Spot the scam: How to protect yourself against fraudsters

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Arecord number of serious fraud cases hit the courts in the first six months of the year. KPMG's "Fraud Barometer" revealed that there were 163 charges of serious fraud – where more than £100,000 is embezzled – in the first half of this year, with a combined value of £636m. The figures are the highest in the 21 years that KPMG has been tracking the data. Worryingly, more than half the money – £321m – was stolen from investors, with the Government and financial institutions losing £153m and £111m respectively.

The figures are just the tip of a massive iceberg as tricksters have been upping the stakes in their attempts to swindle people out of their cash. The most high-profile fraud case of the year broke this week when City of London Police revealed that some 600 well-heeled investors have been taken for £80m in what is believed to be the biggest-ever, get-rich-quick Ponzi-style pyramid scheme to hit the UK.

The police said the sting was so successful that many investors refused to believe they'd been ripped off. Victims of the gang of Ferrari-driving fraudsters are thought to include former England cricketer Darren Gough, pictured.

The scheme was set up by a Knightsbridge-based company called BCI. It targeted wealthy people by offering extremely generous returns of up to 13 per cent a month. The company claimed the dividends were generated by lending to struggling companies that were willing to pay high rates of interest on loans. In truth, investors' money funded the payments to other investors in a classic pyramid structure. With all such schemes, the whole thing unravels when fraudsters can't find fresh investors to fund payments to existing members.

The crooks prey on people's greed when setting up their cons and, at a time when money is tight, it's easy for even the most cautious among us to get caught out. KPMG says professional gangs are out in force looking for targets. Hitesh Patel, partner at KPMG Forensic, says: "The figures are bad, but the worst is yet to come. It will be a number of years before the impact of the recession fully feeds through into the fraud statistics. Hard times mean more people driven to fraud by personal pressures, and more investors willing to believe in cooked-up investment schemes."

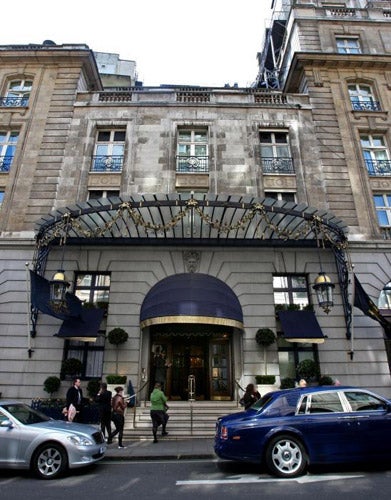

The biggest case that has come to court this year was a £200m swindle involving the attempted fraudulent sale of the Ritz Hotel in London. But not all cases are aimed at the obviously wealthy.

A large buy-to-let fraud in the North East earlier this year conned around 2,000 investors out of £80m, after they were persuaded to invest an average £40,000 each in properties which often turned out to be little more than derelict shells.

Other fraudsters target the companies they work for, or insurance firms. A construction company secretary in Merseyside claimed she had cancer so that she could take compassionate leave from work. She spent her time off getting plastic surgery and taking holidays with some of the £600,000 she had stolen from the company and a previous employer by paying wages into her own account.

Meanwhile, a social worker in the North West made up an entire children's home called Cherrywood. She authorised a number of payments for the home and its "staff" into her own bank account, taking over £600,000 of public funds over a period of five years.

In a landmark case earlier this year, an insurance company hit back at a fraudster by taking her to court for contempt. Joanne Kirk, of Preston in Lancashire, was convicted of contempt of court following a road traffic accident with a customer of NIG, an RBS-owned insurer that offers policies through brokers.

Mrs Kirk, who was seeking compensation of more than £800,000, had her claim slashed by the courts to £25,000 after NIG produced photographic evidence of her shopping and filling up her car with petrol, despite her protestations that she was hardly able to walk.

In fining her £2,500 and awarding costs to the insurer, Justice Coulson ruled that Mrs Kirk "exaggerated her symptoms to a significant and unconscionable degree" and can have had no "honest belief" that much of her claim was true.

Allan Clare, head of financial crime at NIG, says: "Anyone considering committing fraud, whether they be our policy-holder or third parties, will now have to face very serious consequences beyond the main personal injury action for dishonestly inflating a claim.

"With fraud adding around £40 to an average insurance premium, any measures which make fraud less attractive to fraudsters is good news for honest policy-holder."

The battle against fraud continues with police and specialist fraud departments working together to detect and convict crooks. But there is also a personal responsibility that we all bear to be on guard against becoming a victim. When presented with any money-making scheme it should be obvious if it's suspicious, but it's worth reminding yourself to be alert.

Brian Dennehy, managing director of investment experts Dennehy, Weller & Co, says: "There are always fraudsters out to dupe investors, but there are usually some giveaway signs, for example the promise of unrealistic returns. If anyone offers returns much higher than the building society, say 5 per cent and above, and claims such returns are secure or guaranteed, be very wary."

He also warns about the danger of relying on word of mouth. "It is often said that a personal recommendation is preferred, but the reality is that a plausible conman is highly effective at building trust and encouraging just such recommendations."

Another rule that Dennehy sticks to when investing is this: if you don't understand something, don't invest. "You must ask detailed questions and expect clear answers," he advises.

It's also a very good idea to check someone's credentials and whether they are authorised to give you investment advice. You can check an individual's or firm's standing at the Financial Services Authority's register on its website www.fsa.gov.uk, or by calling 0300 500 5000.

It's not only investors who can be hit by fraudsters, and sophisticated cyber-crooks are finding their victims online, stealing their identities to run up debts or even clean out victims' bank accounts. In the last two weeks, for instance, there's been a spam email popping up in inboxes claiming to be from Inland Revenue & Customs and promising the chance of a tax rebate.

With the upcoming 31 July self-assessment tax deadline on people's minds, it could be easy to click on the link in the message. But doing so will be playing into the hands of the fraudsters. HMRC says it will never send out such an email to people. Similar emails from other government bodies or financial institutions asking for personal details or for you to click on a site will always be cons.

Andrew Hagger of Moneynet.co.uk says some simple financial housekeeping could help keep fraudsters at bay. He says that crooks try to target dormant accounts or old credit cards that people may have forgotten all about.

"For example, if anyone moves house, it's easy to forget about an old credit card that you don't use now the 0 per cent deal has ended," he says. "But in 12 or 18 months' time when the card expires, a replacement card will be sent to your old address, which is an open temptation to a fraudster.

"It is the same situation with current account or savings statements; you don't want to make life easier for someone to steal your identity." In other words, be sure to close any accounts that you no longer need, otherwise you could become easy prey yourself.

The holiday season can leave people even more open to the charms of a crook, warns David Alexander, a forensic accountant and director at Smith & Williamson. "People are probably at greater risk from fraud when travelling abroad – not least because there is a tendency for them to let their guard down while relaxed and in a holiday mood, therefore putting them at high risk of fraud," he says.

To protect yourself, he suggests using cash rather than plastic abroad. Also, don't take all your credit and debit cards with you, only those you need, and make a separate note of the card numbers and the provider's telephone number to report lost or stolen cards. Finally, before you travel, call your credit card provider and let them know your travel plans.

Identity fraud: How to protect yourself

"It can only take three pieces of information for a fraudster to be able to steal someone's identity, open accounts in their name, rack up huge debts and then leave the victim to foot the bill," warns Neil Munroe of credit report company Equifax. He advises doing the following to reduce the chance of becoming a victim.

* Be careful of what you carry around in your handbag or wallet. Credit card receipts, payslips, driving licences, bank statements, utility bills... these all reveal a lot of information about you and a combination of these can be a fraudster's dream.

* Shred statements, bills and mail which contains personal information.

* When using online banking, ensure people can't view your details and log out of the website, rather than just closing the window.

* Use the privacy settings on social networking sites.

* If you are disposing of an old computer, make sure you destroy information on the hard drive.

* Redirect your mail if you move house.

* Keep your PIN numbers secure.

* Always check bank statements and credit card statements carefully against receipts.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments