Fossil fuel tax could raise £580bn to fight climate crisis, new report finds

Tax of £3.99 per ton of carbon pollution in wealthy countries could help fund green transition and compensate victims

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

A fossil fuel tax on companies in the wealthiest nations could raise vast sums of money to tackle the climate crisis, according to a new report by a coalition of green groups.

The tax would be levied on extraction of fossil fuels in the world’s richest economies and could raise as much as $720bn (£580bn) by the end of the decade, according to a proposal released in a report entitled The Climate Damages Tax on Monday.

The report has been released by Stamp Out Poverty and backed by dozens of climate and aid organisations such as Greenpeace, Powershift Africa and Christian Aid.

Raising money to decarbonise the world and help victims of intensifying disasters has been a major challenge in recent years.

International agreements and commitments have been made to raise climate finance, but the money collected so far has been a tiny fraction of what is required to meet the challenges of a rapidly heating world.

The required, the report says, should come from fossil fuel companies operating in the Organisation for Economic Co-operation and Development, which consists of countries like the US, the UK, Japan, Spain, Canada which are among the biggest polluters historically.

The report recommends levying a $5 (£3.99) tax for every ton of carbon pollution starting from 2024, and increasing it by $5 a tonne each year.

The money raised could play a crucial role in combating the worst impacts of the climate crisis if it’s directly diverted to helping countries transition to greener sources of energy and compensate the most vulnerable people.

A climate damages tax would be a powerful tool to help achieve both aims: unlocking hundreds of billions of funding for those at the sharp end of the climate crisis while helping accelerate a rapid and just transition away from fossil fuels around the world.”

The Loss and Damage fund, which almost 200 countries agreed to set up at the UN Cop28 summit last year, alone needs billions of dollars for people who have sustained irreplaceable losses due to disasters fuelled by the climate crisis.

The report says that 80 per cent of the tax collected should be given to this fund while the remaining amount could be used as “domestic dividend” to help communities within richer nations with a just climate transition.

David Hillman, director of the Stamp Out Poverty campaign and a co-author of the report, says it is “surely the fairest way to boost revenues for the loss and damage fund to ensure that it is sufficiently financed as to be fit for purpose”.

“It demonstrates that the richest, most economically powerful countries, with the greatest historical responsibility for climate change, need look no further than their fossil fuel industries to collect tens of billions a year in extra income by taxing them far more rigorously.”

Setting accountability for the damage the planet has endured and its impact on vulnerable populations is one of the most contentious issues in the climate crisis debate.

The landmark Paris Agreement acknowledges that richer countries have more responsibility because they have released the majority of the carbon since the industrial revolution that is heating the planet.

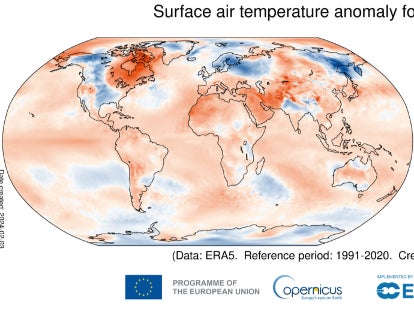

In recent years, record breaking heat and intense disasters have become the norm. For the first time on record, the Earth’s average global temperature exceeded 1.5C above pre-industrial levels for a 12-month period, from February 2023 to January 2024. This is above the threshold set out in the Paris Agreement.

The report comes just before a meeting in Abu Dhabi to discuss how to raise money for the Loss and Damage fund.

The Cop29 summit in Baku in November is expected to yield a final treaty that will include funding mechanisms for the fund.

Major climate goals like achieving net-zero carbon emission are also facing economic challenges due to wars and continued investments in oil and gas projects in countries like the US and the UK.

Climate activists say taxing fossil fuel companies is the only fair way to raise money and set accountability for pollution.

“A climate damages tax would be a powerful tool to help achieve both aims: unlocking hundreds of billions of funding for those at the sharp end of the climate crisis while helping accelerate a rapid and just transition away from fossil fuels around the world,” said Areeba Hamid, a joint director at Greenpeace UK.

She added that governments can no longer sit back and let ordinary people pick up the bill for the climate crisis while “oil bosses line their pockets and cash in on high energy prices”.

“We need concerted global leadership to force the fossil fuel industry to stop drilling and start paying for the damage they are causing around the world,” she said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments