How savers can cope with rising inflation

As the cost of living continues to increase, what can consumers do to make their cash work harder? Chiara Cavaglieri investigates

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Savers were left struggling this week after official figures showed that inflation remained unchanged at 3.1 per cent last month, ending a three-month period of decline.

Despite a fall in fuel prices, the UK Consumer Prices Index (CPI) is still well above the Bank of England's 2 per cent target after a surge in the cost of air fares, clothing and food.

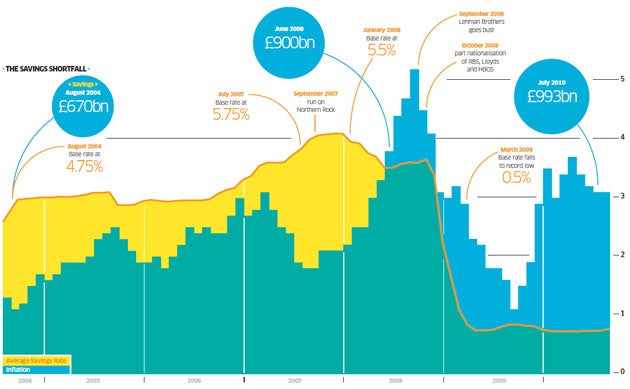

The news leaves savers with an even bigger challenge to protect their money from the rising cost of living. With interest rates low, high inflation means that the actual value of savings is steadily shrinking, leaving anyone with a nest egg watching it languish in a low-interest account.

"The average instant access savings rate is still at rock bottom at a rate of only 0.77 per cent," says Darren Cook, from the financial comparison site Moneyfacts.co.uk. But what can savers do to make their cash work harder?

One of the best ways to combat inflation is to use up your individual savings account (ISA) allowance and take advantage of the tax-free returns. There are only 51 ISAs to choose from that beat inflation and, of those that accept transfers in, Halifax is a best buy paying 4.25 per cent on its fixed-rate, four-year bond. Derbyshire building society also pays a healthy fixed rate of 4.25 per cent, but again you'll lose access to your money, this time for five years.

Elsewhere, savers need a rate high enough to beat both tax and inflation to maintain the spending power of their money. For a basic rate taxpayer this means finding a savings account paying 3.88 per cent just to break even – and with only 91 out of a possible 1,020 savings accounts paying this, there are few options. Again, this means savers are forced to lock their money away.

No variable, easy access account comes close to beating 3.88 per cent and the best returns require savers to put their money away for five years, which carries the risk of missing out on better rates further down the line. Both Aldermore and ICICI Bank UK pay the top rate of 4.75 per cent on their five-year bonds, for example, but if you only want to hold your money in their two-year bonds, the returns fall to 3.75 per cent and 3.70 per cent respectively.

For a higher rate taxpayer losing 40 per cent of their interest in tax, beating inflation is almost impossible, with only a return of 5.17 per cent able to maintain the real value of their savings. Even worse, many of the accounts that do offer higher returns require savers to open riskier investment products as well. For example, Yorkshire building society and the Barnsley, which it owns, offer combination bonds paying 6 per cent but these require a further investment of £5,000 in a longer term investment product from Legal and General.

Things have been made even more difficult after the withdrawal of the five-year ISA from National Counties building society, offering a rate of 1 per cent plus the retail prices index (RPI) until autumn 2015.

For the short time that it was available, this was the only account guaranteeing an inflation-beating return, after the closure of National Savings & Investments' (NS&I) index-linked certificates in July – although NS&I's customers are still able to roll over their investment into the same issue.

With deposit accounts struggling to offer decent returns, savers should consider riskier investments which may be less vulnerable to inflation.

"For those concerned about rising inflation the best way to protect your income is to invest in assets which can grow the income generated. This can be done through shares where companies can raise prices to compensate for the inflationary effects, and can increase dividends," says Adrian Lowcock, from independent financial adviser (IFA) Bestinvest.

Equities are an important part of a diversified portfolio and have historically provided the best long-term protection against inflation, with defensive sectors such as pharmaceuticals and tobacco remaining relatively strong. Likewise, gold has also traditionally been used as the classic inflation hedge.

"Gold tends to shimmer brightest under the backdrop of rising inflation. I believe the best gold strategy is investing in a fund that has exposure to companies exploiting the asset class – BlackRock Gold and General is my preferred fund in this area," says John Kelly, from the IFA Chelsea Financial Services.

M&G has even launched a corporate bond fund, which aims to keep up with inflation using the CPI as the benchmark, although investors should consider a fund with no track record with a healthy dose of caution.

"It will appeal to those investors who are concerned about the future outlook for price inflation. However, it is important to remember that the gilt yields are near all-time lows, and with investment-grade corporate bonds closely correlated to gilts, now could be a bad time to be buying into some corporate bonds," says Martin Bamford from Informed Choice, an IFA.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments