The gain in Spain for thousands of Brits

If you've invested in the Spanish property market, you could be in line for a big payout. Kate Hughes explains

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Buying property in Spain seems to answer a number of Britons' prayers, from the weather to the cost of living. But when it comes to selling that property, it can be a different story. Accusations of years of deliberate tax rip-offs for non-Spanish residents, the majority of them British, are now starting to bounce off the terracotta tiles.

A Spanish law firm is preparing to take the Spanish government to the European Court of Justice for what it describes as illegal capital gains taxes on foreigners. Costa, Alvarez, Manglano & Asociados has found that until 2007 a capital gains charge of 35 per cent was levied on property sold by non-Spaniards, despite the fact that the same tax charge was just 15 per cent for Spanish sellers.

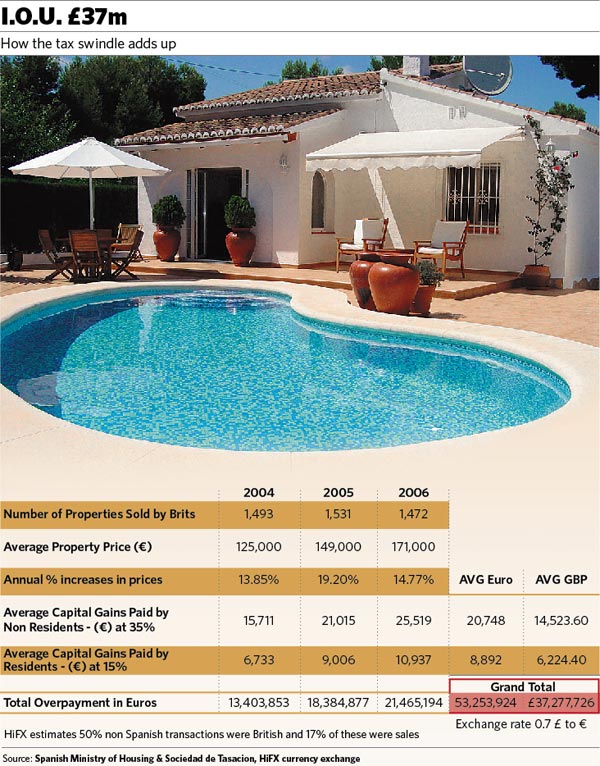

The firm believes that an estimated £37m is now owed to British former owners alone. What is more, they say that Brits can now start the long process of getting their money back because, they suggest, it flies in the face of EU laws on discrimination. This means that if you were one of the 4,500 British citizens who sold Spanish property between 2004 and 2007, and were charged at the non-resident's CGT rate, you could be eligible for an average rebate of £11,000.

The devil in the detail

According to the Spanish Ministry of Housing (Ministerio de Vivenda), non-residents sell over 17,000 properties a year in Spain. Based on the number of British ex-pats in Spain, the law firm estimates that around 50 per cent of these transactions were made by British citizens, and that around 17 per cent of those were house sales rather than purchases. If these estimates are accurate, it means that the Spanish government could owe Brits over €53.25m, around £37.27m, in capital gains tax refunds.

The ministry's figures suggest that the average property price has increased from €125,000 in 2004 to €171,000 by the end of 2006. This means that the average capital gains bill for non residents was around €20,700, or £14,500, between 2004 and the beginning of 2007. Meanwhile, the average capital gains charges paid by Spanish residents over the same period was an average of just €8,892, or £6,224.

"Anyone who has sold a Spanish property between March 2004 and December 2006 will have been victim to this inflated capital gains tax rate," says Emilio Alvarez of Costa, Alvarez, Manglano. "This saw non-residents scammed into paying inflated capital gains tax (CGT) by as much as 20 per cent. This tax trap is thought to have affected hundreds of thousands of people across the UK and Europe."

A change in Spanish law at the start of 2007 saw the standard CGT for non-residents being brought into line with residents' CGT. Although this went largely unnoticed, Alvarez says this now allows for those who may have been overcharged to get their money back.

He reports that the Spanish government has so far ignored or refused claims, but because the different charge contravenes European Community Treaty rules on discrimination, cases are now being prepared for the European court in a bid to claim back both the original overpayment and several years' worth of interest.

Since the law was changed in early 2007, this means that there is a window of opportunity for those who sold property between 2004 and 2007 to claim back unlawful tax. The bad news is that if a sale occurred before 2004, it is outside the four-year period that the law allows for claims. "Placing an actual figure on the number of people affected by this is very difficult, as the Spanish government understandably appears reluctant to disclose this information," says Mark Bodega, of currency broker HiFX, which is supporting the campaign. "Those who sold property before March 2004 have already missed out, as claims can only be backdated four years. This means that millions more have become victims of this tax trap and can do nothing about it."

Let battle commence

But Brian Charles, 62, from London is determined to get his money back. He bought a three-bedroom property on the Costa Blanca in 2001 for around €160,000. He sold it in January 2006 for €230,000, paying CGT of 35 per cent on the difference, a bill of around €21,000 or £14,700. If he were a Spanish resident he would have paid €9,000 or £6,300.

"I speak Spanish, so I was much more aware of what was going on than some Brits abroad who buy and sell without engaging with the process," he says. "But even then, I sold the house and paid what I was told to pay. I didn't think about it until I found out that something could be done.

"It is unfair to charge people more because they are not residents. But if it can be put right with a refund plus the interest I will be happy with that."

Were you overcharged?

When The Independent contacted the Ministerio de Vivenda over the issue they declined to comment, but if you feel you are entitled to a CGT refund, you don't need to take no for an answer. However, it is a long process. Taking these cases though the European courts is expected to take between three and four years in total.

Costa, Alvarez, Manglano is understandably keen to take on a class action against the Spanish government in the European courts – should the act be successful the firm will take 35 per cent of the amount recovered per claimant in a no-win, no-fee arrangement. For more information, call their helpline on 0845 680 3849, or visit their website www.spanishtaxreclaim.co.uk.

Alternatively, dig out your copy of the Spanish tax form "Modelo 212" which should have been signed and presented to the Spanish authorities when you sold the property, along with any other relevant documentation from the sale, and contact your own legal adviser for help.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments