Pity the poor Office for Budget Responsibility. George Osborne's fiscal watchdog-cum-forecaster has been a model of openness since it was set up in May 2010. Visit the OBR's website and one can see its forecasts broken down into granular detail. It even publishes the equations that Robert Chote and his small team of economists use to calculate the size of the UK's structural deficit. Compared with the Bank of England's interest-rate setting Monetary Policy Committee, which keeps its calculations and equations jealously hidden from the unwashed public, the OBR lets it all hang out.

The trouble is that openness has a price. It allows other economic researchers to replicate the OBR's methods and predict what Mr Chote and co are going to conclude even before they have done their sums. So when the OBR publishes its forecasts tomorrow and rules whether or not Mr Osborne is on course to hit his Fiscal Mandate, its verdict is unlikely to come as a total surprise.

So what is the size of the fiscal hole that the Chancellor will confront? What size mountain will Mr Osborne have to commit to climb in order to eradicate the current structural deficit in five years' time, as his self-imposed mandate compels him to do? The Institute for Fiscal Studies has run the numbers and come up with what it calls a "pessimistic" scenario, whereby the Chancellor would need to fill a £23bn gap by 2017-18. Ian Mulheirn and Nida Broughton of the Social Market Foundation have performed a similar exercise and produced a figure of £22bn.

So how did they get there? Weak growth is the main story. The economy has double dipped into recession since the OBR last laid out its forecasts. At the time of the March Budget it expected GDP to grow by 0.9 per cent over the first three quarters of the year. But in fact the economy has expanded by just 0.3 per cent. This has depressed tax receipts, which are up 0.4 per cent this year as against the OBR's forecast of 3.7 per cent growth. Government spending is running slightly lower than the OBR's expectations but not enough to offset the tax shortfall. This combination looks likely to result in £10bn to £15bn extra government borrowing for the 2012/13 financial year.

Other economic forecasters have downgraded their UK growth outlooks for future years too. In the past the OBR's output forecasts have tended to follow the consensus. This implies that the UK government's public borrowing will also be higher over the rest of the OBR's five-year forecast period. The question is how much of this deterioration in the public finances the OBR will find to be structural, rather than cyclical? When growth disappointed in 2011 the OBR argued that much of the extra borrowing was permanent and would not disappear with an economic recovery.

And the SMF expects it to do so again, based on what information the watchdog has published on how it works out the output gap (the amount of slack in the economy). Using the OBR's equations the SMF (see chart, right) estimates that the output gap has fallen since the end of last year, and hence that the structural deficit is 1.1 per cent bigger.

It's true that some private forecasters have revised up their estimate of the size of the output gap this year. So it's possible that the OBR will do the same. But this would leave the forecaster open to the charge that it has ignored its own model out of a desire to make life easier for the Chancellor.

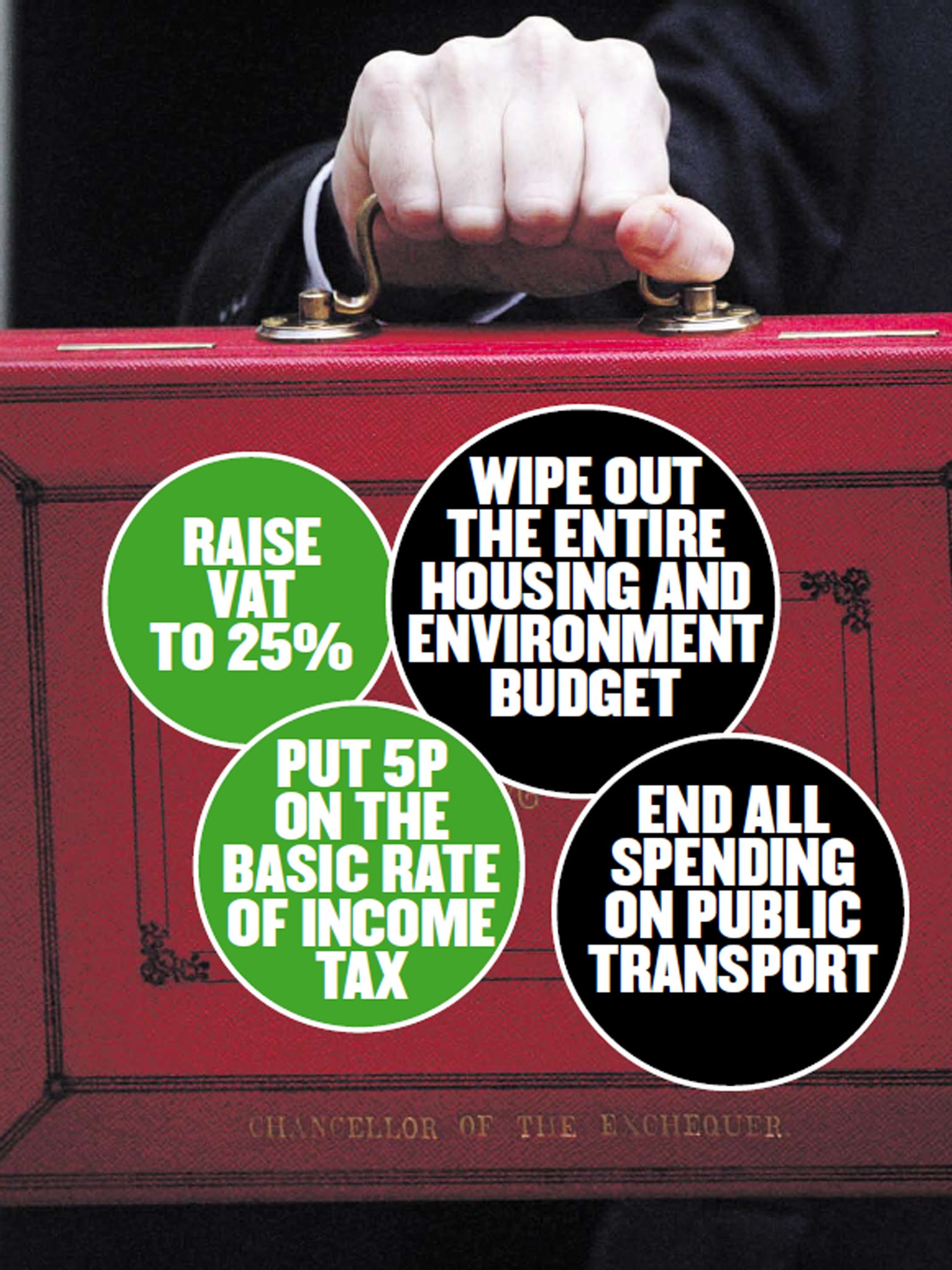

So assuming the IFS's pessimistic scenario and the SMF's central view are correct, how could this £22bn-£23bn gap — roughly equivalent to the entire transport budget — be filled? By way of illustration the IFS says the Chancellor could fill the gap at a stroke by hiking VAT from 20 per cent to 25 per cent. The SMF estimates that if the Government spread the cuts (on top of the savings Mr Osborne has already pencilled in for the next parliament) evenly over all government departments spending would drop by 11 per cent in real terms between 2015-16 and 2017-18. But if the health, education and international development departments were held steady in real terms, other departments' budgets would have to come down by 23 per cent over the three years. As the SMF points out, that would imply cutting police and crime expenditure by a third. It would mean halving all employment programme outlays. And, of course, that would be on top of the unprecedentedly prolonged round of cuts already due over the remainder of this Parliament.

More likely Mr Osborne will promise to make the post-2015 cuts but fail to spell them out. That's what he did in November 2011 when the OBR last revised up its estimate of the size of the structural deficit. Another Spending Review, which sets departments' multi-year budgets, is not due until next autumn. It remains to be seen whether the Conservatives and Liberal Democrats will be able to agree to further cuts which will fall during the next Parliament, when the Coalition could well be history. That would effectively commit the two parties to fight the next election on a common fiscal platform, something their respective MPs would baulk at.

Yet, before confronting that hurdle, there's a more immediate challenge for the Chancellor tomorrow. His fiscal mandate has a supplementary target, which is to put the national debt on a downward trajectory by 2015-16. There is now not a forecaster in the land who expects that the OBR will find the Chancellor to be on course to hit that target under present plans. So the burning question is whether the Chancellor will announce new spending cuts and tax rises to put himself back on course to hit it — something even deficit hawks accept would damage the economy — or whether he will abandon the target and inflict potentially huge political damage on his reputation.

Thanks to the OBR's openness, we can be confident that Mr Osborne's fiscal cage will shrink. Now we wait to see whether he will produce the key to that cage that he always swore he would not use.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments