Don’t get spooked – Bitcoin is hardly the only volatile commodity out there

Copper, coffee, orange juice, fine wines, classic cars, property, silver, gold – they all get traded and they all have, at any given short term horizon, a pretty fixed amount in existence, so relatively small movements in demand produce big changes in their price. Investing in those is also risky

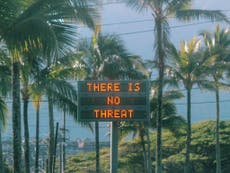

Volatility thy name is Bitcoin. By which I mean that any “investor” in Bitcoin should really not be surprised that the value of this “cryptocurrency” is prone to wild swings, including the near 20 per cent drop registered earlier. Before Christmas, it was gyrating away like a colleague at a festive office bash and few will have failed to notice its phenomenal and stratospheric risk – nor the warnings from the Bank of England and officialdom generally about its riskiness.

So anyone who puts their life savings into Bitcoin (at about £8,800 per Bitcoin at the time of writing) has to be prepared to lose the lot. It is not for the proverbial widows and orphans, or desperate millennial looking for a quick way to gather up a deposit for a flat. You really have to know what you’re doing, yes, but also the scale of the downside. (In fact, in that respect, it is safer than some spread-betting style derivatives which can leverage a virtually unlimited liability on you if things go wrong. At least with Bitcoin you can say that when it’s gone, it’s gone, and no-one can come after you for more than your initial stake).

Then again Bitcoin is hardly the only volatile commodity out there; copper, coffee, orange juice, fine wines, classic cars, property, silver, gold – they all get traded and they all have, at any given short term horizon, a pretty fixed amount in existence, so relatively small movements in demand produce big changes in their price. Investing in those is also risky.

Gold, older than any paper currency in the world, has a formidable reputation as a long term store of value, and is always in demand at times of uncertainty and economic dislocation. Yet it too has always been prone to these sorts of swings. Had you, for example, bought a big pile of the stuff in about 1981, when the world was – a familiar thought this – readying itself for all-out thermonuclear war then you’d have lived through a collapse in its value only made up relatively recently (and with no income through interest of dividends in the meantime). So even gold can be a poor investment except perhaps over the very long run, by which I mean several decades, when it is more resistant to inflation than bank deposits or notes and coins.

So we need, as ever, to keep Bitcoin in perspective. There are places, admittedly sometimes operating on the fringes of legality, and beyond, where Bitcoin is favoured as money, indeed more so than any other form of payment, including cash. It may well continue to be so, and other competing cryptocurrencies may give the impetus to “keep it clean” so to speak.

It is, to a degree, linked to the price of energy and oil, because it is quite energy intensive to “manufacture” on computers, so its intrinsic value can be influenced either way by movements in other, also volatile, commodity values. As a store of value, another fundamental purpose of money, it is probably less useful in the short term, but the long term really does remain to be seen.

In a way, linked as it is to the value and volume of the transactions underlying it, it is superior to the pound coin in your pocket, which can be (and has been) inflated and debased by a desperate government. It is also adaptable in that its volume can increase with the value of trade and economic growth, which is not the case with gold. More specifically I guess it is linked most closely to the value and volume of illicit trading and global criminality, and, unless you really are an optimist, they are likely to be with us until the Second Coming of Jesus.

It is telling that the more strait-laced authorities, such as the South Koreans, are trying to restrict its trading. Ironically that would only add to its problems, reducing its liquidity and thus making it less valuable. The Chicago Exchange has done the right thing in allowing futures trading in Bitcoin, so that it is opened up to closer scrutiny by analysts, economists and investors (who admittedly can make their own errors of judgement). The best thing to do with Bitcoin is, then, to try and civilise it and habilitate it into the wider world of money and investment. We need to make it more comprehensible because, as Warren Buffett famously remarked, you should only really invest in things you understand: all the rest is speculation, and with the terrible risks attached to it. bitcoin

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies