Hamish McRae: The picture is starting to look brighter for Europe - in the short term at least

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Europe is looking up. Or to be more precise, we are just beginning to signs of rising confidence in the business community in several countries, although this has yet to feed through into the wider economy and there are some countries that are lagging seriously behind.

In the coming weeks, there will be plenty more bad news, with record unemployment levels showing no sign of reversing and all the social consequences of that becoming more evident. But we have had several months now when the purchasing managers’ index for the eurozone has climbed, and that has in the past been associated with a turn-up in economic growth.

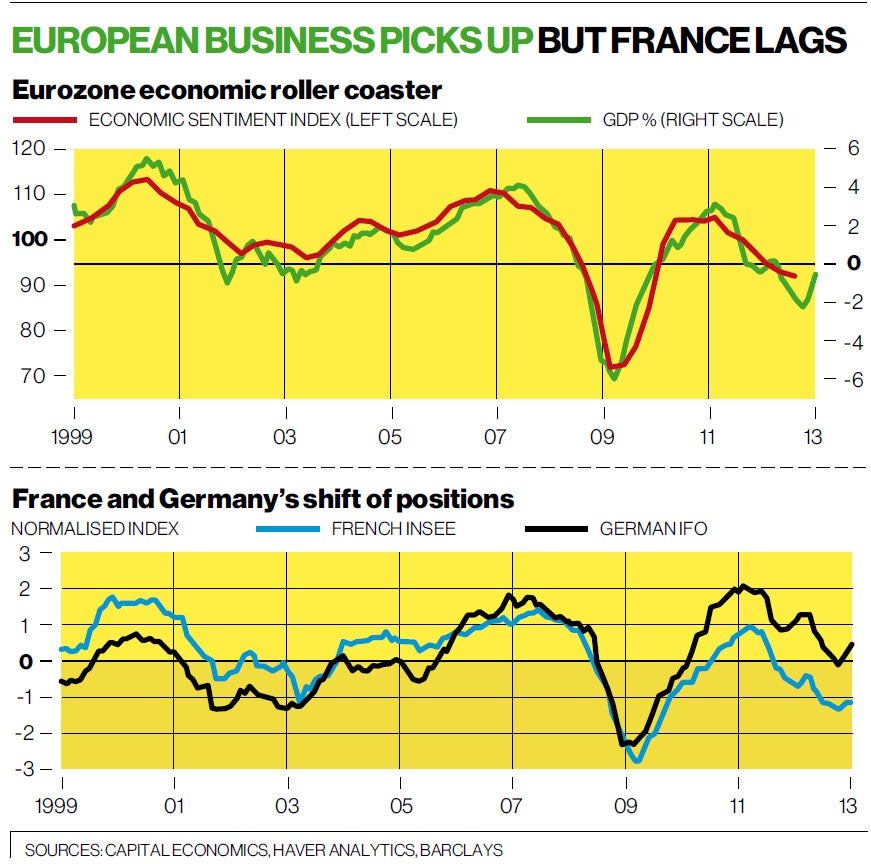

Indeed, economic sentiment was yesterday reported to be at its highest level since last June. As you can see from the top graph, shifts in business sentiment give a lead indicator for economic growth. While the overall expectation is still of a shrinking eurozone economy this year, some sort of turning point does seem to have been reached.

This recovery in business sentiment would be consistent with the recovery in European share prices. It obviously depends on your starting point, and what market you take, but European shares have risen faster since last summer than those of the UK or US, notwithstanding the worse economic forecasts.

What is new, however, is a growing divergence between France and Germany. There has been a decent recovery in German business sentiment but a much slower one in France, as you can see from the bottom graph. Barclays, which drew attention to this divergence in a recent paper, notes that businesses in France are now more gloomy even than their counterparts in Italy and Spain, and only marginally less glum than businesses in Greece.

I suppose when the French employment minister says the country is “totally bankrupt”, this is not likely to raise spirits, but the underlying financial position of France is surely better than that of Italy or Spain. After all, it can still borrow for ten years at around 2.2 per cent, against Italy at 4.4 per cent (well down from last summer, by the way) and Spain at 5.2 per cent (also well down).

So what is happening? The general answer is that the French business community feels it has a government that is against wealth creation, and that it will bear the brunt of the fiscal tightening to which the government is committed. Against this negative backcloth, the positive things being done by the government, such as labour market reforms, are being ignored.

Looking at the eurozone as a whole, I have been struck by the number of comments from political leaders that the situation has been stabilised. The wording varies but the general thrust is that the financial aspects of the crisis have been contained, and that a start has been made on the structural changes that need to be made.

Unless there is some unexpected disaster, I suspect this sense that the healing of the eurozone economy has begun will strengthen as we move through the year. It won’t help the unemployed; it won’t help the small shopkeepers; and it will not help property owners who need to sell. The price for keeping the euro going for a bit longer is to impose years of austerity on a great swathe of southern Europe, compelling millions of its young people to move north if they want to get a job.

But to focus on these social costs, terrible through they are, is to ignore the shift in the mood of business and indeed of the financial markets. The long-term outlook for the eurozone has not changed but the short-term one is improving – although perhaps not yet in France.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments