Would you leave it to a robo-adviser to sort out all your investments?

Special computer software has stepped out of a sci-fi screenplay to offer low-cost financial guidance. Simon Read reports

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

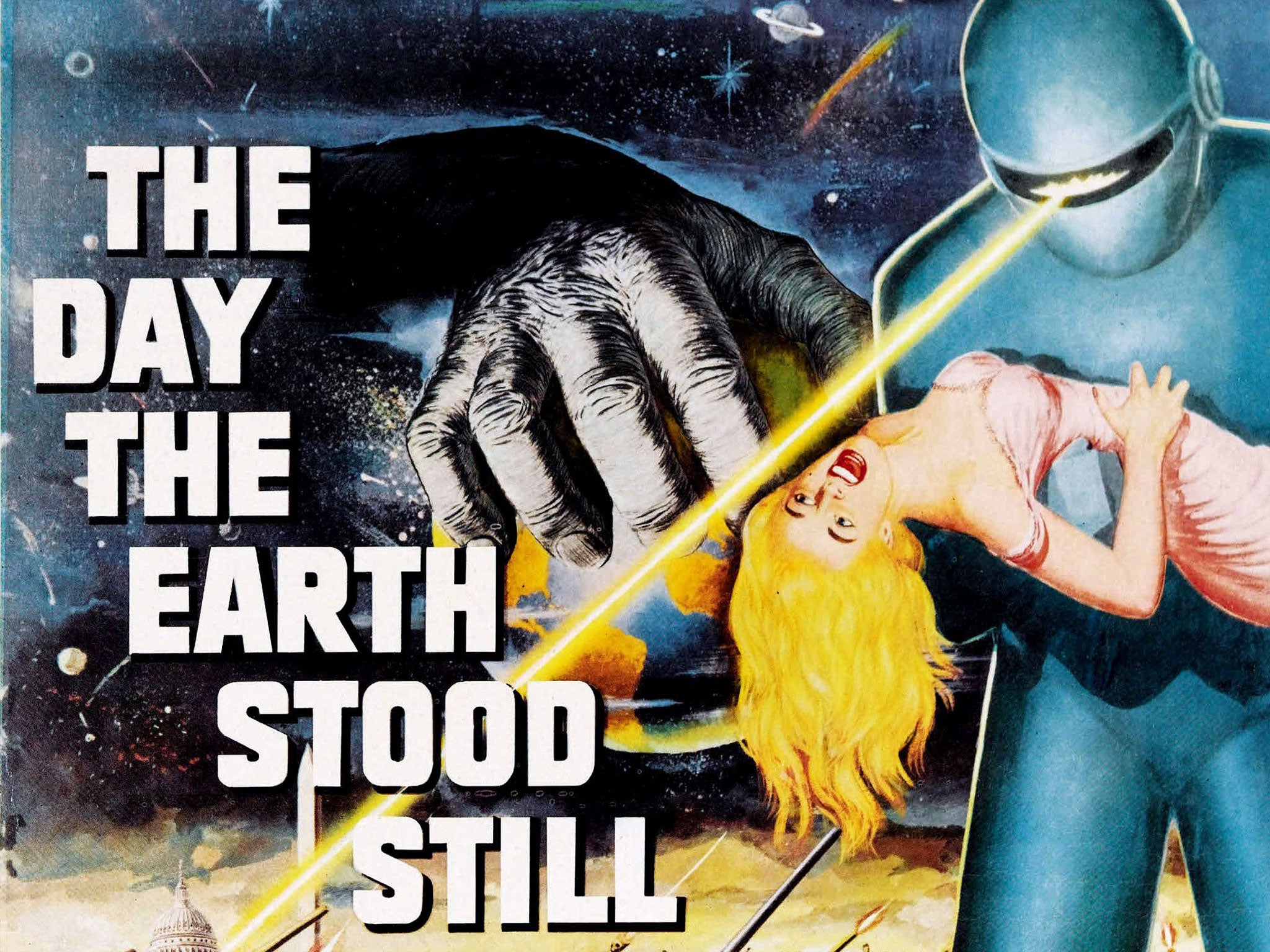

Your support makes all the difference."Klaatu barada nikto" is the phrase uttered by an alien to stop his powerful robot from destroying the planet in the 1950s sci-fi movie The Day The Earth Stood Still. In that film – and many since – robots are depicted as crazy cyborgs of whom we should be very afraid.

In the past few days the UK's financial regulators have been discussing the implications of robots in terms of advising consumers on investments. Known as robo-advice, it's already massive in the US – and now it's beginning to take off here.

But don't worry, robo-advice doesn't involve 7ft metal monsters coming into your home and telling you which funds to choose. The truth is a little more prosaic. It's simply a term to describe computer software that uses complicated algorithms to work out what might be the best investment opportunities for you.

And Harriet Baldwin, the Economic Secretary to the Treasury, reckons that could be a good thing. "The exciting thing about robo-advice is that is has the potential to be much cheaper and quicker than face-to-face financial advice," she told the audience at a conference organised by the Financial Conduct Authority (FCA).

She added: "Not only that, but it's also the kind of quick and simple online service we're using elsewhere in our daily lives – and which many in the millennial generation see as standard procedure."

It’s not just a case of letting algorithms do the calculations to develop an asset allocation

But she sent out a warning too, saying: "Robo-advice shouldn't aspire to be simply a way of commoditising financial advice; it should be used to make advice better."

What is it exactly? It's a catch-all term to describe digital or online financial advisers and wealth managers. Many of Britain's best-established robo-advisers were speaking at this week's FCA conference, including Wealth Wizards and Money On Toast, which both offer online pensions advice to consumers. Also there was Wealthkernel, an automated investment platform for financial advisers, and Nutmeg, which chief executive Nick Hungerford likes to describe as a robo-manager.

"We don't give advice," he pointed out. "We're a discretionary investment manager.

"But unlike traditional managers, our relationship with clients is conducted primarily through an internet-based service with telephone support."

However, the key difference between Nutmeg and traditional face-to-face managers is cost, he said. The online firm's approach means charges are much lower, while the fund management performance is comparable. And it's not just a case of letting the algorithms do the calculations to develop an asset allocation and stick to it, as happens in most of the similar US robo-advisers.

"We take an active approach to our asset allocation," Mr Hungerford said. "Is this the right time in the economic cycle to own small-cap stocks, for instance? Should we be currency hedged? Should we reduce the sensitivity of our bond holdings to take account of rising interest rates? These are all asset-allocation decisions that add value over time."

But the cost of some robo-advisers isn't cheap enough, reckons Darius McDermott at the fund supermarket Chelsea Financial Services. "Robo-advice sits somewhere between direct-to-consumer guidance and full discretionary management, and you can get good guidance for a lot less money and full discretionary management for not a lot more," he said

Others warn that the different services offered by online financial firms could be confusing for consumers. "There is a huge risk that people won't understand what they're getting," said Patrick Connolly at the adviser Chase de Vere. "Many robo-advice services are simply a means to encourage people to invest more money – and while investors may think they're getting some form of advice, if they make the wrong decisions then they have no comeback."

But Matt Phillips of Thomas Miller Investment welcomes the growth of robo-advice: "It will mean more people will be engaged in savings. In the future I can see the wealth manager and robo-adviser working alongside each other, which means it will be positive for consumers and advisers."

Danny Cox, Hargreaves Lansdown

Robo-advice is a generic term and a bit of a misnomer as it is doesn't involve robots and doesn't, in most cases, give advice. It is actually a range of financial planning tools that help people to make their own investment decisions.

"They range from ideas for simple model portfolios, through to more sophisticated cashflow scenario modelling and everything in between. The investor answers a number of questions and is given an answer.

"Robo-advice tools will help people to engage with their finances and make investment decisions. They are an extension of the calculators, information, guides and tools already on offer via direct-to-consumer investment services.

"They are not a replacement for advice – face-to-face or telephone. They are also not a replacement for non-advised and execution- only transactions."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments