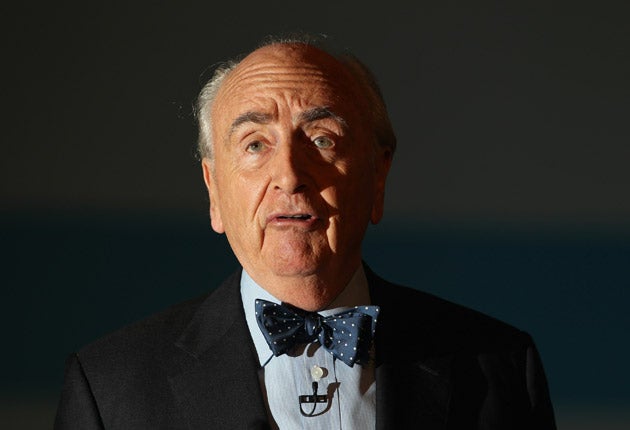

Julian Knight: Lordy! 'Never had it so good' gaffe costs Young his job. But he was right

I'm glad Lord Young has gone, but not for his "never had it so good" gaffe.

My heart sank when David Cameron dusted off the living-fossil peer and made him a Downing Street adviser. In his heyday, in the 1980s, Lord Young was the driest of the Thatcherites; apparently he brought Maggie solutions rather than problems. Well, judging from the "never had it so good" furore, he brought Cameron the complete reverse.

For me, and for many others who grew up in the 1980s, the Lord Youngs, Kenneth Bakers, Norman Tebbits and Nicholas Ridleys of Thatcher's government seemed to delight in crowing over the fact that their new economics was causing the destruction of large parts of the economy of the north of England, Scotland and Wales. Two generations have now lived through this frightful legacy on benefits, with many kept compliant by the issuing of anti-depressants en masse. Lord Young's last time close to power gave us the underclass.

It's for his small part in this social catastrophe that Lord Young should never have been allowed to darken the door of government again. However, his comment that Britons have never had it so good in this recession, is not a good reason for him to have left the political stage again – because he is, in part, right. His phraseology was crass and a gift for the journalist who interviewed him, but the truth is that if you had a tracker or interest-only mortgage and a secure job – such as teacher or doctor – then you had an excellent recession. Historic low interest rates mean that there are hundreds of thousands of people who since 2007 have paid next to nothing in mortgage repayments. For these people this was the recession that never was. Even the fall in property prices was only a temporary blip in London and the South-east, with Hampton estate agents predicting that, even with austerity biting, property prices in the capital will rise 3 per cent in 2011.

But, of course, this isn't the whole story. The million-plus people who have lost their jobs since 2007, or who had their hours cut, or those – such as the elderly – who rely on their savings, have had a very bad recession. And yet again the north of the country has suffered disproportionately; losing the last vestiges of manufacturing. As for house prices north of Watford, the best I can see is the next decade being one of stagnation. No one is talking about it, but negative equity will be a part of many of these people's lives for many years to come. The recession has brought back the acute north-south divide. It must feel like old times to Lord Young.

No thanks, Sheila

I keep being told that car insurance premiums are soaring and consumers will have to just grin and bear it. Certainly this thesis seemed to be borne out when getting our renewal quote from Sheila's Wheels for our ancient Mitsubishi – or the geography teacher's car, as I refer to it. The "bonza" deal offered was a premium increase of nearly 20 per cent. This after the same insurer had not reduced the cost of cover on us moving to a lower-crime area yet levied a large, inflexible and unjustifiable fee for adding an extra named driver to the cover just a few months ago. The excuse was that this was extra risk, and needed to be reflected in the premium. But why then was the charge the same for all customers, seemingly regardless of when it was levied in the span of the policy?

Sheila's went further into our bad books when a quick check on a price-comparison website revealed that it was offering to insure new customers for less than we have been paying for the past 12 months.

So, as a loyal customer, I can pay 20 per cent more than a Johnny-come-lately. Am I surprised? Not a bit of it. I suspect most car insurers pull a fast one at renewal, relying on our inertia. The onus is on consumers to do a simple check of comparison websites and either go with these or ask their current insurer to match the deal. This time, we decided not to give Sheila's Wheels a second chance and went with Admiral's quote instead. Let's see what happens at the next renewal, presuming the old banger makes it that far.

Promises, promises

Nationwide has made seven "savings promises" to its customers. Some are trite, such as: "We will help choose the best savings account for you." Thanks, Nationwide. But one stands out – the commitment to pay interest from the moment it receives an ISA transfer form from a customer. In the past, Nationwide has come under fire for taking far too long to transfer ISAs, costing customers interest. To some extent, Nationwide and Santander – another firm criticised for this – have been victims of their own success, attracting the customers but found wanting in the administration stakes. At least with the savings promise, Nationwide will ensure its customers won't miss out – and it's only its own bottom line that will suffer if it fails to get its admin right. Now, if only the powers that be at Clydesdale would take a leaf out of Nationwide's customer-service book and stop pursuing mortgage customers for a debt that is entirely down to the fact that they can't add up. The Ombudsman ruled against them last week, yet the Clotsdale still pursues these debts. Pathetic.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments