For free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails

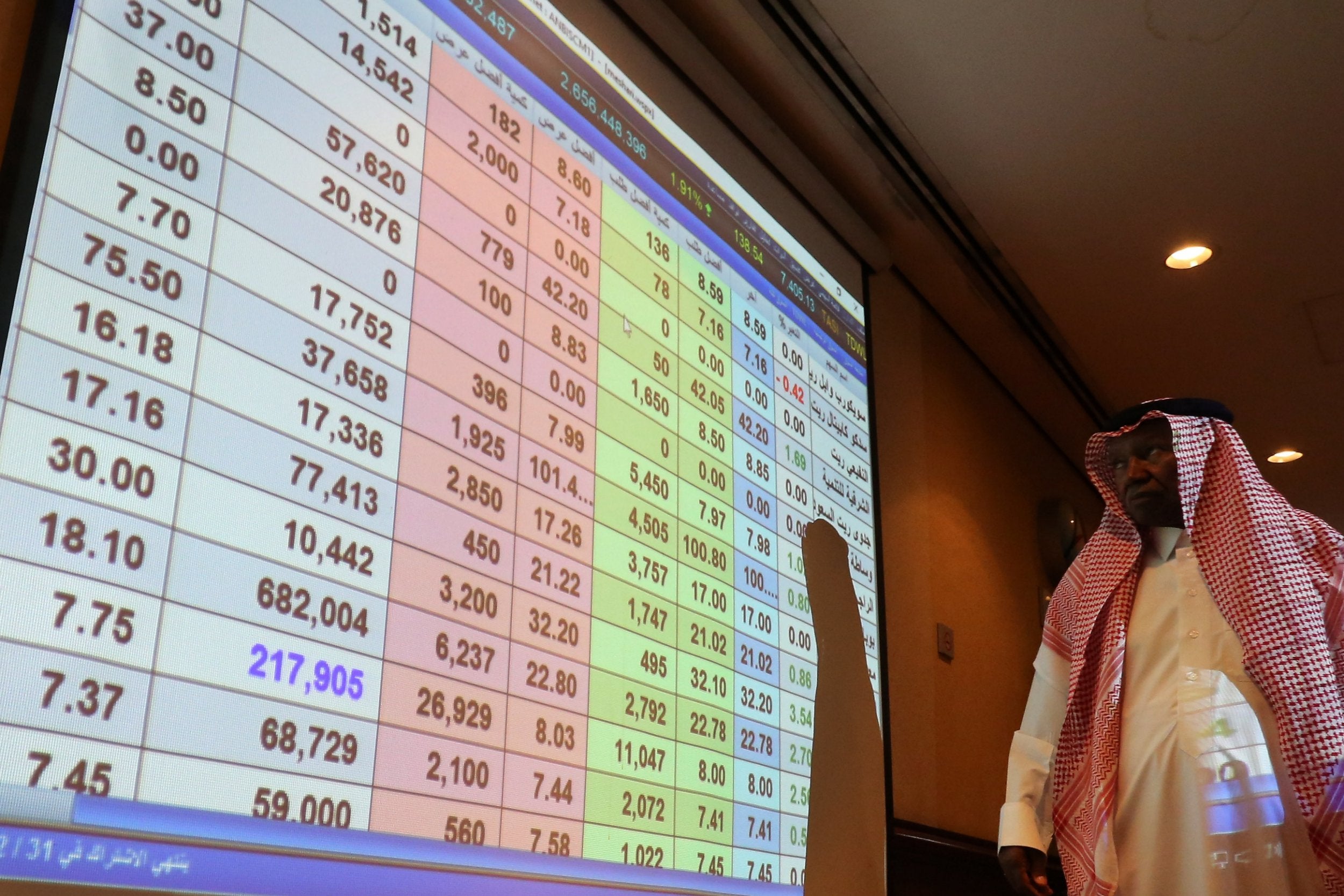

Overseas investors offloaded more than $1bn (£800m) in Saudi shares last week as pressure mounted on the kingdom to provide a plausible explanation for the death of journalist Jamal Khashoggi .

The outflow sent the country’s stock market tumbling after investors sold 5 billion riyals (£1bn) worth of shares and only bought 991.3 million riyals worth.

The sell-off is one of the biggest since Saudi Arabia opened up its markets to direct foreign investment in 2015.

After more than two weeks of denials, Riyadh finally admitted on Friday that the dissident journalist had died in the Saudi consulate in Istanbul, but claimed that it had been an accident after an altercation.

Following widespread incredulity at that account, Saudi foreign minister Adel al-Jubeir then issued a new explanation to Fox News, conceding that Mr Khashoggi was murdered in a “rogue operation” .

Events in Istanbul have critically damaged crown prince Mohammad bin Salman ’s attempts to portray himself as a moderniser, a tactic that had helped boost investment in the Gulf kingdom.

The alleged brutal murder and dismemberment of Mr Khashoggi also calls into question Saudi Arabia’s long-standing close ties with the US.

Treasury secretary Steven Mnuchin said on Sunday that the explanation of the killing was a “good first step but not enough”, adding it was too early to consider implementing sanctions.

According to Reuters, funds linked to the Saudi regime may have been used to support the country’s stock market, which was down 3 per cent on Sunday, adding to a 4 per cent fall since Mr Khashoggi disappeared on 2 October.

Saudi Arabia also faces higher payments on its foreign debt, with yields on its 2026 bond jumping to a record high last week.

The kingdom denies its crown prince or king were involved in Mr Khashoggi’s death. Mr al-Jubeir echoed Donald Trump’s warnings about rushing to judgement against Saudi leaders, saying “there is the presumption of innocence until proven guilty” and that some have “turned that upside down”.

But companies have been pulling out of an investment conference beginning this week in Riyadh, concerned that any association with the country’s leadership might be bad for business.

Show all 50 1 /50World news in pictures World news in pictures 30 September 2020 Pope Francis prays with priests at the end of a limited public audience at the San Damaso courtyard in The Vatican

AFP via Getty

World news in pictures 29 September 2020 A girl's silhouette is seen from behind a fabric in a tent along a beach by Beit Lahia in the northern Gaza Strip

AFP via Getty

World news in pictures 28 September 2020 A Chinese woman takes a photo of herself in front of a flower display dedicated to frontline health care workers during the COVID-19 pandemic in Beijing, China. China will celebrate national day marking the founding of the People's Republic of China on October 1st

Getty

World news in pictures 27 September 2020 The Glass Mountain Inn burns as the Glass Fire moves through the area in St. Helena, California. The fast moving Glass fire has burned over 1,000 acres and has destroyed homes

Getty

World news in pictures 26 September 2020 A villager along with a child offers prayers next to a carcass of a wild elephant that officials say was electrocuted in Rani Reserve Forest on the outskirts of Guwahati, India

AFP via Getty

World news in pictures 25 September 2020 The casket of late Supreme Court Justice Ruth Bader Ginsburg is seen in Statuary Hall in the US Capitol to lie in state in Washington, DC

AFP via Getty

World news in pictures 24 September 2020 An anti-government protester holds up an image of a pro-democracy commemorative plaque at a rally outside Thailand's parliament in Bangkok, as activists gathered to demand a new constitution

AFP via Getty

World news in pictures 23 September 2020 A whale stranded on a beach in Macquarie Harbour on the rugged west coast of Tasmania, as hundreds of pilot whales have died in a mass stranding in southern Australia despite efforts to save them, with rescuers racing to free a few dozen survivors

The Mercury/AFP via Getty

World news in pictures 22 September 2020 State civil employee candidates wearing face masks and shields take a test in Surabaya

AFP via Getty

World news in pictures 21 September 2020 A man sweeps at the Taj Mahal monument on the day of its reopening after being closed for more than six months due to the coronavirus pandemic

AP

World news in pictures 20 September 2020 A deer looks for food in a burnt area, caused by the Bobcat fire, in Pearblossom, California

EPA

World news in pictures 19 September 2020 Anti-government protesters hold their mobile phones aloft as they take part in a pro-democracy rally in Bangkok. Tens of thousands of pro-democracy protesters massed close to Thailand's royal palace, in a huge rally calling for PM Prayut Chan-O-Cha to step down and demanding reforms to the monarchy

AFP via Getty

World news in pictures 18 September 2020 Supporters of Iraqi Shi'ite cleric Moqtada al-Sadr maintain social distancing as they attend Friday prayers after the coronavirus disease restrictions were eased, in Kufa mosque, near Najaf, Iraq

Reuters

World news in pictures 17 September 2020 A protester climbs on The Triumph of the Republic at 'the Place de la Nation' as thousands of protesters take part in a demonstration during a national day strike called by labor unions asking for better salary and against jobs cut in Paris, France

EPA

World news in pictures 16 September 2020 A fire raging near the Lazzaretto of Ancona in Italy. The huge blaze broke out overnight at the port of Ancona. Firefighters have brought the fire under control but they expected to keep working through the day

EPA

World news in pictures 15 September 2020 Russian opposition leader Alexei Navalny posing for a selfie with his family at Berlin's Charite hospital. In an Instagram post he said he could now breathe independently following his suspected poisoning last month

Alexei Navalny/Instagram/AFP

World news in pictures 14 September 2020 Japan's Prime Minister Shinzo Abe, Chief Cabinet Secretary Yoshihide Suga, former Defense Minister Shigeru Ishiba and former Foreign Minister Fumio Kishida celebrate after Suga was elected as new head of the ruling party at the Liberal Democratic Party's leadership election in Tokyo

Reuters

World news in pictures 13 September 2020 A man stands behind a burning barricade during the fifth straight day of protests against police brutality in Bogota

AFP via Getty

World news in pictures 12 September 2020 Police officers block and detain protesters during an opposition rally to protest the official presidential election results in Minsk, Belarus. Daily protests calling for the authoritarian president's resignation are now in their second month

AP

World news in pictures 11 September 2020 Members of 'Omnium Cultural' celebrate the 20th 'Festa per la llibertat' ('Fiesta for the freedom') to mark the Day of Catalonia in Barcelona. Omnion Cultural fights for the independence of Catalonia

EPA

World news in pictures 10 September 2020 The Moria refugee camp, two days after Greece's biggest migrant camp, was destroyed by fire. Thousands of asylum seekers on the island of Lesbos are now homeless

AFP via Getty

World news in pictures 9 September 2020 Pope Francis takes off his face mask as he arrives by car to hold a limited public audience at the San Damaso courtyard in The Vatican

AFP via Getty

World news in pictures 8 September 2020 A home is engulfed in flames during the "Creek Fire" in the Tollhouse area of California

AFP via Getty

World news in pictures 7 September 2020 A couple take photos along a sea wall of the waves brought by Typhoon Haishen in the eastern port city of Sokcho

AFP via Getty

World news in pictures 6 September 2020 Novak Djokovic and a tournament official tends to a linesperson who was struck with a ball by Djokovic during his match against Pablo Carreno Busta at the US Open

USA Today Sports/Reuters

World news in pictures 5 September 2020 Protesters confront police at the Shrine of Remembrance in Melbourne, Australia, during an anti-lockdown rally

AFP via Getty

World news in pictures 4 September 2020 A woman looks on from a rooftop as rescue workers dig through the rubble of a damaged building in Beirut. A search began for possible survivors after a scanner detected a pulse one month after the mega-blast at the adjacent port

AFP via Getty

World news in pictures 3 September 2020 A full moon next to the Virgen del Panecillo statue in Quito, Ecuador

EPA

World news in pictures 2 September 2020 A Palestinian woman reacts as Israeli forces demolish her animal shed near Hebron in the Israeli-occupied West Bank

Reuters

World news in pictures 1 September 2020 Students protest against presidential elections results in Minsk

TUT.BY/AFP via Getty

World news in pictures 31 August 2020 The pack rides during the 3rd stage of the Tour de France between Nice and Sisteron

AFP via Getty

World news in pictures 30 August 2020 Law enforcement officers block a street during a rally of opposition supporters protesting against presidential election results in Minsk, Belarus

Reuters

World news in pictures 29 August 2020 A woman holding a placard reading "Stop Censorship - Yes to the Freedom of Expression" shouts in a megaphone during a protest against the mandatory wearing of face masks in Paris. Masks, which were already compulsory on public transport, in enclosed public spaces, and outdoors in Paris in certain high-congestion areas around tourist sites, were made mandatory outdoors citywide on August 28 to fight the rising coronavirus infections

AFP via Getty

World news in pictures 28 August 2020 Japanese Prime Minister Shinzo Abe bows to the national flag at the start of a press conference at the prime minister official residence in Tokyo. Abe announced he will resign over health problems, in a bombshell development that kicks off a leadership contest in the world's third-largest economy

AFP via Getty

World news in pictures 27 August 2020 Residents take cover behind a tree trunk from rubber bullets fired by South African Police Service (SAPS) in Eldorado Park, near Johannesburg, during a protest by community members after a 16-year old boy was reported dead

AFP via Getty

World news in pictures 26 August 2020 People scatter rose petals on a statue of Mother Teresa marking her 110th birth anniversary in Ahmedabad

AFP via Getty

World news in pictures 25 August 2020 An aerial view shows beach-goers standing on salt formations in the Dead Sea near Ein Bokeq, Israel

Reuters

World news in pictures 24 August 2020 Health workers use a fingertip pulse oximeter and check the body temperature of a fisherwoman inside the Dharavi slum during a door-to-door Covid-19 coronavirus screening in Mumbai

AFP via Getty

World news in pictures 23 August 2020 People carry an idol of the Hindu god Ganesh, the deity of prosperity, to immerse it off the coast of the Arabian sea during the Ganesh Chaturthi festival in Mumbai, India

Reuters

World news in pictures 22 August 2020 Firefighters watch as flames from the LNU Lightning Complex fires approach a home in Napa County, California

AP

World news in pictures 21 August 2020 Members of the Israeli security forces arrest a Palestinian demonstrator during a rally to protest against Israel's plan to annex parts of the occupied West Bank

AFP via Getty

World news in pictures 20 August 2020 A man pushes his bicycle through a deserted road after prohibitory orders were imposed by district officials for a week to contain the spread of the Covid-19 in Kathmandu

AFP via Getty

World news in pictures 19 August 2020 A car burns while parked at a residence in Vacaville, California. Dozens of fires are burning out of control throughout Northern California as fire resources are spread thin

AFP via Getty

World news in pictures 18 August 2020 Students use their mobile phones as flashlights at an anti-government rally at Mahidol University in Nakhon Pathom. Thailand has seen near-daily protests in recent weeks by students demanding the resignation of Prime Minister Prayut Chan-O-Cha

AFP via Getty

World news in pictures 17 August 2020 Members of the Kayapo tribe block the BR163 highway during a protest outside Novo Progresso in Para state, Brazil. Indigenous protesters blocked a major transamazonian highway to protest against the lack of governmental support during the COVID-19 novel coronavirus pandemic and illegal deforestation in and around their territories

AFP via Getty

World news in pictures 16 August 2020 Lightning forks over the San Francisco-Oakland Bay Bridge as a storm passes over Oakland

AP

World news in pictures 15 August 2020 Belarus opposition supporters gather near the Pushkinskaya metro station where Alexander Taraikovsky, a 34-year-old protester died on August 10, during their protest rally in central Minsk

AFP via Getty

World news in pictures 14 August 2020 AlphaTauri's driver Daniil Kvyat takes part in the second practice session at the Circuit de Catalunya in Montmelo near Barcelona ahead of the Spanish F1 Grand Prix

AFP via Getty

World news in pictures 13 August 2020 Soldiers of the Brazilian Armed Forces during a disinfection of the Christ The Redeemer statue at the Corcovado mountain prior to the opening of the touristic attraction in Rio

AFP via Getty

World news in pictures 12 August 2020 Young elephant bulls tussle playfully on World Elephant Day at the Amboseli National Park in Kenya

AFP via Getty

Google, HSBC, Uber and JPMorgan are among those who have said they will not attend the Future Investment Initiative (FII) summit , which has been dubbed “Davos in the desert”.

The managing director of the International Monetary Fund, Christine Lagarde, has pulled out of a planned trip to the Middle East which included a stop at the event.

She said: “I have to conduct the business of the IMF in all corners of the world and with many governments. When I visit a country I always speak my mind. You know me, I always do.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies