destroying economic recovery in order to satisfy hypothetical irrational demands from the markets. Awesome."

Mr Stiglitz suggests moving expenditure from wars to public infrastructure, and to tax capital gains on all property deals at 40 per cent, both politically awkward if economically impeccable proposals.

Ed Miliband, meanwhile, and his new shadow Chancellor, Alan Johnson, are tilting the policy away from spending cuts towards tax rises. As Chancellor, Alistair Darling's plans envisaged about 70 per cent of the savings coming from spending cuts and 30 per cent from tax changes. Mr Johnson wants the ratio to be 60:40.

In the red corner: Yes, the Chancellor has got it about right

If anyone was searching for a handy list of backers for the Chancellor's strategy of eliminating the budget deficit, they could do worse than the one he himself provided a few weeks ago at the Conservative Party conference. As George Osborne declared: "On one side there is the IMF, the OECD, the credit rating agencies, the bond markets, the European Commission, the Confederation of British Industry, the Institute of Directors, the British Chambers of Commerce, the Governor of the Bank of England, most of British business, two of our great historic political parties, one of the Miliband brothers, Tony Blair, and the British people."

He may have been overstating matters when it came to the British public – their response to the imminent cuts depends very much on what question the pollsters ask – but he was right about his long list, and they are now joined by bosses from BT Group, GlaxoSmithKline, Microsoft UK and Diageo, among others.

But the most valuable endorsement arrived just after the election, from the Governor of the Bank, Mervyn King. Mr King, flirting with politics, said: "I am very pleased that there is a very clear and binding commitment to accelerate the reduction in the deficit over the lifetime of the Parliament and to introduce additional measures this fiscal year to demonstrate the importance of getting to grips with that before running the risk of an adverse market."

Now that Mr King seems to have replaced Vince Cable as the man the public trust on economics, his endorsement was doubly welcome.

Even more complimentary was the IMF. In its annual review of the British economy, the Fund downgraded its growth forecasts a little, but concluded that the Osborne plan "greatly reduces the risk of a costly loss of confidence in public finances and supports a balanced recovery".

That pretty much sums up the case for the cuts: a hypothetical argument about a financial crisis that never transpired or, as the Chancellor calls it, "the absence of war" and the trauma that has shredded Greece and Ireland's credit ratings, and sent interest rates spiralling. In avoiding that – if the case is accepted – Mr Osborne has done everyone with a mortgage a favour, saved the nation from the humiliation of having to approach the IMF for a loan, as well as saving money on debt interest payments that can better used to improve public services.

Despite some quibbles about the nature of the cuts, business organisations and leaders are firmly supportive, and insist that they can replace the half a million jobs that will be lost in the public sector. Most, such as the British Chambers of Commerce and the CBI, would prefer it if the Chancellor protected infrastructure projects that help competitiveness, while the Institute of Directors suggests that the NHS be cut. But all agree the rebalancing of the economy from public to private sector is unavoidable. Besides, if it all goes wrong the Bank of England can print more money. Can't it?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks