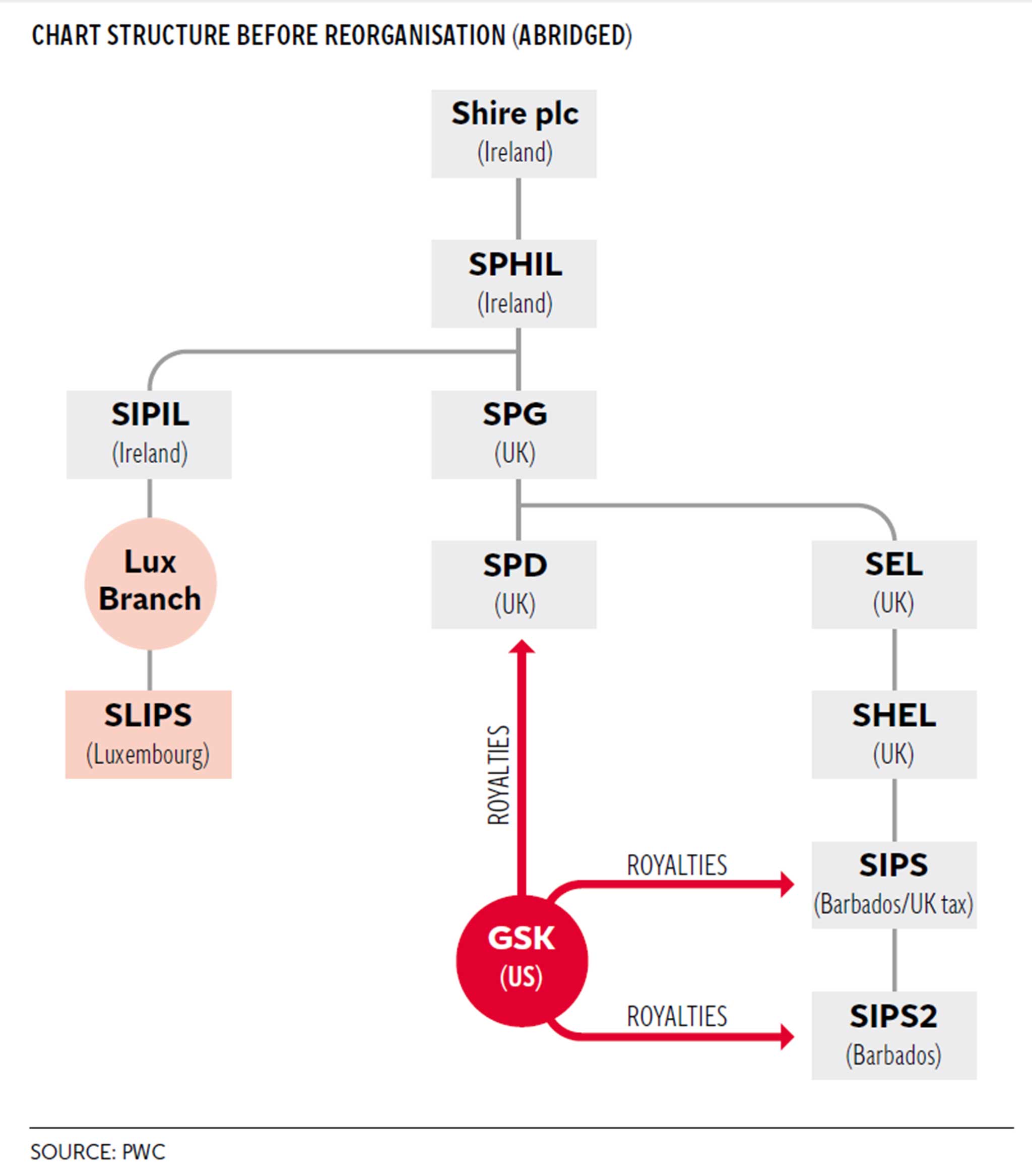

The chart that lays bare Shire pharmaceuticals' complex tax arrangements

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Shire is a global pharmaceutical company, incorporated in Jersey but domiciled in Ireland for tax purposes. It has around 5,600 staff worldwide, the majority in the US but only two in Luxembourg, where it paid tax at a rate of only 0.0156 per cent on its profits, the Public Accounts Committee said.

Neither PwC nor Shire could demonstrate that the company’s presence in Luxembourg was designed to do anything other than avoid tax, said the committee.

Shire told the MPs: “It is not necessarily a question of comparative efficiency. We could have the lending in and lending out in all sorts of other jurisdictions. It is just a good location”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments