Contemporary art is a fraud, says top dealer

The soaring prices - and their subsequent collapse - are proof to some experts that the works had a price, but not much value

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.One of the world’s leading art dealers this week launched an astonishing attack on the contemporary art market, condemning the millions charged for some works as “almost fraud”.

The comments from David Nahmad, a Monaco-based dealer who is possibly the biggest in the world, come as art buyers reel from the collapse of the contemporary market.

They echo remarks by the British sculptor Sir Anthony Caro, who last week said that “stupid outrageous values” had become more important than the work itself.

Mr Nahmad, who is reputed to have a £2bn collection of some 5,000 paintings, including 300 Picassos, told The Independent on Sunday: “There are a lot of embarrassed people who bought art that is now not worth what they paid for it. For the past three or four years it’s been a very, very thin market, with just two or three buyers pushing up prices by bidding against each other.

“Unfortunately, a lot of people knew the game. So those people who did not know are realising it now. It’s almost a fraud. I would never advise my clients to buy contemporary art.”

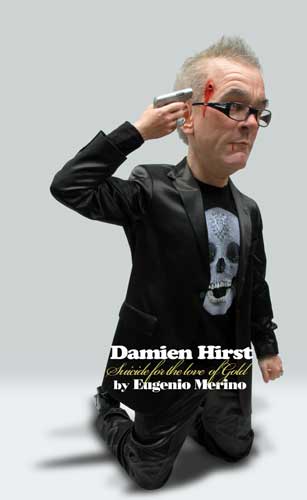

Mr Nahmad and his family have made billions of dollars trading art. They specialise in the works of great modern artists such as Picasso, Matisse and Rothko. He added that he doesn’t think any artist since Francis Bacon had pushed art forward. The last notable artists were Lucio Fontana and Yves Klein, he said. “There is the real art market, with real artists, and then there is the stupid art market which uses publicity to make some artists become very expensive. That doesn’t mean they are good. Damien Hirst’s diamond skull at $100m was a stupid thing; $100m is an offence. Hirst started with $10,000 – that’s OK. But $100m? That’s ridiculous.”

Last week Sir Anthony Caro, 84, one of Britain’s greatest living artists, bemoaned the fact that the market value of paintings had become more meaningful to artists than creating beautiful work. “Some art has got some stupid, outrageous values and it is very sad that money has become a very important part of the art world,” he said at the opening of a new sculpture exhibition in Monterrey, Mexico.

“Because of this crisis, something will change in art and there may be a rethinking of value. In my time, art was never about money. I am not a millionaire. I have tried to make good art.”

Louisa Buck, a columnist for The Art Newspaper, disagreed. “There is no doubt that the likes of Rothko, Picasso and Matisse are magisterial figures,” she said. “But the art world has moved on and to dismiss everything after Bacon is utter nonsense. The contemporary market has been subject to extreme speculation, but there is a difference between speculation and fraud. The economic downturn will moderate the speculative bubble that has seen some less deserving artists command extreme prices.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments