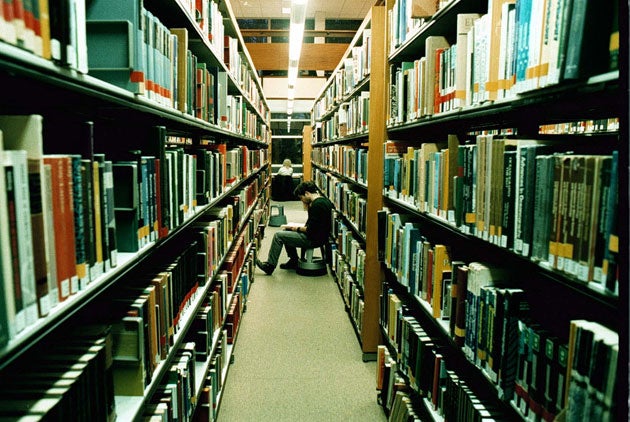

Make the most of your student days

University needn't leave you in debt forever if you follow our tips for savvy spending, says James Daley

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Thousands of students will head off for their first term at university over the next few weeks – an event which, for most, will sadly mark the beginning of many years of debt.

Most students today pay tuition fees of about £3,000 a year, while grants are smaller than they used to be and harder to come by. The happy exceptions are Scotland, where residents still have their tuition fees paid for them, and Wales, where you'll receive a grant of £1,890 towards your fees if you study at a Welsh university. But in England and Northern Ireland, only those from the poorest households will qualify for any kind of state help at all.

But whether you qualify for help or not, there's no doubt that you need to be thinking about money from the moment you decide to go to university. Even your choice of place to study could have a big impact on how much you spend.

Where to study

According to the NatWest Student Living index, Plymouth is the most cost-effective place to study in the UK, with relatively low living costs and high potential for earning a decent wage in part-time work. Cambridge, Dundee, Brighton and Portsmouth were also picked out as relatively cost-effective, while Exeter, Southampton and Manchester were among the most expensive.

Deciding whether to study somewhere close to home is the decision that could have the biggest effect on your finances. If you continue living with your parents while you study, you could save thousands on accommodation and food costs. But you'll also qualify for much smaller levels of loans – and you will have to put off the true discovery of your independence.

Fees and funding

Although grants are much harder to get today, they are available for families with very low incomes. The maximum maintenance grant today is just £2,835, and in England, your household (that is, your family, if you're under 25 and living at home) must have a total income of less than £25,000 a year for you to qualify. In Wales, Northern Ireland and Scotland, your family's income will have to be less than about £18,300 for you to receive the full amount. You should still qualify for something if your household income is between £18,000 and £60,000 a year, but at the top of that scale, it could amount just £50.

You can also apply to your university for a bursary if you are from a low-income family. And if you qualify for a full maintenance grant, your college is obliged to give you at least £305 a year. Last year, the typical bursary was closer to £1,000. Some universities offer scholarships and other awards, while some charities make donations to students' fees or living costs.

If you don't qualify for any of these, there's no option but to take out a loan to pay for your fees. The good news is that you won't be charged commercial rates; student loans are only charged interest at the rate of inflation (Retail Prices Index), and you don't have to start paying them off until you're in work and earning more than £15,000 a year. However, if you're receiving no support from your parents, and don't qualify for any grants or bursaries, be aware that you're likely to end with at least £20,000 of debt when you finish your course.

The Government-run student loan organisation will lend you the full amount of your tuition fees, plus up to a further £6,475 for living costs, each year. This maximum is only available to students studying in London and living away from home. If you're at home, you may not qualify for any more than £810 a year.

Don't be tempted to think that an extra thousand pounds of debt here or there doesn't matter. The less debt you build up, the less time you'll be paying it off for. It may be tempting to apply for the full amount in your first year, but do some budgeting to work out how much you'll really need.

For information on student finance, visit www.direct.gov.uk.

Banking

The next thing to do is to get a good bank account. The start of university is the best time to do this, as banks are eager to get your business. Most of today's top lawyers, doctors and rich City bankers started out as penniless students – and many of them have not changed their bank since.

The main things to consider when opening an account are: what size overdraft facility does the bank offer; what are its terms and conditions; is there a branch near your university (if you want branch access); and what incentives do they offer? This year, you can get anything from free cinema tickets for six months to a free five-year young person's railcard (see table).

All the main banks will offer you an interest-free overdraft, up to as much as £3,000. Some, like Halifax, will offer you this from year one; others will increase your limit year by year, which may be a healthier way to manage your money.

Finally, it's worth opening your bank account before you arrive at university, as there are likely to be long lines on campus during the first days of term.

Get covered

Finally, it's worth at least thinking about taking out insurance before you go. Most students have their own computers, and perhaps TVs, music systems and other personal items. Policies with companies such as Endsleigh and HSBC can be relatively cheap and may make all the difference if you're unlucky enough to be burgled.

If you'll have a television, make sure you get a licence. But remember that you can claim a rebate for the summer holiday period when you're not using it.

Spend less, earn more

* You don't need a degree in economics to know that spending responsibly and maximising your income will leave you better placed once you finish your degree. Spending £1,000 may feel inconsequential when you're £20,000 in debt, but years down the line it could be the extra bit of debt that stops you buying a house, or doing a postgraduate course.

* Arriving at university, the first thing to get under control is start-up costs. Textbooks could set you back hundreds of pounds, so see if you can find used ones from former students or websites like amazon.co.uk. Join clubs and societies only if you're sure to attend. If you can, eat your meals in a hall of residence each night; it'll cost far less than eating out and be far healthier than a Pot Noodle in your bedroom.

* Create a realistic budget. Chances are that once you've paid for accommodation, food and transport, you won't have much for going out. Try to get casual work to fund your leisure time. A part-time job will not only earn you some extra cash; it will also stop you spending money in the evenings. Websites such as www.e4s.co.uk may help you to find a job before you head off to college. Once you're there, the Student Union should be able to help.

* Finally, make sure you get some holiday work. Christmas is a great time to pick up a part-time job on the high street. Summer also throws up plenty of opportunities, both at home and abroad.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments