Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In Philip Hammond’s Autumn Budget there was the usual barrage of announcements of everything from growth downgrades, to new spending pledges, to tax cuts, to welfare tweaks.

But the big picture we should take away from this fiscal event?

What did we learn about the outlook for the economy as we hurtle towards Brexit in 2019?

Brutal productivity downgrades…

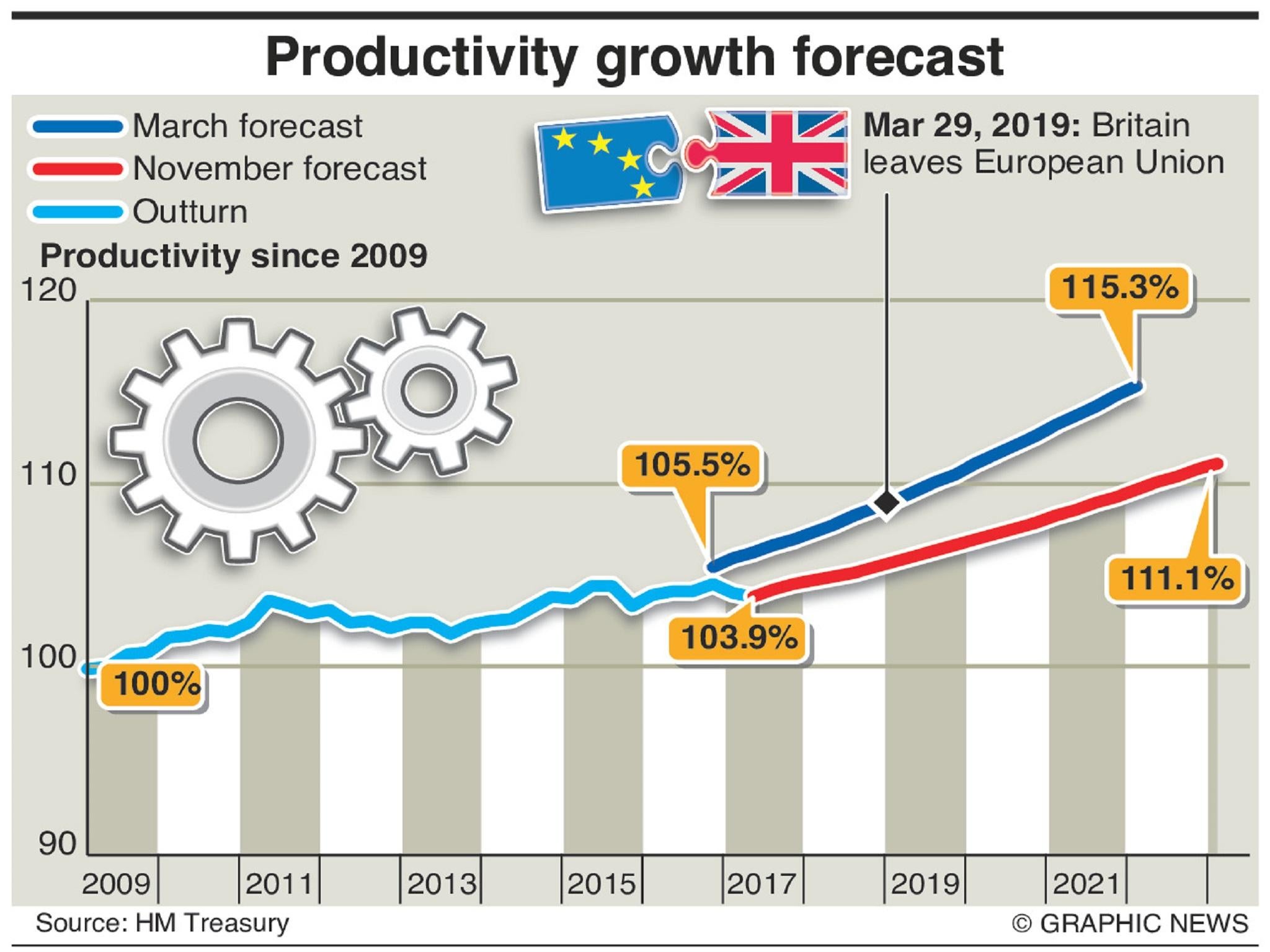

The basis for all of the forecasts from the Office for Budget Responsibility, the Treasury’s official prognosticator, are its view of productivity, or the nation’s output per hour worked.

And, as expected, at this fiscal event the OBR has taken a much more pessimistic view relative to its last report in March.

The OBR has downgraded its estimate of productivity growth by 0.6 per cent on average in the four years to 2021-22.

...result in an awful set of growth forecasts...

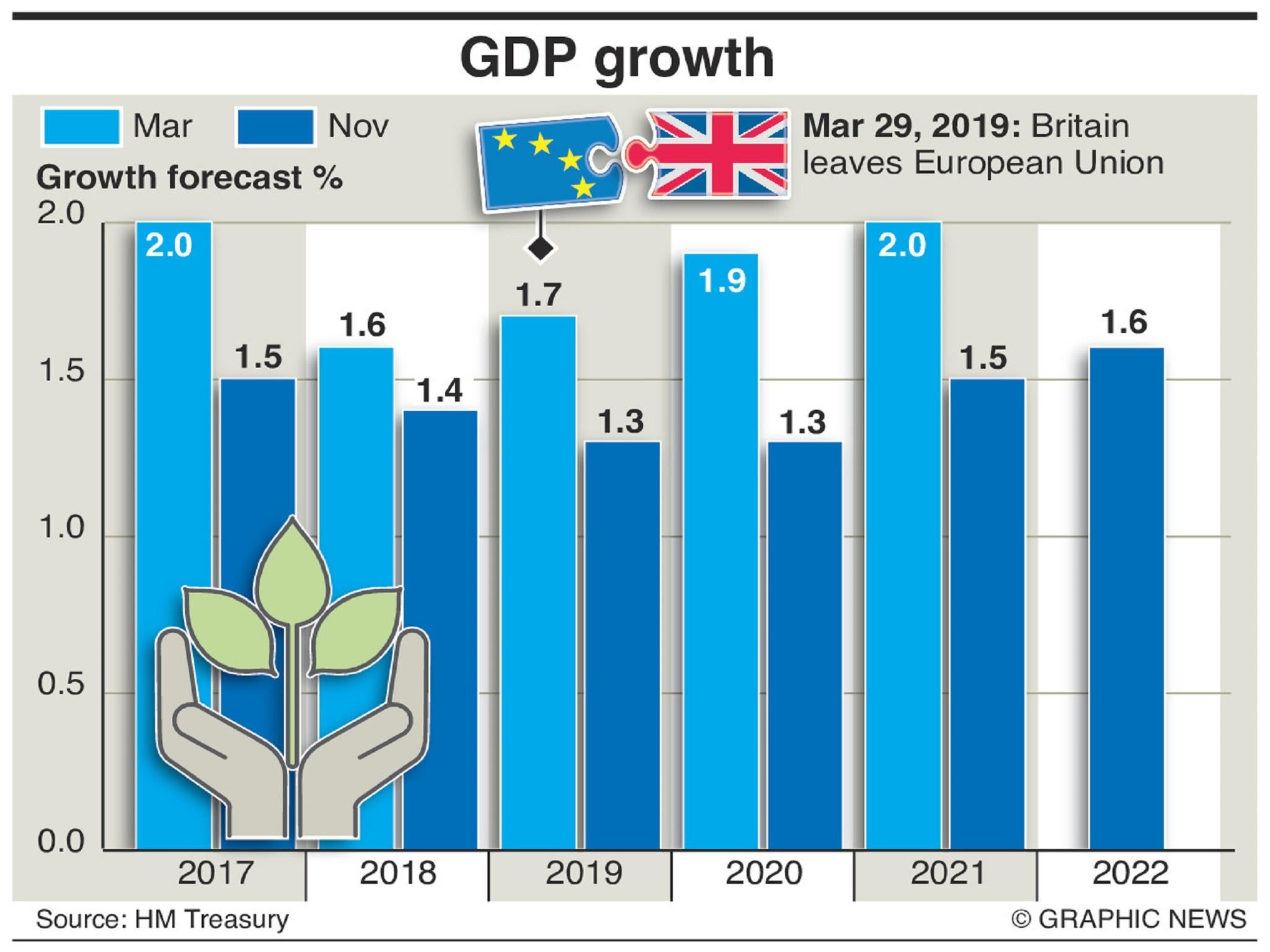

Because productivity growth is a key ingredient of overall GDP growth, those downgrades have a negative impact on the OBR’s view of how rapidly the overall economy will grow over the coming years.

The OBR now expects growth to dip to just 1.3 per cent in 2019, the year of Brexit.

Even worse, it only expects growth to pick up moderately to 1.6 per cent by 2022.

In March, the OBR expected the economy to grow by 7.5 per cent in the five years to 2021-22. Now it expects just 5.7 per cent growth over that period.

In fact, this is the worst five-year GDP outlook produced by the OBR since it was established in 2010.

...Hammond loosens fiscal policy over next few years…

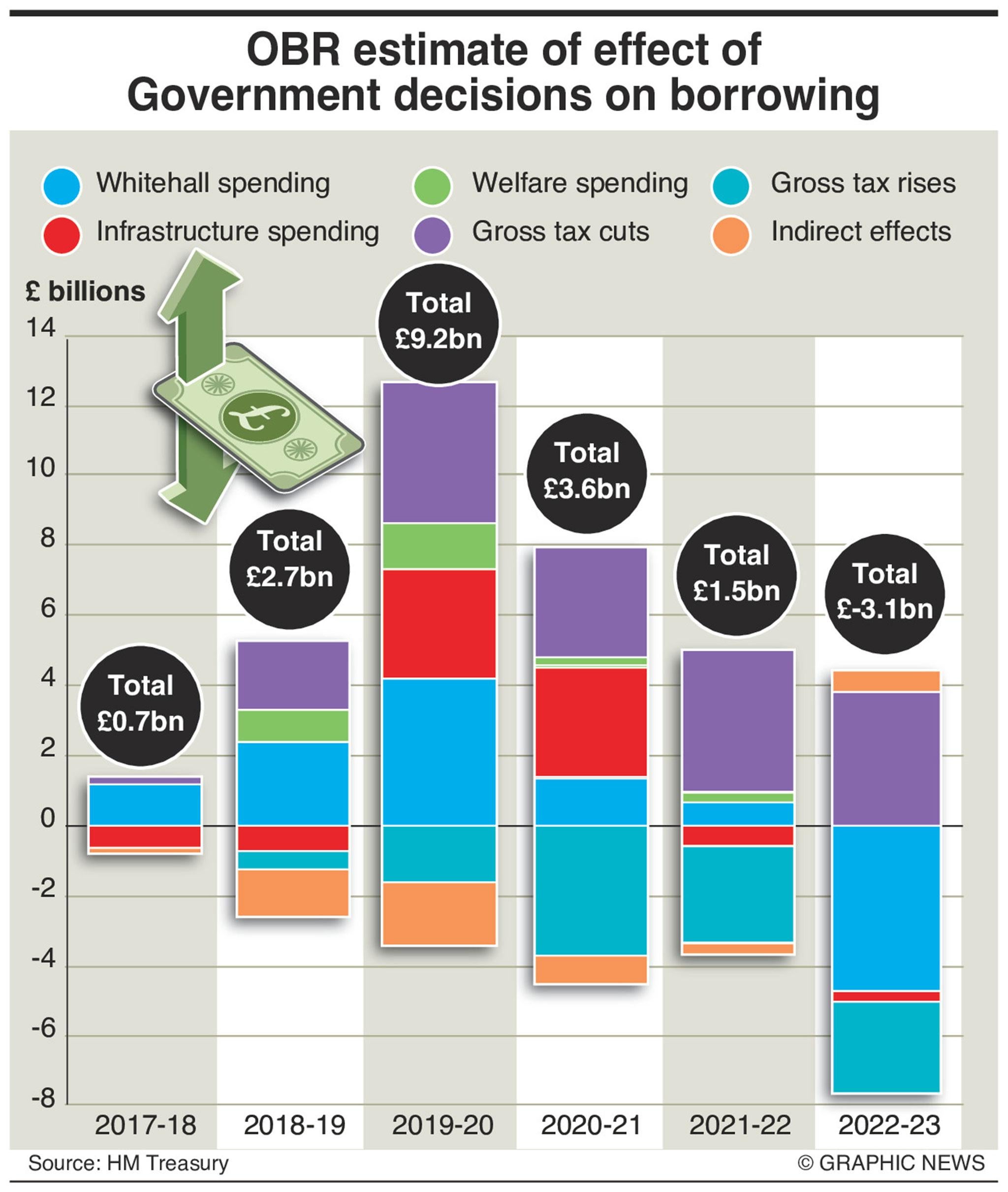

Lower productivity and GDP growth will hit tax revenues over the coming years.

Yet, despite this, the Chancellor announced plans today to loosen fiscal policy over the near term, allowing government departments to spend more and delivering a net tax-cut for households.

Notable was more funding for the NHS in 2018-19 and 2019-20. Fuel duty was frozen yet again. The Treasury has also pencilled in £3bn in spending to “prepare” for Brexit.

…but Chancellor still on course to hit deficit target…

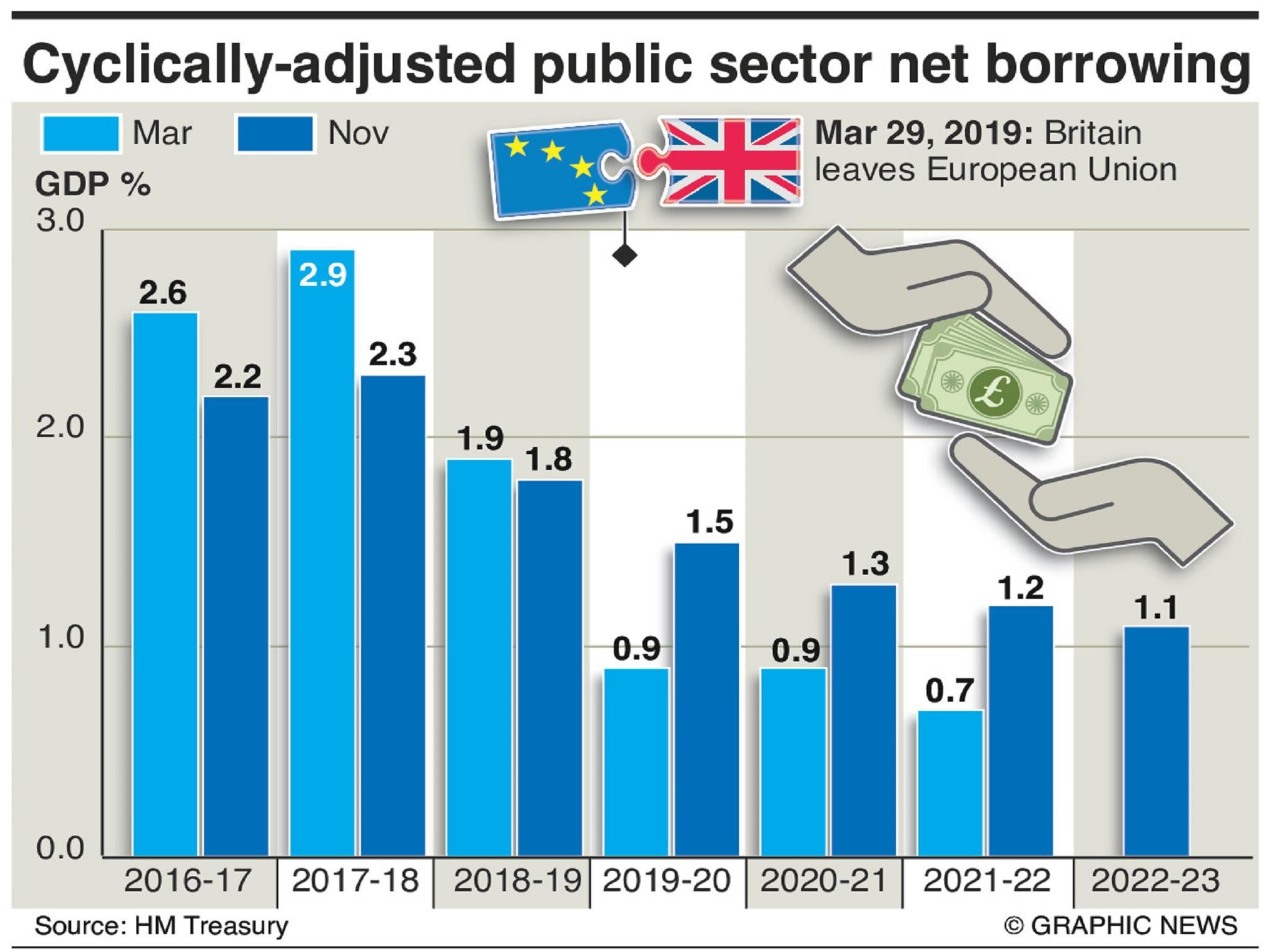

Still, despite this near-term fiscal loosening, Mr Hammond is still projected by the OBR to be on course to meet his self-imposed fiscal mandate of limiting the structural deficit to below 2 per cent of GDP in 2020-21.

However, he had around £26bn of leeway against this target in March. Now, that headroom has been significantly reduced to just £14bn.

If the economy falters even more than expected over the next two years – which could well happen if it looks like we are heading for a cliff-edge Brexit – that remaining headroom would be quickly wiped out.

…and for national debt to actually fall this year...

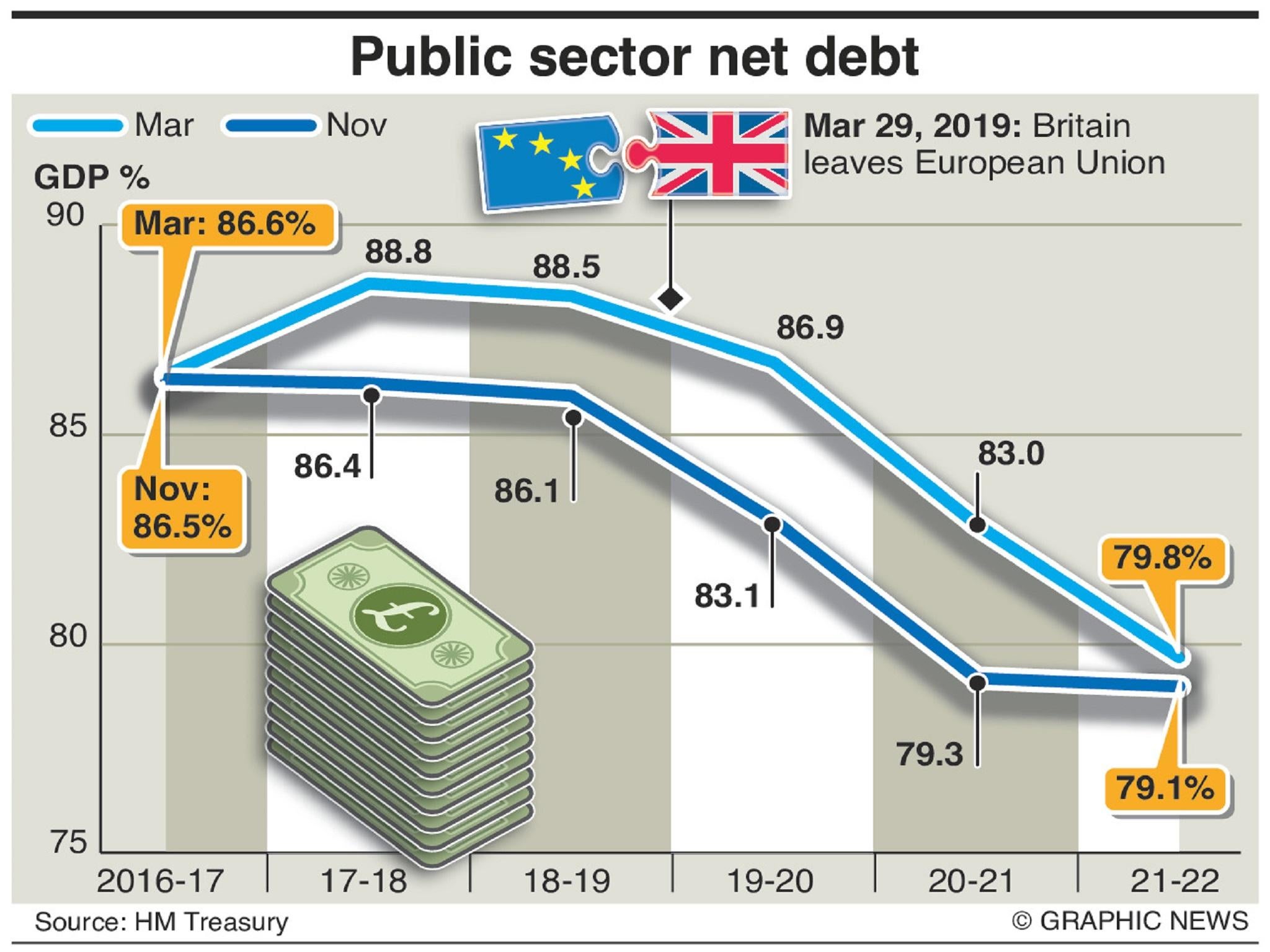

The second part of the Chancellor’s self-imposed fiscal mandate is to see debt falling as a share of GDP by 2020-21.

In March this was due to be achieved early, occurring in 2018-19.

But now the OBR expects it to happen earlier still. In this very financial year (2017-18) net public-sector debt is due to peak and edge down by 0.1 percentage point to 86.5 per cent of GDP in 2018-19.

However, the watchdog explains in its report that this unexpected improvement is primarily due to the recent re-classification of some £70bn of housing-association debt as no longer being on the public balance sheet.

The OBR adds that this doesn’t make any substantive difference since the Government would almost certainly have to rescue any housing associations if they went bust, meaning that their liabilities remain effectively on the public books even if, for accounting purposes, they have been removed.

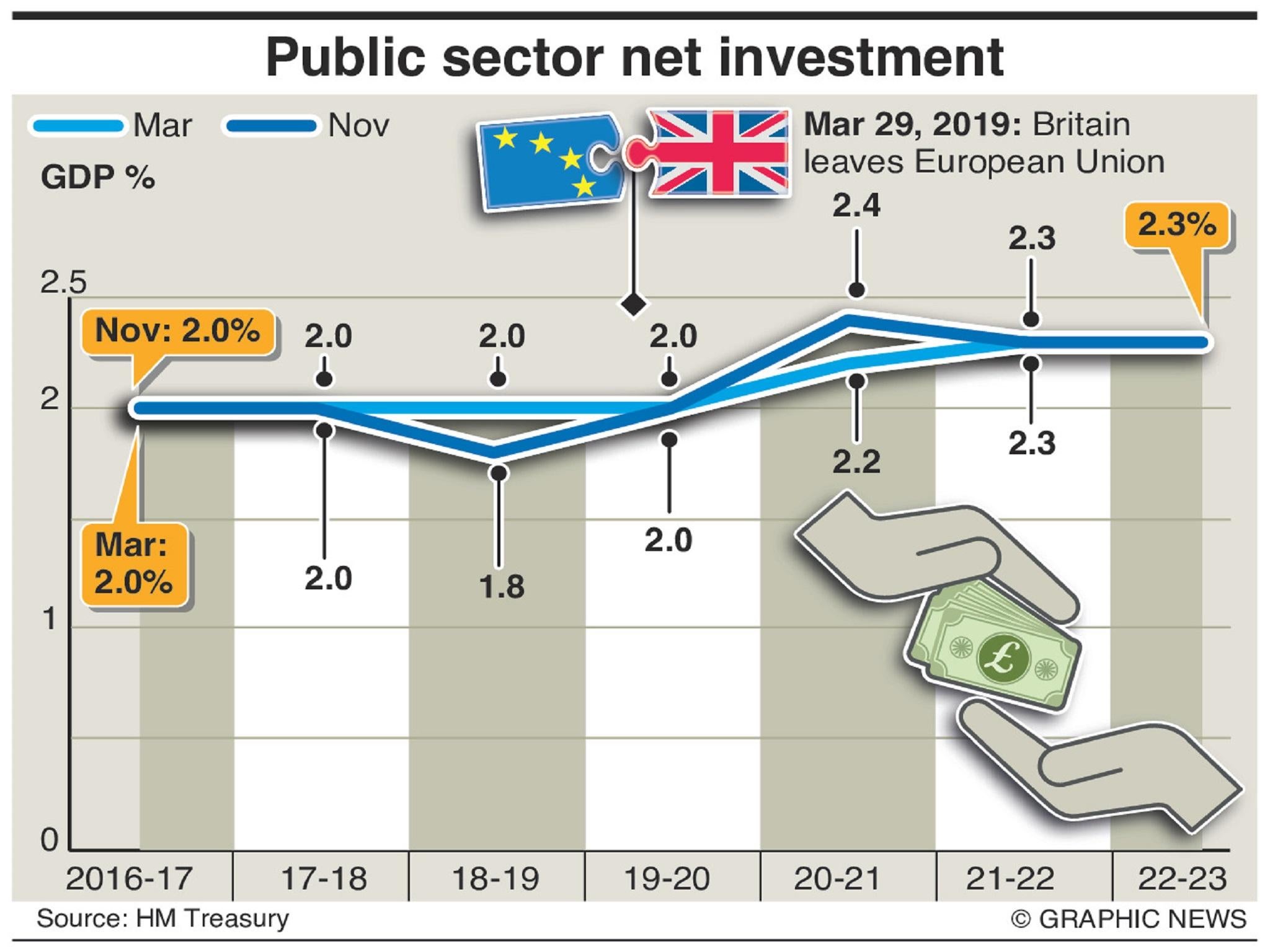

…but still no sign of state investment splurge

The Chancellor spoke once again of the imperative of lifting state investment to help raise the abysmal levels of productivity in the UK.

There was indeed some additional infrastructure investment spending over the next two years in the figures.

Yet, overall, the level of state investment relative to GDP by 2022-23 is still only 2.3 per cent, which is rather low compared to many of our peer economies in Europe.

Labour, by contrast, have pledged to raise the state rate of investment to 3 per cent of GDP.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments